“`html

October CPI Report: Indicators of Steady Inflation Amid Reinflation Concerns

This morning, the market received the latest inflation report for October – the Consumer Price Index (CPI) data. It showed that while the market rally remains strong, investors need to stay alert about possible risks that could halt this Wall Street progress.

CPI Data Meets Expectations

On a positive note, the report did not come with any unexpected increases. In fact, October’s inflation figures matched predictions closely.

Year-over-year, CPI rose 2.6%, and core inflation increased 3.3%. For the month alone, CPI went up 0.2%, while core inflation rose by 0.3%. These figures align precisely with what analysts anticipated.

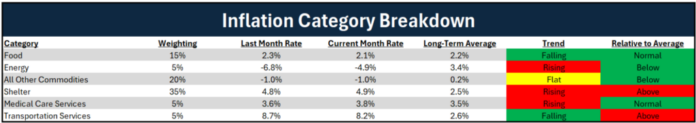

Given the current fears of reinflation, a CPI report that reflects expected outcomes is reassuring. Furthermore, the trends within the data present encouraging signals. When excluding housing, inflation in most significant categories is either declining or is more favorable than its long-term average.

For instance, the rate of food inflation decreased from 2.3% to 2.1% in October, which is slightly below the long-term average of 2.2%. Energy inflation was calculated at -4.9% last month, significantly lower than the long-term average of 3.4%. Additionally, inflation across other commodities was measured at -1.0%, again well below the long-term average of 0.2%. The inflation for medical services has stabilized around its historical average.

The main concern, however, lies with shelter costs.

Shelter Inflation Remains Stubbornly High

Shelter inflation stands at 4.9%, significantly above the long-term average. After several months of decline, it even saw an increase in October.

It’s evident that the Federal Reserve is unlikely to control shelter inflation without risking a recession. Over the years 2022 and 2023, the Fed raised interest rates rapidly, resulting in higher mortgage rates. Yet, this strategy failed to markedly reduce shelter inflation, suggesting it is largely out of the Fed’s hands.

The root of this issue is supply-related.

Outside of housing, inflation currently sits at a much healthier rate of 1.3%.

Overall, excluding shelter, inflation appears to have returned to normal levels. This stability could motivate the Fed to proceed with interest rate cuts in the coming months, providing further support for the U.S. economy.

Indeed, prior to the release of October’s CPI data, the likelihood of a rate cut in December was estimated at around 60%. Following the report, those odds increased to over 80%. The market is still adjusting to these developments.

“`

Inflation Trends and the Stock Market: What You Need to Know

The latest Consumer Price Index (CPI) report offers encouraging insights, hinting at the possibility of three more interest rate cuts this cycle. This backdrop supports the ongoing strength of the stock market.

However, this situation might not last indefinitely.

Risks of Rising Inflation

The CPI report highlights six major categories: Food, Energy, Commodities, Shelter, Transportation Services, and Medical Care Services. Of these, four are currently aligned with historical “normal” levels. Yet, only two show a decline in inflation rates.

Specifically, inflation remains stable across All Other Commodities, while it is increasing for Energy, Shelter, and Medical Care Services.

Taking a broader view, the overall U.S. inflation rate increased from 2.4% to 2.6% in October. Furthermore, the Cleveland Federal Reserve projects another uptick to 2.7% in November.

In summary, the stock market has thrived on decreasing inflation over the past two years. However, that trend is shifting.

Final Insights

Currently, inflation is not decreasing; it is stabilizing and may even be on the rise.

This evolution occurs amid potential policy shifts planned for 2025 and 2026. Things like tax cuts, deregulation, new tariffs, and mass deportations could all contribute to inflationary pressures.

Historically, during Donald Trump’s first term, inflation climbed from 1.6% in mid-2017 to almost 3% by the end of 2018.

What does this mean for investors?

Inflation isn’t a current concern, but it could become one in the following quarters.

While you should be aware of these risks, it’s crucial not to let them drive you out of the market. The stock market appears poised for growth, so consider participating. However, approach it with caution; avoid letting euphoria or greed cloud your judgment.

Though reinflation risks are significant, they are unlikely to disrupt market stability immediately. Nevertheless, it is wise to prepare for potential challenges ahead.

If you’re looking to capitalize on the current market enthusiasm, we have some promising investment opportunities in sight.

As of the publication date, Luke Lango did not hold (either directly or indirectly) any positions in the securities discussed in this article.

P.S. Stay updated on Luke’s latest market insights by reading our Daily Notes! Explore the current issue on your Innovation Investor or Early Stage Investor subscriber site.