“`html

Nvidia’s Stock Performance: Opportunities Amid Market Challenges

It has been a challenging year for Nvidia (NASDAQ: NVDA). At one point, shares dropped more than 30%, resulting in a loss of over $1 trillion in market valuation.

Currently, shares are down by 20% year to date after a brief recovery. Although the stock is not as affordable as it was a few weeks ago, it still presents a significant opportunity for patient investors looking to acquire shares in a company poised for exponential growth in the coming years.

Why Nvidia Maintains a $2.7 Trillion Valuation

Nvidia ranks among the world’s most valuable companies, thanks in large part to its advanced graphic processing units (GPUs).

Particularly in the realm of AI applications, Nvidia’s GPUs are regarded as the industry standard. They play a crucial role in enabling companies to train and operate large models that demand extensive data to function effectively.

The company’s next-generation Blackwell chips set performance benchmarks that few can rival. However, the strength lies not only in performance; it is also backed by a robust software suite known as Compute Unified Device Architecture (CUDA).

CUDA empowers developers to tailor Nvidia’s GPUs for specific applications, enhancing performance even further. Once a customer integrates CUDA, they tend to remain committed to Nvidia’s hardware and software, allowing the company to control both ends of its value chain.

Nvidia’s exceptional chips, particularly for AI, and the integration of CUDA create a sustainable competitive edge. This positioning is crucial as the AI industry is projected to soar beyond $4 trillion by 2033, growing from just $189 billion in 2023.

The company’s outlook remains optimistic, bolstered by recent remarks from Morgan Stanley analyst Joseph Moore that may further excite investors regarding its long-term potential.

Assessing the Market: No Bubble in Sight

Nvidia’s stock price pullback has been influenced by multiple factors. The broader market downturn earlier this year affected many leading companies.

Concerns have arisen regarding potential overvaluation in the AI sector, leading some investors to speculate that we might be facing an AI bubble. Such anxiety suggests further declines could be imminent. However, Moore’s recent insights aim to alleviate these fears.

In a note to clients last week, he stated, “The idea that we are in a digestion phase for AI is laughable given the obvious need for more inference chips which is driving a wave of very strong demand. Those who want to view this as a bubble are misinterpreting the ongoing discussions surrounding long-term data center leases; actual customer demand remains robust.”

These remarks align with Nvidia’s backlog statistics, indicating that many of its chips have waiting periods of up to 12 months. Data center operators, a critical customer segment, show no indication of reduced spending in the coming years, despite potential short-term fluctuations. “We are hearing about demand levels that are tens of billions above current run rates, limited by supply,” Moore added in his analysis.

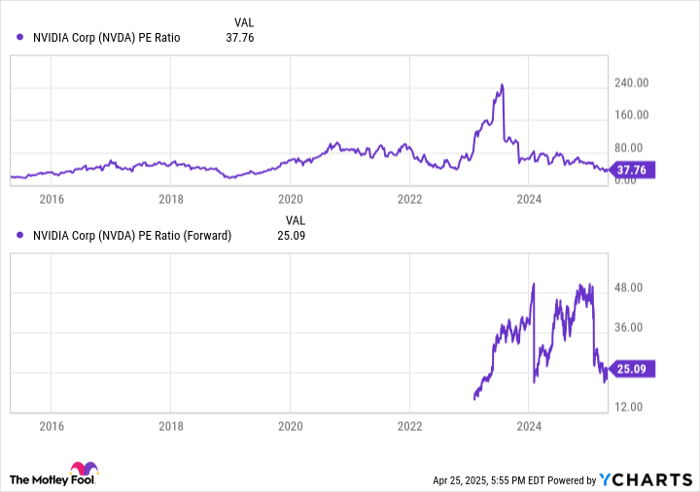

NVDA PE Ratio data by YCharts; PE = price to earnings.

The AI revolution is ongoing. Despite its premium valuation, Nvidia trades at just 25 times forward earnings, a reasonable figure for a rapidly growing, profitable company.

Given the anticipated demand for AI GPUs throughout this decade and beyond, Nvidia’s stock might continue to rise, potentially exceeding its current $2.7 trillion valuation.

Seize the Opportunity: A Potentially Lucrative Investment

If you have ever felt you missed out on investing in successful stocks, now might be your chance.

On rare occasions, analysts highlight a “Double Down” recommendation for companies they believe are on the verge of significant gains. If you’ve been concerned that you might have already missed your opportunity to invest in Nvidia, now is a critical time to reconsider.

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $282,457!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $40,288!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $610,327!*

We are currently issuing “Double Down” alerts for three exceptional companies, available through our advisory services, and this opportunity may not last long.

*Stock Advisor returns as of April 28, 2025

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`