A Tale of Two Tech Titans: Nvidia vs. Palantir in the AI Race

Nvidia (NASDAQ: NVDA) and Palantir (NASDAQ: PLTR) have emerged as leaders in the stock market this year, driven largely by advancements in artificial intelligence.

Nvidia has established itself as the dominant player in the data center GPU market, particularly amid the current AI surge. Its stock has skyrocketed roughly tenfold since January 2024. Meanwhile, Palantir has seized the opportunity as a frontrunner in AI-driven software. Its experience in deep data mining, referred to as data fusion, has yielded impressive returns, especially after launching its artificial intelligence platform (AIP) last year.

Start Your Mornings Smarter! Subscribe to Breakfast News for market updates delivered directly to your inbox each day. Sign Up For Free »

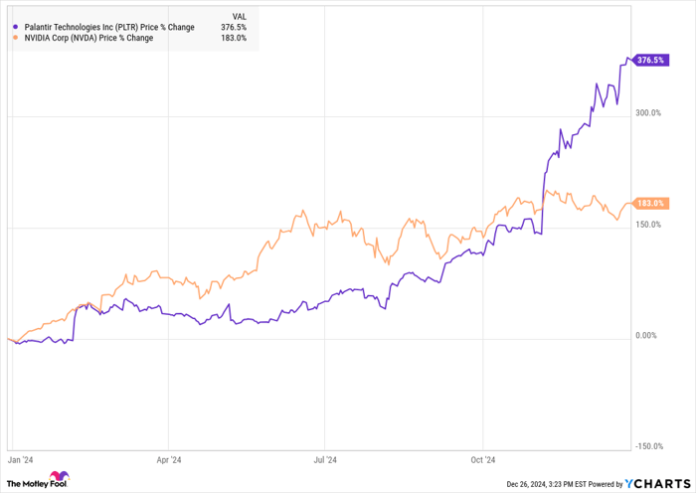

The chart below illustrates the remarkable performance of both stocks this year.

PLTR data by YCharts

Comparing Business Models: Nvidia and Palantir

Nvidia has cemented its reputation as a leading chip designer, leveraging its skills in AI and investing in essential technologies like the CUDA software library, which gives it a competitive edge.

With its advanced AI-focused products, including the new Blackwell platform, Nvidia boasts impressive profit margins, achieving a GAAP operating margin of 62% in the third quarter. The culture within the company prioritizes innovation, positioning it favorably against competitors as it relies on foundries like Taiwan Semiconductor Manufacturing Company. However, Nvidia remains susceptible to the cyclical nature of the semiconductor industry and potential shifts in AI investment sentiment.

Launched in the wake of 9/11, Palantir initially supported U.S. intelligence agencies in data analysis to prevent threats. Since then, it has broadened its services to address varied business needs, such as cryptocurrency monitoring and money laundering prevention.

Palantir’s key software platforms include Gotham, Foundry, Apollo, and AIP. Gotham and Foundry help transform vast amounts of data into actionable insights, while Apollo allows commercial clients to deploy software over diverse environments, and AIP enhances data utilization through machine learning.

Despite its comparatively limited number of clients, Palantir handles substantial contracts, reducing direct competition from other software firms. Internal software creation by clients presents a more significant challenge than external competitors.

Similar to Nvidia, Palantir’s fortunes could be affected by a broader market downturn, yet its specialized approach helps maintain a sturdy competitive position.

Financial Performance Comparison: Nvidia vs. Palantir

Both Nvidia and Palantir have shown remarkable financial results, yet Nvidia’s growth stands out more prominently.

In the third quarter, Nvidia’s revenue surged by 94%, reaching $35.1 billion, while net income soared to $19.3 billion, reflecting a 109% increase year-on-year. Conversely, Palantir experienced a 30% revenue growth to $726 million, alongside a net income rise to $149.3 million, an increase of 103% as operational margins expanded sharply.

Valuation Insights: Nvidia vs. Palantir

Palantir’s significant growth has led to a substantial valuation increase, now trading at a price-to-sales ratio of 75 and a price-to-earnings ratio of 411 based on GAAP earnings.

By contrast, Nvidia’s valuation appears more grounded, trading at a price-to-sales ratio of 31 and a price-to-earnings ratio of 55.

Which Stock is the Better Investment?

Both Nvidia and Palantir present worthy investment prospects, particularly amid rising AI demand. However, Nvidia currently stands out as the more attractive option overall.

Although Palantir’s unique offerings and competitive edge are commendable, its high valuation carries inherent risks, particularly if it fails to meet market expectations.

Nvidia, meanwhile, shows promising growth potential with comparatively reduced downside risk.

Explore Potential Stock Opportunities

Wondering if you missed earlier chances to invest in top-performing stocks? There may still be great opportunities ahead.

Occasionally, our expert analysts provide a “Double Down” stock recommendation for companies poised for growth. If you think you’ve missed out on investing, now might be an ideal time to act before it’s too late. The historical performance of these stocks is noteworthy:

- Nvidia: A $1,000 investment from our 2009 recommendation would be valued at $355,269!

- Apple: A $1,000 investment from our 2008 recommendation would now be worth $48,404!

- Netflix: A $1,000 investment from our 2004 recommendation has grown to $489,434!

Currently, we’re issuing “Double Down” alerts for three incredible stocks that could yield similar results, and opportunities like this are rare.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Jeremy Bowman holds no positions in the mentioned stocks. The Motley Fool has positions in and recommends Nvidia, Palantir Technologies, and Taiwan Semiconductor Manufacturing. Please refer to The Motley Fool’s disclosure policy for further information.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.