NVIDIA vs. Palantir: Analyzing AI Stocks with Growth Potential

Over the past year, advancements in artificial intelligence (AI) have driven NVIDIA Corporation (NVDA) and Palantir Technologies Inc. (PLTR) to become top trading stocks on Wall Street. As AI enters an early expansionary phase, we will examine which company offers greater growth potential and investment appeal.

Strong Financial Performance Boosts NVIDIA’s Favorability

NVIDIA reported impressive financial results for fiscal 2025, which ended in January. The company’s revenues soared 114% to $130 billion, while adjusted earnings surged 130% to $2.99 per share. Its dominance in the data center graphics processing unit (GPU) market, accounting for 98% of data center GPU sales, significantly contributed to these results.

Given its strong position in the GPU sector, NVIDIA’s sales are expected to rise this year. The increasing demand for its advanced Blackwell chips, recognized for their speed and energy efficiency, is likely to enhance revenues and drive stock prices upward. Prominent tech companies such as Microsoft Corporation (MSFT) and Alphabet Inc. (GOOGL) have already adopted Blackwell chips, while the demand for the older Hopper chips remains steady, attributed to their superior quality over competitors like Intel Corporation (INTC).

Concerns about competitors like DeepSeek are overstated. Its budget-friendly model may actually boost AI adoption, increasing demand for NVIDIA’s chips. Moreover, the automotive sector is set to fuel additional demand for NVIDIA’s technology. The company projects its automotive revenue will reach $5 billion in fiscal 2026, tripling the figure from the previous year.

Palantir’s Potential is Enhanced by Government Demand

Palantir also reported strong financial results in 2024, with revenues climbing 29% to $2.8 billion and non-GAAP net income increasing 64% to $0.41 per share. The surge in demand for its Artificial Intelligence Platform (AIP), which automates tasks beyond human capability, played a key role in these results.

Significantly, unrecorded sales in the last quarter exceeded revenue growth, suggesting possible expansion. Increased spending from government and commercial clients in the U.S. further signals strong growth opportunities.

Additionally, Palantir’s leadership in AI-driven process mining showcases substantial growth potential, supported by continuous integration of innovative AI and machine learning solutions.

NVIDIA’s Advantages Over Palantir

Despite both companies’ favorable performances, NVIDIA appears to have the upper hand. The intense demand for NVIDIA’s chips and its comprehensive AI computing solutions provide a significant advantage over Palantir, which may encounter challenges if AI investments decline. Notably, Palantir’s primary customer, the U.S. government, is currently reducing spending amid uncertainties regarding future software budgets.

Moreover, NVIDIA’s growth estimates are more optimistic. The company anticipates sales will jump by 65% year-over-year in the first quarter, eclipsing Palantir’s projected revenue growth of 31% for the year.

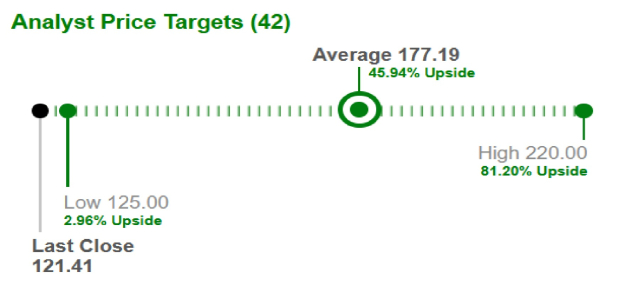

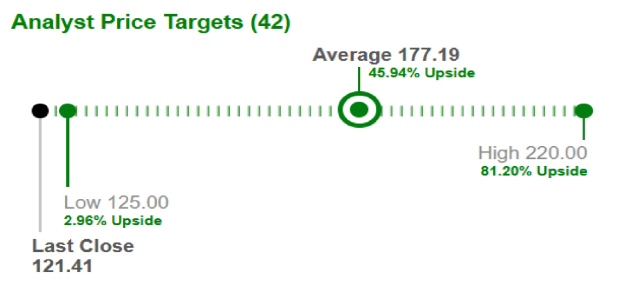

This favorable outlook has led brokers to exhibit increased confidence in NVIDIA. They raised the average short-term price target for NVIDIA by 45.9%, moving it from $121.41 to $177.19.

