Amazon Aims for $3 Trillion Status by 2025

Eight American tech companies now have valuations over $1 trillion, but only three have reached the $3 trillion mark:

- Apple: $3.7 trillion

- Nvidia: $3.3 trillion

- Microsoft: $3.3 trillion

Amazon (NASDAQ: AMZN) ranks as the fourth largest company globally, currently valued at $2.4 trillion. Its stock has climbed over 50% this year, reaching an all-time high, bolstered by strong cloud growth, increasing profits, and a leading role in artificial intelligence (AI).

Where to invest $1,000 right now? Our analysts have identified the 10 best stocks to buy now. See the 10 stocks »

This article explains why Amazon is on a promising trajectory to potentially join the $3 trillion club by 2025.

The Surge in Cloud Revenue Thanks to AI

As the largest e-commerce platform, Amazon also sits at the forefront of the cloud computing industry through Amazon Web Services (AWS). Offering a wide range of services, AWS supports businesses moving into the digital space, from basic data storage to advanced software development tools.

Additionally, AWS is a hub for Amazon’s AI projects. The company’s goal is to dominate the three key areas of AI: hardware, large language models (LLMs), and software, positioning itself as a comprehensive resource for developers and businesses.

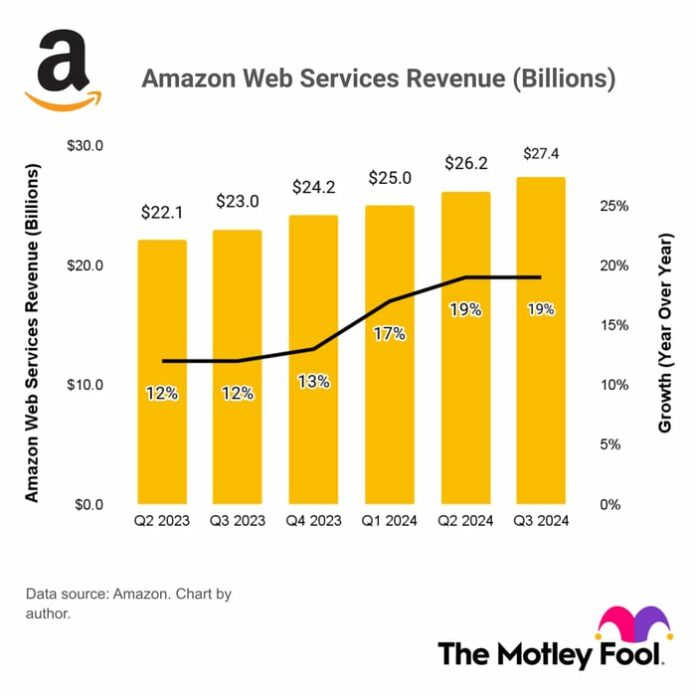

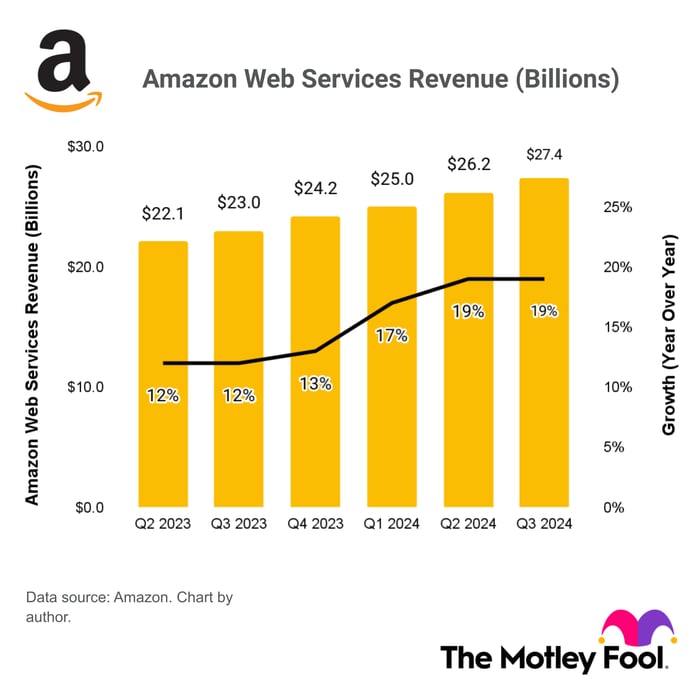

In the third quarter of 2024 (ending September 30), AWS reported impressive earnings of $27.4 billion, a 19% increase from the previous year. This accelerated growth is largely attributed to AI advancements.

