Nvidia’s Shift: Impacts on Supermicro and Market Dynamics

In the world of artificial intelligence (AI), few companies are as closely monitored as Nvidia (NASDAQ: NVDA). The company’s announcements can significantly influence the capital markets.

With the upcoming launch of its new Blackwell graphics processing unit (GPU) architecture, interest is particularly high around Nvidia and its partner network. Super Micro Computer (NASDAQ: SMCI) has been a major beneficiary of Nvidia’s GPU success over the past two years.

However, recent reports indicate that Nvidia might reduce its dependence on Supermicro’s IT infrastructure and explore new partnerships.

This article will analyze Nvidia’s potential shift, its impact on Supermicro’s stock, and what it may mean for investors in both the short and long term.

Latest Developments from Nvidia

The launch of the Blackwell chips is generating significant excitement for 2024. Nvidia CEO Jensen Huang claims demand for these new chipsets is “insane.” According to Morgan Stanley, analysts project that Blackwell could generate $10 billion in sales in just the fourth quarter. While these figures present a positive outlook, there are underlying issues that investors should keep an eye on.

A recent article from Digitimes suggested that Nvidia is shifting Blackwell orders away from Supermicro in favor of other IT specialists.

Image source: Getty Images.

Reasons Behind Nvidia’s Shift from Supermicro

Supermicro has faced significant challenges in recent months.

In August, Hindenburg Research released a short report accusing Supermicro of having weak accounting controls, raising concerns about potential discrepancies in its financial statements.

Initially, these allegations seemed less significant, as short-sellers often aim to drive down stock prices, and Supermicro’s stock did decline after the report.

However, Supermicro’s situation worsened when it delayed its annual report following the short report and later filed an 8-K indicating that its auditor, Ernst & Young, had resigned.

Given the importance of the Blackwell launch, it’s logical for Nvidia to reconsider its supply chain arrangements. Moving forward, Supermicro must address its auditing and reporting issues while managing expectations related to Blackwell, as failure to deliver could exacerbate its troubles.

What Should Investors Watch?

The precise impact of Nvidia’s Blackwell orders on Supermicro remains uncertain. The competitive market for data center storage clusters and server designs means Supermicro does not dominate the landscape alone.

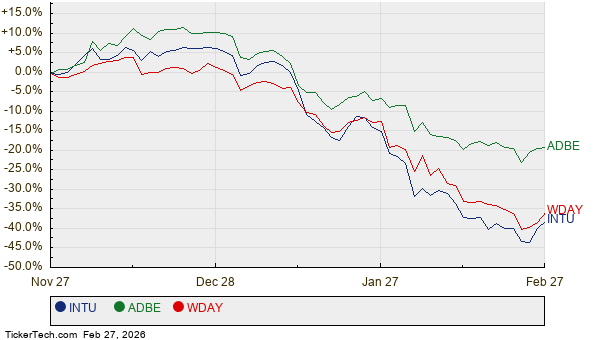

Since the Hindenburg report, Supermicro’s stock has dropped 58% (as of this writing). Although migrating Blackwell orders could further hinder Supermicro’s growth, much of this news may already be reflected in the current stock price.

SMCI data by YCharts

On the upside, Nvidia’s stock has been showing significant momentum lately. At the time of writing, Nvidia is the most valuable company globally, surpassing Apple by approximately $200 billion.

This upward trend reflects investor enthusiasm for Blackwell and the company’s impending third-quarter earnings report on November 20. Further revelations about whether moving orders from Supermicro impacts Blackwell shipments will be critical to Nvidia’s near-term growth.

Currently, both Nvidia and Supermicro stocks are experiencing considerable volatility. Investors would do well to adopt a cautious approach, observing how the situation evolves with Blackwell, as AI is a long-term investment theme with future entry points at more favorable valuations.

Seize Your Opportunity to Invest Wisely

If you’ve ever felt you missed the chance to invest in top-performing stocks, now is a moment worth considering.

Occasionally, analysts issue a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you’re worried about having missed your chance, this could be an opportune time to invest:

- Amazon: A $1,000 investment in 2010 grew to $23,446!*

- Apple: A $1,000 investment in 2008 is now worth $42,982!*

- Netflix: A $1,000 investment in 2004 skyrocketed to $428,758!*

Right now, analysts are issuing “Double Down” alerts for three incredible companies, and opportunities like this may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Adam Spatacco has positions in Apple and Nvidia. The Motley Fool has positions in and recommends Apple and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.