NYT Surpasses Expectations with Steady Growth in Q3 2024

The New York Times Company (NYT) reports solid results for the third quarter of 2024. The adjusted earnings per share (EPS) came in at 45 cents, exceeding the Zacks Consensus Estimate of 42 cents. This marks an improvement over the previous year’s adjusted earnings of 37 cents. Total revenues reached $640.2 million, aligning with the Zacks Consensus Estimate of $640 million, showcasing a 7% yearly increase.

Stay updated with the Zacks Earnings Calendar for important market news.

During this quarter, NYT added around 260,000 net digital-only subscribers, reflecting the success of various offerings across its platforms.

NYT’s digital-only average revenue per user (ARPU) grew to $9.45 in the third quarter, up from $9.28 last year. This rise results from many subscribers moving from promotional pricing to higher rates, along with price increases for long-term customers not in bundle plans.

Significant Growth in NYT Subscription Revenues

Subscription revenues reached $453.3 million, an 8.3% increase compared to last year. Digital-only subscription revenue surged by 14.2% to $322.2 million. While bundle and multi-product revenues rose, there was a slight decline in news-only subscriptions. Print subscription revenues fell by 3.8% to $131.1 million, primarily due to lower domestic home-delivery revenue.

At the end of the quarter, the company reported 11.09 million subscribers across its print and digital products, including 10.47 million digital-only subscribers, of which 5.12 million were in bundle or multi-product subscriptions.

Looking forward, management estimates a 7-9% growth in total subscription revenues for the fourth quarter of 2024, with digital-only revenues expected to rise by 14-17%.

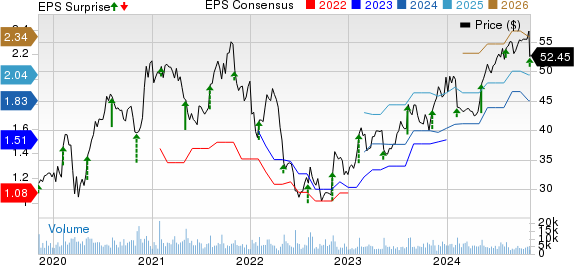

NYT Financial Performance: Price, Consensus, and EPS Surprise

The New York Times Company’s price, consensus, and EPS surprise trends

Advertising Revenues on the Rise

Total advertising revenues increased by 1.1% from last year, reaching $118.4 million. Digital advertising revenues climbed by 8.8% to $81.6 million, boosted by greater revenues from open-market programmatic advertising.

In contrast, print advertising revenues decreased by 12.6% to $36.8 million this quarter, with notable declines in the finance and classifieds categories.

For the fourth quarter of 2024, the company projects a slight increase in overall advertising revenues, with digital advertising revenues expected to grow by high-single-digit to low-double-digit percentages.

Key Highlights from NYT’s Q3 Results

Other revenues rose by 9.3% year over year to $68.5 million, driven by higher licensing and Wirecutter affiliate referrals. Management anticipates an 11-13% rise in other revenues for the fourth quarter of 2024.

Adjusted operating costs also increased by 5.4% to $536 million during the quarter. For the fourth quarter of 2024, management expects operating costs to rise by 5-6%.

The adjusted operating profit grew by 16.1% to $104.2 million, while the adjusted operating margin expanded by 130 basis points to 16.3%.

NYT’s Segment Performance Overview

The New York Times Group reported a 5.7% increase in revenues year over year, reaching $596 million. Subscription revenues grew by 7.4% to $422.2 million, primarily due to the boost in digital-only subscription revenues, although print subscription revenues fell. Advertising revenues rose by 0.6% to $109.3 million, thanks to higher digital advertising revenues.

Meanwhile, revenues for The Athletic segment totaled $44.7 million, a 29.8% increase from the previous year. Subscription revenues for The Athletic increased to $31.1 million from $25.6 million in Q3 2023, due to a higher subscriber count. Additionally, advertising revenues rose to $9 million from $8.4 million, fueled by increased direct-sold display advertising.

Assessing NYT’s Financial Position

At the end of the quarter, NYT reported cash and marketable securities totaling $820.4 million, a rise of $111.2 million from $709.2 million on December 31, 2023.

The company incurred around $6 million in capital expenditures this quarter. For 2024, management forecasts capital expenditures of $35 million.

During the quarter, the company repurchased 341,456 shares of its Class A common stock, totaling $18.3 million. As of November 1, 2024, approximately $183 million remains authorized for further repurchases.

It’s noteworthy that shares of this Zacks Rank #3 (Hold) company have grown by 26.6% over the past year, though this growth lags behind the industry average of 39.3%.

Stocks to Watch

Other stocks worth considering include DocuSign, Inc. (DOCU), PayPal Holdings (PYPL), and Meta Platforms, Inc. (META).

Currently, DocuSign holds a Zacks Rank #1 (Strong Buy), with an average trailing four-quarter earnings surprise of 18.3%. The Zacks Consensus Estimate suggests growth of 6.5% in revenues and 15.8% in EPS for DocuSign compared to the previous year.

PayPal Holdings has a Zacks Rank #2 (Buy) and has delivered an average earnings surprise of 15.1% over the past four quarters, with its current financial-year sales set to grow 6.4% from the previous year.

Meta Platforms, ranked #2, has an average trailing four-quarter earnings surprise of 11.3%, with expected growth of 20.8% in sales and 51.5% in EPS compared to last year.

Explore Investment Opportunities

Only $1 for 30 days of access to our top stock recommendations.

Years ago, we surprised our members by offering a 30-day trial for just $1, with no further obligations. Thousands have benefited from this offer, while others hesitated, thinking there was a catch. Our goal is to familiarize you with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, that achieved 228 positions with double- and triple-digit gains in 2023.See Stocks Now >>

If you’re interested in today’s top investment picks from Zacks Investment Research, download our report on 5 Stocks Set to Double today.

The New York Times Company (NYT) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Docusign Inc. (DOCU) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.