Chip Giants Face Off: Nvidia Dominates While AMD Aims to Regroup at CES 2025

AI Growth Fuels Nvidia’s Rise Amid AMD’s Struggles

The stage is set for a semiconductor showdown as Nvidia Corp NVDA and Advanced Micro Devices, Inc. AMD square off at the CES 2025.

Nvidia is experiencing tremendous growth driven by its dominance in artificial intelligence (AI), while AMD seeks to regain its competitive edge. The contrasting fortunes of these two semiconductor giants underscore the shifting landscape in the tech industry.

The pivotal question remains: will CES be the turning point for AMD, or will Nvidia maintain its stronghold?

Nvidia’s Impressive Performance and Market Dynamics

Nvidia has been soaring, with a remarkable 189.61% increase in stock price over the past year.

Chart created using Benzinga Pro

Currently, Nvidia’s stock is on a bullish trajectory, supported by several key indicators:

- NVDA Price Action: Trading at $151.21, the stock is well above significant simple moving averages (SMAs), including the 8-, 20-, 50-, and 200-day averages.

- MACD (Moving Average Convergence/Divergence): Stands positive at 1.14, indicating solid upward momentum.

- RSI (Relative Strength Index): At 65.52, it suggests further growth potential.

As global enthusiasm for AI continues to grow, Nvidia’s server partner Foxconn reported a 15% revenue increase, primarily due to rising AI infrastructure sales.

As anticipation builds for CES 2024, CEO Jensen Huang is expected to unveil the highly anticipated Blackwell chip. With supply chain challenges now resolved, Nvidia may be poised for a significant rebound following a dip in November.

AMD’s Setback and Hopes for Recovery

In contrast, AMD is struggling, with its stock down 11.25% over the past year and a more alarming 27.40% drop in the last six months. This stark decline highlights the competitive pressures from Nvidia.

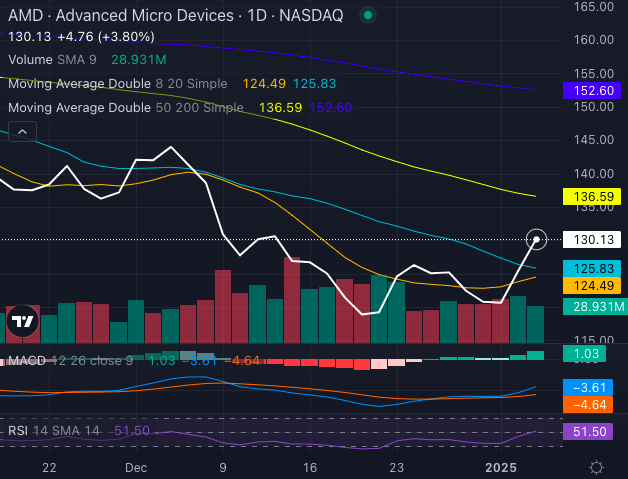

Chart created using Benzinga Pro

The technical outlook for AMD reveals limited encouragement:

- AMD Price Action: Currently at $130.13, the stock is below key SMAs (50- and 200-day).

- MACD: At a negative 3.61, it indicates ongoing weakness.

- RSI: Stands at 51.50, indicating stagnation.

AMD is banking on CES 2024 to mark its comeback, with plans to reveal its RDNA 4 graphics cards alongside new technologies. Despite having a market cap of $203.4 billion, AMD is clearly in a race to catch up with Nvidia.

The Road Ahead for Nvidia and AMD

With Nvidia firmly in the lead in AI advancements and boasting favorable technical indicators, it clearly holds the upper hand. Meanwhile, AMD is still strategizing its comeback as it attempts to regain competitiveness.

Nvidia’s performance resembles a finely-tuned machine, while AMD appears to be in the process of revving its engines. All eyes will be on Huang’s CES keynote scheduled for Monday evening:

https://www.youtube.com/watch?v=UGAT_MK0R6g[/embed>

Read Next:

Photos: Shutterstock

Market News and Data brought to you by Benzinga APIs