Nvidia Dominates the AI Chip Market: Can Competitors Catch Up?

For the past two years, discussions about financial news have been dominated by the rise of artificial intelligence (AI). With AI now a fixture in the tech landscape, one company stands out among its peers: Nvidia (NASDAQ: NVDA). Over the last two years, Nvidia’s stock price has surged by nearly 900%, making it one of the world’s most valuable companies.

The growth of Nvidia can largely be attributed to its compute and networking division, which includes the company’s powerful graphics processing units (GPUs) and data center services. With an estimated 88% share of the total addressable market for GPUs, one must wonder if there is any company that could possibly challenge Nvidia’s status in the semiconductor industry.

1. Advanced Micro Devices: A Key Competitor

Nvidia’s closest rival is Advanced Micro Devices (NASDAQ: AMD). Similar to Nvidia, AMD has been growing its GPU and data center business and has benefited from the AI boom in recent years.

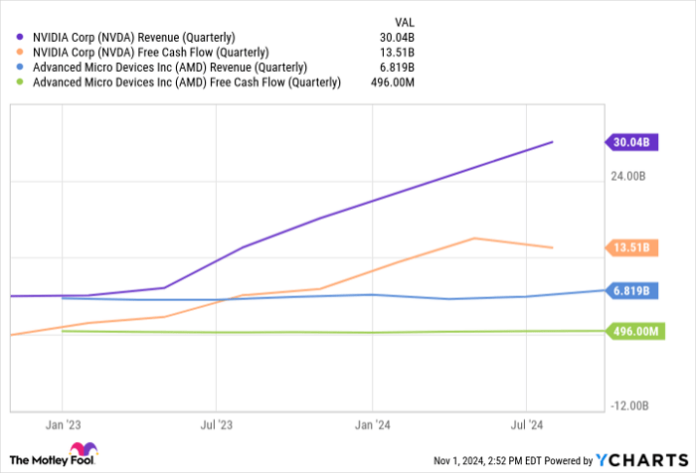

AMD’s third-quarter earnings, released on October 29, were impressive. The company reported a total revenue of $6.8 billion, an 18% increase from the previous year. Adjusted gross profit rose by 23%, while operating profit increased by 34% compared to the same period last year.

Over the past few years, AMD has aggressively acquired smaller AI companies. Although it may take time for these acquisitions to influence performance, the company is showing encouraging signs of growth by boosting sales and profit margins as it integrates new AI-focused products.

However, a deeper look reveals challenges. Compared to Nvidia, AMD is a much smaller operation. In its latest quarter, Nvidia generated $30 billion in revenue and $13.5 billion in free cash flow, a staggering difference that highlights Nvidia’s dominance.

Moreover, Nvidia’s growth trajectory outpaces AMD’s significantly. It has been reinvesting its substantial profits into research and development, with plans to launch its next-generation Blackwell GPUs later this year. The demand for these new GPUs is already impressive, while AMD’s recent financial outlook raises some concerns.

While AMD is well-positioned to take advantage of the growing generative AI market, it is unlikely to outpace Nvidia significantly in the near future.

2. Cerebras Systems: An Emerging Player

Another notable competitor is Cerebras Systems. Although still privately held, the company is preparing for an initial public offering (IPO), and its S-1 filing provides insights for potential investors.

Cerebras operates in a different niche. It specializes in a unique chip design known as the wafer-scale engine (WSE), which is significantly larger than typical GPUs produced by Nvidia.

Image source: Getty Images.

Cerebras claims that its larger chip architecture could lead to vastly improved computing power, memory, and bandwidth compared to existing GPU models. However, it’s worth noting that Cerebras is still much smaller than Nvidia. In 2023, the company reported revenue of $78.7 million, a 220% increase from the previous year, and sales of $136 million in the first half of 2024.

Despite these impressive growth figures, Cerebras relies heavily on one customer for nearly 90% of its revenue. This dependency raises concerns about the company’s stability and growth sustainability. While interest in new chip designs may rise as technology investments increase, it’s unlikely that Nvidia customers will abandon their established products in favor of experimental new technologies in the near term.

I’m intrigued by Cerebras, but as an Nvidia investor, I don’t see this company posing a significant threat anytime soon.

Where to Invest $1,000 Right Now

When our analyst team recommends a stock, it’s smart to pay attention. For context, Stock Advisor’s average total return stands at 815%—far outpacing the S&P 500’s 167% return.*

They’ve just revealed their picks for the 10 best stocks to buy right now, and while Advanced Micro Devices made the list, there are nine other potentially strong investments to consider.

See the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.