CEO Andy Jassy noted that AI revenue in AWS grew at a triple-digit percentage during Q3 compared to last year. Remarkably, this growth rate is three times faster than that of the cloud division at a comparable stage.

Focusing on the three AI categories, AWS utilizes data centers equipped with Nvidia’s latest AI chips, leasing computing power to clients. Furthermore, Amazon has developed its chips, named Trainium (for AI training) and Inferentia (for AI inference). Developers can save up to 50% on training costs by using Trainium compared to competitors, with future savings expected as Trainium2 is rolled out.

Many developers favor pre-built LLMs from third-party sources to save time and resources. AWS’s Bedrock platform provides access to the Titan LLMs developed by Amazon, alongside the latest models from major companies like Anthropic and Meta Platforms, offering a wealth of options.

At the software layer, Amazon has created an AI assistant called “Q,” designed to answer inquiries about organizational data and generate computer code, expediting project timelines. Amazon claims that Q boasts the highest code acceptance rate in the industry and helped save 4,500 developer years (and $260 million) on a single internal software project.

Amazon’s Profits are Rising Rapidly

With over half a trillion dollars in yearly revenue, Amazon excels in various sectors, including e-commerce and cloud, while also expanding in areas like streaming and digital advertising. As the company matures, attracting new customers becomes increasingly challenging.

Nonetheless, Amazon has achieved significant bottom-line growth through expense management and improved efficiency. Last year, the company overhauled its e-commerce logistics by dividing the U.S. market into eight areas, resulting in shorter delivery distances. This change has led to a 25% improvement in order distribution accuracy across its fulfillment centers.

Investing in technology continues to be a priority, with robotics speeding up picking, packing, and shipping. AI tools like Project Private Investigator help maintain product quality, reducing refunds and returns. Thanks to these innovations, a record number of customers receive same-day deliveries, while the cost to serve declines.

During the first three quarters of 2024, total operating expenses reached $402.7 billion, a modest 5.6% increase from the previous year. Meanwhile, revenue climbed 11.2% to $450.1 billion, resulting in net income surging by 98% to $39.2 billion, positioning the company for its highest-ever annual profit.

Image source: Amazon.

Is Amazon Stock a Good Buy at This Price?

Through the first three quarters of 2024, Amazon’s net income yields earnings per share (EPS) of $3.67. Analysts expect a total EPS around $5.14 by the end of the year, according to Wall Street’s consensus forecast.

As of now, Amazon shares trade at $227.46, corresponding to a price-to-earnings (P/E) ratio of 44.2. Although not outright cheap—compared to the Nasdaq-100‘s P/E of 34.9—Amazon warrants a premium for its rapid EPS growth and dominance across e-commerce, cloud computing, and AI.

Looking ahead to 2025, the consensus anticipates an EPS of $6.19, which aligns the stock’s forward P/E at 36.8, comparable to the Nasdaq-100’s current position. However, to maintain its present P/E ratio of 44.2, Amazon stock needs to rise by 20% next year.

If Amazon achieves this, its market capitalization would reach $2.9 trillion. Should the company continue to outperform EPS estimates, as evidenced in 2024, surpassing $3 trillion in market cap remains a strong possibility.

Considering its current emphasis on efficiency and likely continued momentum in earnings, Amazon appears well-poised to join Nvidia, Apple, and Microsoft in the elite $3 trillion club in 2025.

Should You Invest $1,000 in Amazon Now?

Before making an investment, keep this in mind:

The Motley Fool Stock Advisor team has listed the 10 best stocks for potential investors currently… and Amazon is not included. The stocks selected could yield substantial returns in the upcoming years.

Consider Nvidia’s story: if you had invested $1,000 when it was listed on April 15, 2005, your investment would be worth $799,099!

Stock Advisor offers an easy-to-follow framework for investment success, providing portfolio guidance, consistent analyst updates, and two stock picks each month. Since 2002, the Stock Advisor service has generated returns more than four times that of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, which is now part of Amazon, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is also on the board. Anthony Di Pizio does not hold positions in the mentioned stocks. The Motley Fool holds positions in and recommends Amazon, Apple, Meta Platforms, Microsoft, and Nvidia, and provides recommendations for certain options. Please consult their disclosure policy.

The views expressed in this article are those of the author and do not necessarily represent those of Nasdaq, Inc.