Nvidia Soars to New Heights: $3.6 Trillion Market Cap Achieved

Nvidia (NVDA) recently made headlines by becoming the first company in history to reach a market capitalization of $3.6 trillion. This milestone showcases the total value of its outstanding shares and highlights NVDA’s remarkable performance in the stock market. Amidst a recent rally, the company’s stock has enjoyed consistent gains, further propelled by Donald Trump’s recent victory, which is expected to benefit the tech sector through less regulation.

Current Status of Nvidia Stock

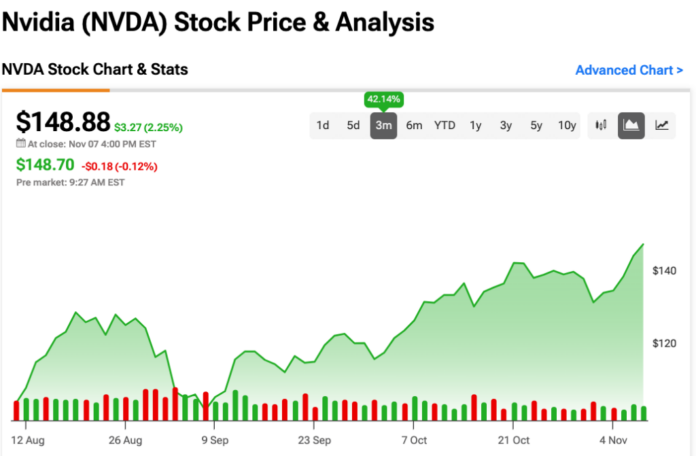

In spite of some fluctuations in pre-market trading, Nvidia’s stock has soared this week. It closed with a 2% rise yesterday, contributing to an impressive 9% increase over the last five days. Earlier in September, the company faced some challenges, leading investors to question its valuation. Yet, the new market cap clearly indicates that Nvidia continues to lead the market.

Nvidia’s current market cap of $3.6 trillion places it ahead of other major tech firms like Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOGL). While Trump’s recent victory has created a favorable environment for NVDA stock, the company has seen growth for several months. Over the past three months, it has climbed 42%, demonstrating resilience in the face of market fluctuations.

Even without the changing political landscape, Nvidia’s robust position in a rapidly growing market suggests that it would have performed strongly under any administration. Nevertheless, the anticipated reduction of regulations for Big Tech may offer Nvidia an even clearer path for future growth.

Positive Wall Street Outlook for NVDA

Wall Street analysts remain bullish on Nvidia’s prospects. Currently, the stock has a Strong Buy consensus rating, supported by 38 Buy ratings and three Holds in the last three months. Following a significant 218% increase in its share price over the past year, the average price target for NVDA stands at $154.28 per share, suggesting a potential upside of 3%.

See more NVDA stock analyst ratings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.