Image Source: Zacks Investment Research

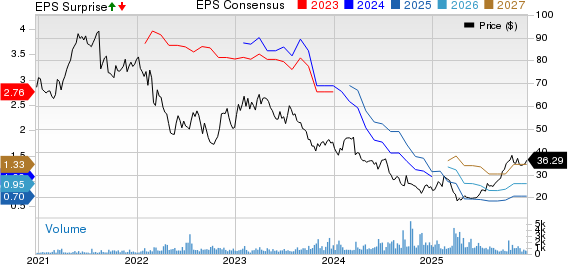

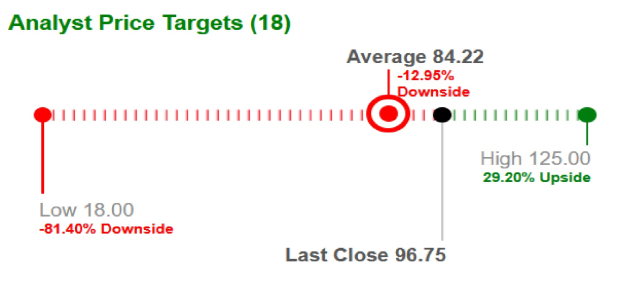

Conversely, brokers adjusted Palantir’s average short-term price target downward by nearly 13%, from $96.75 to $84.22.

Image Source: Zacks Investment Research

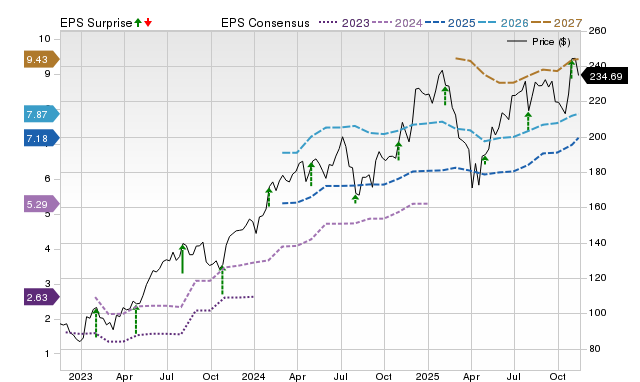

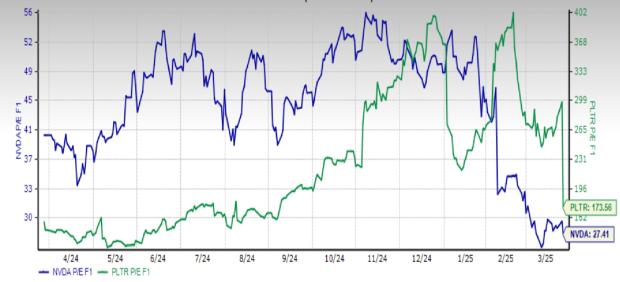

Furthermore, NVIDIA holds a price/earnings ratio of 27.41, notably lower than Palantir’s ratio of 173.56, making it a more attractive investment choice.

Image Source: Zacks Investment Research

Consequently, NVIDIA enjoys a Zacks Rank of #2 (Buy), while Palantir holds a Zacks Rank of #3 (Hold). For a complete listing of the highest-ranked stocks, including Zacks #1 (Strong Buy), you can click here.

Zacks Highlights Top Semiconductor Stock

While NVIDIA has seen impressive gains, reaching over 800% since our recommendation, our current top chip stock presents even greater growth potential. With robust earnings growth and a growing customer base, this stock is well-positioned to meet the increasing demand for AI, machine learning, and the Internet of Things. The global semiconductor market is expected to expand from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock for Free >>

Intel Corporation (INTC): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.