Bitcoin Surges in October: A Closer Look at Crypto-Related Stocks

The Bitcoin (CRYPTO: BTC) cryptocurrency experienced a significant rise of 10.2% in October 2024, as reported by S&P Global Market Intelligence. This surge positively influenced stocks and funds closely tied to Bitcoin, which often outpaced Bitcoin’s gains. Below, we highlight some vital figures showcasing this trend, including Bitcoin itself as well as a leading S&P 500 (SNPINDEX: ^GSPC) index fund:

|

Investment |

Relation to Bitcoin |

October Price Change |

Market Cap (Stocks and Cryptocurrencies) or Assets Under Management (ETFs) |

|---|---|---|---|

|

MicroStrategy (NASDAQ: MSTR) |

Owns 252,220 Bitcoins and plans to buy more. |

45% |

$42.5 billion |

|

Riot Platforms (NASDAQ: RIOT) |

Bitcoin mining company. |

24.5% |

$2.8 billion |

|

iShares Bitcoin Trust ETF (NASDAQ: IBIT) |

Largest Bitcoin spot price ETF. |

10.1% |

$30.0 billion |

|

Bitcoin |

This is Bitcoin. |

10.2% |

$1.34 trillion |

|

Vanguard S&P 500 ETF (NYSEMKT: VOO) |

Popular stock index tracker. |

(1%) |

$539.9 billion |

Data collected from YCharts, FinViz, and CoinMarketCap on 11/4/2024.

Bitcoin’s Notable October Rally

Bitcoin saw two major increases in October 2024. Initially, the Chinese government’s new economic stimulus captured investor attention, leading to increased demand for Bitcoin and other cryptocurrencies. Toward the end of the month, a wave of speculation swept over many high-risk assets, including Bitcoin, driven by recent interest rate cuts and the upcoming presidential election.

The iShares Bitcoin ETF mirrored Bitcoin’s price movements, as it is designed to do.

Riot Platforms’ stock peaked at a 46.5% increase in late October, before quickly falling. The stock tends to react strongly to Bitcoin’s market changes. Positive trends benefit Riot’s mining investments in digital coins, while downturns can significantly hurt its business model due to added risks. The company’s Q3 earnings report, which failed to meet analysts’ expectations, contributed to its price decline at the month’s end. Additionally, a recent halving of Bitcoin’s mining rewards has squeezed Riot’s profit margins.

In contrast, MicroStrategy has transformed into a direct Bitcoin investment, converting a significant portion of its cash reserves to acquire Bitcoin. The stock initially soared 53.2% in October before seeing a decline on the 30th. Although the company reported disappointing third-quarter sales and earnings, it significantly expanded its Bitcoin-buying program. MicroStrategy aims to raise $42 billion in the next three years through debt and stock sales, intending to invest this capital into further Bitcoin acquisitions. However, this ambitious plan did not fully convince the market.

Understanding the October Surge

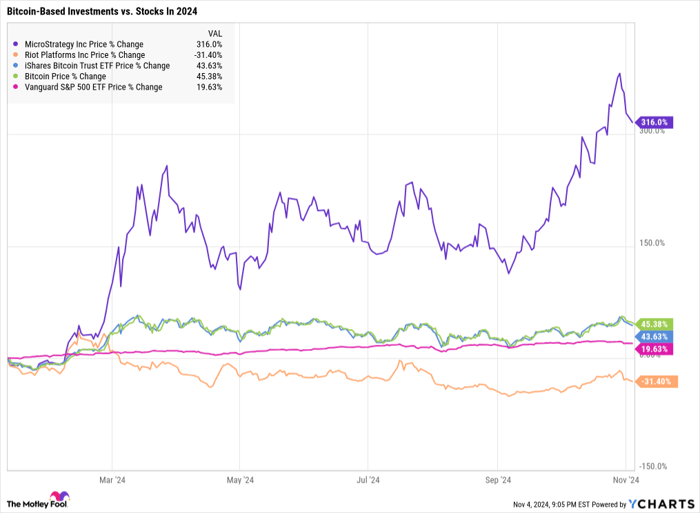

The performance of these Bitcoin-related investments since the launch of spot Bitcoin ETFs on January 10 provides insight into the mixed results of crypto investments. While MicroStrategy has rallied, Riot Platforms has struggled, and Bitcoin itself has outperformed the stock market in 2024:

MSTR data by YCharts

Investors are still on the lookout for positive moves in Bitcoin’s price, historically observed after each halving of mining rewards. Institutional investors are gradually exploring new ETFs, although the largest ETF currently represents only 0.04% of Bitcoin’s total market value.

If you believe in Bitcoin’s potential to reshape the financial landscape, now might still be an opportune moment to make a move. Alternatively, you could adopt the cautious approach of investor Warren Buffett and stay on the sidelines, observing this evolving asset class without direct involvement. Regardless, the ongoing developments in cryptocurrency continue to spark interest.

Uncovering New Investment Opportunities

Have you ever felt like you missed out on top-performing stocks? If so, consider this.

On rare occasions, our skilled analysts issue a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you’re concerned about missing your chance to invest, the present moment may be your best opportunity before it slips away. The track record highlights the potential:

- Amazon: A $1,000 investment in 2010 would now be worth $22,292!*

- Apple: A $1,000 investment in 2008 would now be worth $42,169!*

- Netflix: A $1,000 investment in 2004 would now be worth $407,758!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies; it may be a while before another chance like this arises.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

Anders Bylund has positions in Bitcoin and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Bitcoin and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.