Nvidia’s Future Looks Bright: Stock Price Target of Over $200 by 2025

Nvidia (NASDAQ: NVDA) remains the top supplier of graphics processing units (GPUs) essential for data centers powering artificial intelligence (AI) models. The company is witnessing demand for its chips far outstrip supply, resulting in outstanding financial growth.

CEO Jensen Huang anticipates data center operators will invest up to $1 trillion over the next four years to enhance their infrastructure, primarily to serve AI developers. This projection might even be on the low side based on various forecasts.

Nvidia’s stock could realistically soar by another 82%, potentially pushing it above $200 by 2025. Here’s a closer look at the factors at play.

Rapid Increase in Blackwell Shipments

Nvidia’s H100 GPU gained immense popularity in 2023, providing the company with a dominant 98% market share in AI data center chips. Currently, data center operators are eager to purchase Nvidia’s latest chips featuring the new Blackwell architecture, which offer significantly higher performance for AI training and inference tasks.

The Blackwell-powered GB200 NVL72 system can perform AI inference 30 times faster than the H100. Priced at about $83,000 per GB200 GPU—around double the cost of the H100—the impressive 30-fold speed increase can lead to considerable cost savings for businesses utilizing AI.

Microsoft has emerged as the leading buyer of Blackwell GPUs, intending to leverage them for its own AI projects while renting computing power to other developers via its Azure cloud platform. Other major clients like Amazon Web Services, Alphabet‘s Google Cloud, and Oracle are also expected to be significant consumers of Blackwell chips.

During its fiscal 2025 third quarter, which ended on October 27, Nvidia shipped 13,000 Blackwell units. However, Huang described the demand as “staggering,” indicating rapid growth ahead. Morgan Stanley forecasts Nvidia will ship up to 300,000 units by the end of 2024 and 800,000 units in early 2025.

Nvidia reports that Oracle is assembling clusters with over 131,000 Blackwell GPUs. Given Oracle’s lower AI capital expenditures compared to Microsoft and Amazon, Morgan Stanley’s estimates seem plausible.

