NVR, Inc. Reports Q1 2025 Financial Results, Earnings Miss Estimates

NVR, Inc. has released its financial results for the first quarter of 2025. The company’s earnings and Homebuilding revenues fell short of the Zacks Consensus Estimate. Although Homebuilding revenues increased compared to the same quarter last year, the bottom line declined from the previous year’s figure.

For the quarter, NVR’s Homebuilding segment saw a slight increase in settlements and settlement prices. However, new orders and average sales prices dropped. The backlog weakened and gross margins faced pressure from rising lot costs and affordability issues. On a brighter note, mortgage banking operations reported increases in both closed loan production and segment income.

NVR’s Performance Overview

NVR reported earnings of $94.83 per share, which missed the Zacks Consensus Estimate of $107.87 by 12.1%. This figure is down 18.5% from the earnings of $116.41 per share reported in the prior-year quarter. (Find the latest EPS estimates and surprises on Zacks earnings Calendar.)

Homebuilding revenues reached $2.35 billion, missing the consensus estimate of $2.38 billion by 1%. Consolidated revenues, which include Homebuilding and Mortgage Banking fees, totaled $2.40 billion, representing a 3% increase year over year.

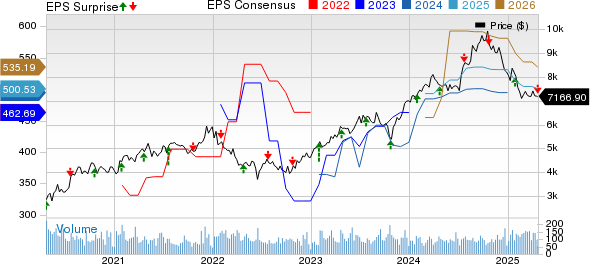

NVR, Inc. Price, Consensus and EPS Surprise

NVR, Inc. price-consensus-eps-surprise-chart | NVR, Inc. Quote

Segment Performance Breakdown

Homebuilding: The Homebuilding segment revenues increased 3% compared to the same quarter last year. Settlements rose by 1% year over year to 5,133 units, falling short of our estimate of 5,271 units. The average selling price (ASP) of settlements increased by 2% year over year, reaching $457,900, slightly above our expectation of $454,400.

However, gross margin contracted by 260 basis points compared to last year to 21.9%, falling short of our estimate of 22%.

New orders saw a 12% decline from the same quarter last year, totaling 5,345 units. The ASP for new orders dropped by 1% to $448,500, below our prediction of $459,900, while the cancellation rate climbed to 16% from 13% a year ago.

By the end of March 31, 2025, the unit backlog decreased by 9% from the previous year to 10,165 homes and fell by 7% on a dollar basis to $4.84 billion.

The company reported an average of 401 active communities in the quarter, down from 427 a year earlier.

Mortgage Banking: Mortgage banking fees increased by 11.2% year over year to $52.6 million. Closed loan production in the mortgage segment totaled $1.43 billion, up 4% year over year. The capture rate remained flat year over year at 86% in the first quarter.

NVR’s Financial Standing

As of March 31, 2025, NVR had cash and cash equivalents of $2.18 billion for Homebuilding and $34.2 million for Mortgage Banking, compared to $2.56 billion and $49.6 million at the end of 2024.

In 2024, NVR repurchased 77,120 shares for a total of $583.4 million. As of the end of the first quarter of 2025, the company had 2,944,615 shares outstanding.

Market Position and Peer Performances

Currently, NVR holds a Zacks Rank of #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

KB Home: KBH reported disappointing fiscal first-quarter 2025 results, with earnings and total revenues missing expectations and declining year over year.

This disappointing performance reflects ongoing softness in the housing market, as homebuyers continue to face affordability challenges from high mortgage rates. Additionally, macroeconomic uncertainties are further destabilizing the housing market. Due to these challenges and a decrease in net orders, KB Home has adjusted its fiscal 2025 guidance downward.

Lennar Corporation: LEN reported first-quarter fiscal 2025 results that surpassed the Zacks Consensus Estimate for earnings and revenues. Although the top line increased year over year, the bottom line experienced a decline.

This performance was affected by the challenging macroeconomic environment. Despite strong demand, high interest rates, inflation, and low consumer confidence have made homeownership harder to attain. A limited supply of affordable homes has added to the struggles, impacting Lennar’s average sales price. Looking ahead, the company plans to adopt a volume-based strategy combined with an asset-light business model to navigate these market uncertainties.

D.R. Horton, Inc.: DHI reported disappointing second-quarter fiscal 2025 results (ending March 31, 2025), with earnings and revenues missing Zacks Consensus Estimates and decreasing year over year.

The persistent housing market challenges, driven by low consumer confidence and affordability concerns, negatively impacted the company’s quarterly performance. Lower net sales orders and reduced contributions from rental operations and financial services exacerbated the downturn. While the company is actively offering sales incentives to boost traffic and sales, these efforts are negatively affecting the bottom line. High selling, general, and administrative expenses are also compressing margins.

7 Best Stocks for the Next 30 Days

Just released: Experts have identified 7 elite stocks from Zacks Rank #1 Strong Buys. These stocks are considered “Most Likely for Early Price Pops.”

The full list has outperformed the market more than twice since 1988, with an average annual gain of +23.9%. Be sure to pay attention to these hand-picked stocks.

See them now >>

Stay updated with the latest recommendations from Zacks Investment Research. Today, you can download the report on 7 Best Stocks for the Next 30 Days. Click to get this free report.

KB Home (KBH): Free Stock Analysis report.

Lennar Corporation (LEN): Free Stock Analysis report.

D.R. Horton, Inc. (DHI): Free Stock Analysis report.

NVR, Inc. (NVR): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.