NVIDIA: A Glimpse at Upcoming Earnings and Future Prospects

Since its initial public offering (IPO) in 1999, NVIDIA Corporation (NVDA) has delivered an impressive annualized compounded return of 33%. This performance stands out as the best in the last 20 years on U.S. stock exchanges.

This year, NVIDIA became a part of the Dow, reflecting its significance in the growing artificial intelligence (AI) industry. The company’s stock has skyrocketed by 186.8% this year alone.

Anticipation is building among investors as NVIDIA prepares to release its third-quarter fiscal earnings report. This report could greatly influence not only its own stock price but also the technology sector at large.

Market participants are weighing their options, considering whether to sell shares to secure profits or hold onto them for potential future gains. Let’s delve into how investors should approach NVIDIA stock ahead of its earnings report.

What to Expect from NVIDIA’s Q3 Results

NVIDIA relies on AI server components crucial for its AI products, making supply chain stability a key concern for its third-quarter results.

Recently, financial instability at Super Micro Computer, Inc. (SMCI) has raised flags about its ability to fulfill NVIDIA’s needs, especially following recent criticisms from Hindenburg Research.

Despite these challenges, the growing demand for AI and data-heavy applications is likely to bolster NVIDIA’s AI and data center revenue in the fiscal third quarter.

The increased demand for graphic processing units (GPUs) from companies like Meta Platforms, Inc. (META) and Microsoft Corporation (MSFT) is expected to enhance NVIDIA’s profit margins for this reporting period.

NVIDIA anticipates an 80% surge in revenue, projecting sales of $32.5 billion. Analysts expect earnings per share (EPS) to reach $0.74, reflecting an increase of over $0.40 from the previous year, representing an 85% jump.

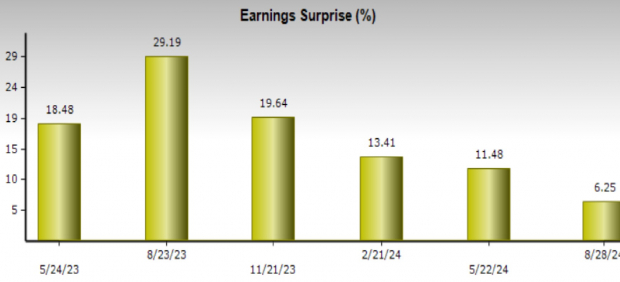

Historically, NVIDIA has surpassed earnings estimates by an average of 12.7%, suggesting a strong chance to report favorable earnings this Wednesday, which could positively affect its stock value.

Image Source: Zacks Investment Research

Key Factors Driving NVIDIA’s Long-Term Growth

While the upcoming earnings report may provide a short-term boost to NVIDIA’s stock price, several long-term factors could sustain its growth.

During the earnings call, NVIDIA is expected to unveil promising details about the much-anticipated Blackwell GPU. CEO Jensen Huang has mentioned that demand is already huge, with the new B200 chips offering enhanced AI capabilities compared to their predecessor, the H100, and with orders secured for the next year.

The Blackwell GPUs are predicted to yield high revenues starting in the fourth quarter due to increased production. Furthermore, rising capital expenditures from NVIDIA’s clients are likely to enhance profit margins. Companies such as Amazon.com, Inc. (AMZN) and Meta plan to ramp up their spending to $75 billion and $40 billion in 2024, respectively, driven by robust AI demand.

NVIDIA’s strong fundamentals position it as a leader in the market, consistently lifting its share price. The company has demonstrated steady growth in cash flow and is expected to see significant increases in revenue from its Blackwell GPU line.

Free cash flow rose from $4.3 billion in FY20 to $26.9 billion in FY24, aiding NVIDIA in meeting obligations and reinvesting in its operations.

NVIDIA’s effective expense management is evidenced by a net profit margin of 55%, which is higher than the 47.3% margin seen in the broader semiconductor industry. A profit margin over 20% is generally considered strong.

Image Source: Zacks Investment Research

NVIDIA also excels in generating returns, with a return on equity (ROE) of 120% outpacing the industry average of 78.3%, indicating robust profitability relative to its equity.

Image Source: Zacks Investment Research

Trading NVIDIA: A Buying Opportunity

With strong cash flows, efficient profit generation, rising capital spending among clients, and increasing demand for its products, NVIDIA is well-positioned for growth, making its stock attractive for buyers.

Moreover, investing in NVDA shares is relatively affordable. The stock trades at 49.4 times forward earnings, compared to the industry average of 58.5 times.

Image Source: Zacks Investment Research

NVIDIA holds a Zacks Rank #1 (Strong Buy), signifying its favorable outlook. For a comprehensive list of today’s Zacks Rank #1 stocks, visit our website.

Discover 7 Top Stocks for Immediate Gains

Experts have just identified 7 top stocks from the current list of 220 Zacks Rank #1 Strong Buys, labeling them as “Most Likely for Early Price Pops.”

Historically, this list has outperformed the market by more than double, averaging an annual gain of +23.7% since 1988. These 7 hand-picked stocks demand your careful consideration.

See them now >>

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double for free today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.