Steady Yet Strong Growth Forecast for Nvidia

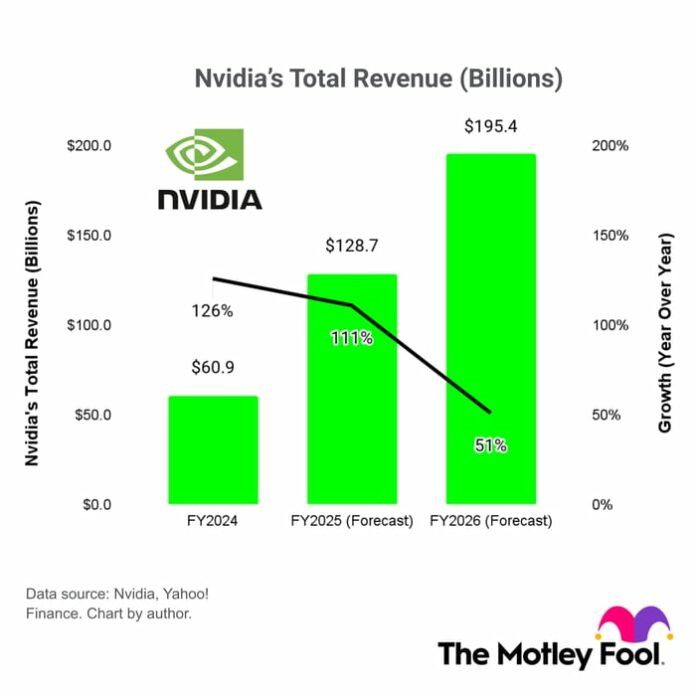

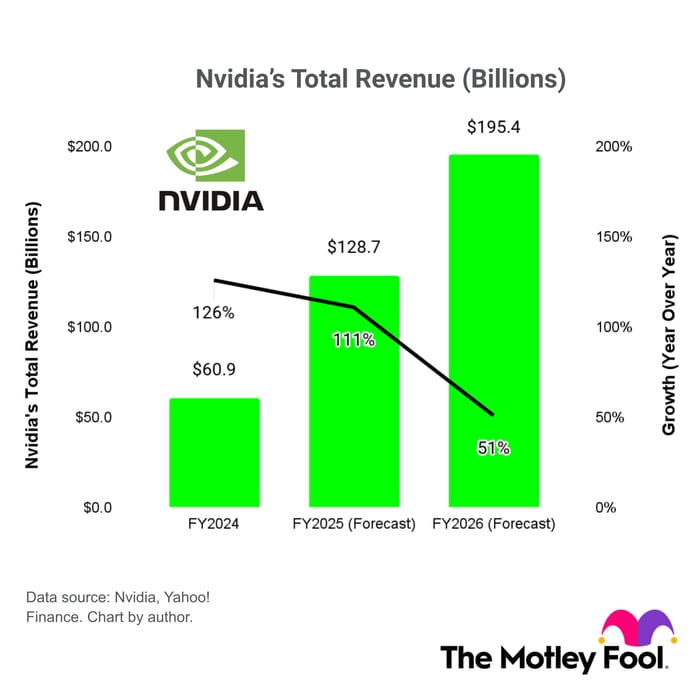

Nvidia operates on a fiscal year that differs from the calendar year. Currently, it is in fiscal 2025, which concludes on January 30, 2025. Consequently, fiscal 2026 will encompass much of calendar year 2025.

The company expects record revenue of $128.7 billion for fiscal 2025, reflecting an impressive 111% rise from fiscal 2024. Notably, 80% of that revenue is projected to come from its data center segment, which includes AI GPUs like the H100 and GB200.

According to consensus estimates from Wall Street, Nvidia’s revenue is set to reach a record $195.4 billion in fiscal 2026. This marks growth of 51%, which is considerably lower than the skyrocketing growth rates seen in fiscal 2024 and 2025.

As Nvidia’s revenue grows, maintaining triple-digit percentage increases becomes increasingly challenging. However, this slowdown is not a negative indicator, especially with expectations of rising AI infrastructure spending.

Huang’s prediction of $1 trillion in AI infrastructure investments over the next four years is significant. Morgan Stanley suggests that just four major companies—Microsoft, Amazon, Alphabet, and Meta Platforms—will collectively spend $300 billion in 2025 alone, excluding other heavy spenders such as Oracle, OpenAI, and Tesla.

Nvidia Positioned to Exceed $200 in 2025

Nvidia’s stronghold on the data center GPU market gives it considerable pricing power. The overwhelming demand allows the company to set high prices, which in turn boosts profit margins.

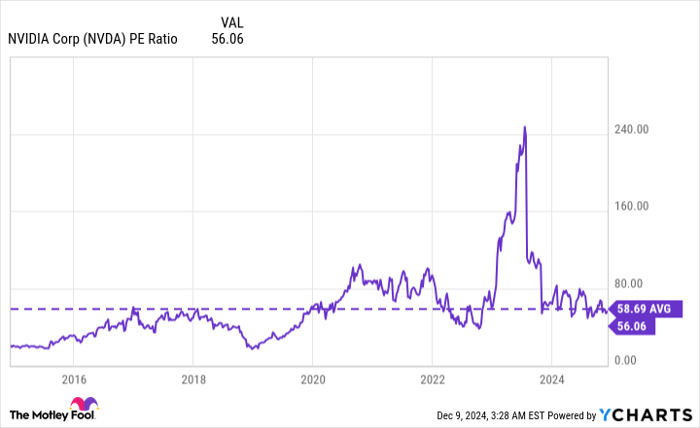

This dynamic contributed to a staggering 103% increase in earnings per share (EPS) in the latest third quarter. With a trailing 12-month EPS of $2.62, Nvidia’s stock is currently valued at a price-to-earnings (P/E) ratio of 56.1.

Although this appears expensive when contrasted with the Nasdaq-100’s P/E ratio of just 33.9, it’s worth noting that Nvidia’s historical average P/E ratio over the past decade has been 58.6. Thus, one could argue the stock may currently be undervalued.

NVDA PE Ratio data by YCharts.

Looking ahead, analysts estimate Nvidia’s EPS could reach $4.43 in fiscal 2026. If so, the stock’s forward P/E ratio would drop to 32.1. Such projections suggest that Nvidia’s stock could need to rise 82% in the coming year just to align with its 10-year average P/E of 58.6, setting a target price of $259.

While Blackwell shipments are ramping up, there’s word from an analyst that Nvidia’s next GPU architecture, Rubin, might debut six months earlier than expected. This development could serve as another upward driver for the stock in the upcoming year.

Is Now the Time to Invest $1,000 in Nvidia?

Before making a decision to purchase Nvidia stock, consider this:

The Motley Fool Stock Advisor analyst team has pointed out what they believe are the 10 best stocks for investors to buy at the moment, and Nvidia is not among them. Their top picks may offer outstanding potential returns in the years to come.

Reflect on the past: had you invested $1,000 in Nvidia when it was recommended on April 15, 2005, you’d have amassed an incredible $827,780!*

Stock Advisor provides useful strategies for investors, including portfolio-building tips, regular updates, and fresh stock recommendations every month. The service has significantly outperformed the S&P 500 since 2002.

See the 10 stocks »

*Stock Advisor returns as of December 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.