Nvidia Teams with Accenture to Enhance AI Capabilities

When chipmaker Nvidia announces partnerships for artificial intelligence (AI) products, investors should take note. Nvidia remains a key player in the AI sector, as most AI servers use its GPUs. During Nvidia’s Q3 conference call, it named Accenture (NYSE: ACN) as a primary partner to expand AI access for businesses.

Accenture’s AI-Focused Workforce

Nvidia’s CFO, Colette Kress, mentioned that Accenture has established a dedicated unit comprising 30,000 employees trained in Nvidia’s AI technology. This positions Accenture as a leading provider of AI expertise, especially for industries like banking and oil that may not have in-house technology resources. As noted, companies like Alphabet and Microsoft maintain large AI teams, making resources like Accenture vital for others.

Accenture’s CEO, Julie Sweet, remarked on generative AI, saying, “In every industry, there is a challenge or opportunity that GenAI can now uniquely solve. Our deep understanding of both the industry and the technology positions us to be the best at creating real value from GenAI with our clients.”

This statement underlines Accenture’s potential growth with generative AI becoming mainstream. However, Accenture’s strengths extend beyond AI as it operates in various sectors. Investors may wonder if the combination of its diverse business model and AI advancements will yield a substantial return.

Assessing Accenture’s Valuation

In its fiscal 2024 fourth quarter, which concluded on August 31, Accenture recorded new bookings of $20.1 billion, with $1 billion attributed to generative AI. This indicates that while generative AI contributes positively, it only represents 5% of the total bookings, which may affect long-term investment perspectives.

Fiscal 2024 was challenging for Accenture, as clients showed caution in their spending habits. Overall revenue growth was modest, increasing by just 3% in Q4 and 1% for the year. The outlook for fiscal 2025 appears more optimistic, with management projecting revenue growth of 3% to 6% in local currencies. Nonetheless, despite this more favorable forecast, many AI firms are experiencing much faster revenue growth, raising questions about Accenture’s attractiveness as an investment.

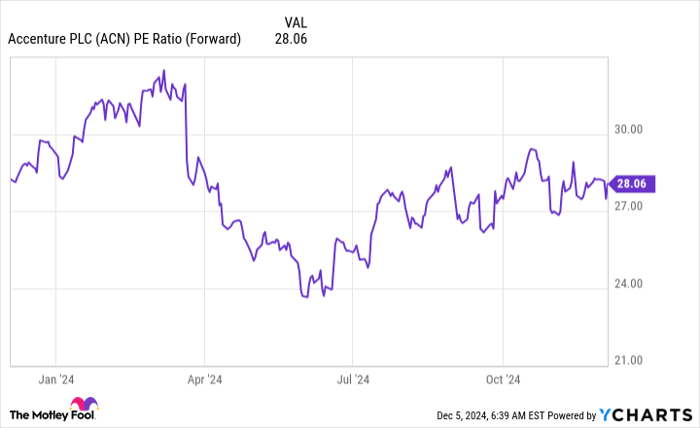

From a forward price-to-earnings standpoint, Accenture’s shares are quite costly, trading at approximately 28 times forward earnings, comparable to Meta Platforms and Taiwan Semiconductor, both of which boast faster growth rates. Why might Accenture still appeal to investors?

One attractive feature is Accenture’s robust capital return program. The firm raised its dividend by 15% in Q4, providing a yield of about 1.6% at current prices. In addition, Accenture repurchased $4.5 billion in shares last year, aiming to enhance earnings per share, projected to grow by 5% to 8% in fiscal 2025.

Despite these incentives, Accenture’s stock appears relatively expensive, especially against other fast-growing AI companies with more favorable valuations. Thus, I would hesitate to invest in Accenture at this time.

Opportunities on the Horizon

Have you ever felt you missed the chance to invest in top-performing stocks? If so, you might want to pay attention now.

Our team of analysts occasionally identifies companies poised for significant growth, issuing “Double Down” stock recommendations. If you believe you’ve missed previous investment chances, this could be the perfect moment to buy. Here are some noteworthy past successes:

- Nvidia: A $1,000 investment made in 2009 would now be valued at $369,349!*

- Apple: A $1,000 investment made in 2008 would now be worth $45,990!*

- Netflix: A $1,000 investment made in 2004 would grow to $504,097!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may not come again anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 2, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a board member at The Motley Fool. Keithen Drury holds positions in Alphabet, Meta Platforms, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Accenture Plc, Alphabet, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2025 $290 calls on Accenture Plc, long January 2026 $395 calls on Microsoft, short January 2025 $310 calls on Accenture Plc, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.