Amazon’s AI Strategy: A Potential Winning Investment

In 2023, Bank of America analyst Michael Hartnett coined the term “Magnificent Seven” to describe a select group of dominant tech stocks, inspired by the classic 1960s film. These high-value companies are making significant advancements in artificial intelligence (AI), cloud computing, online gaming, and sophisticated hardware and software.

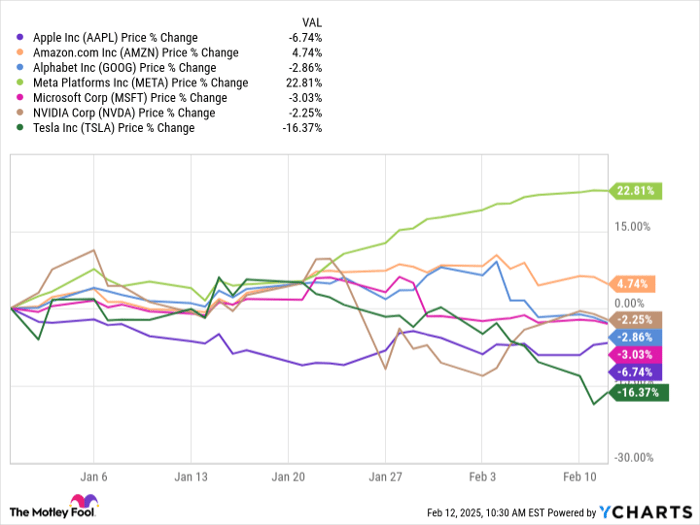

The Magnificent Seven have produced impressive returns over the past five years. However, 2025 has posed challenges for many. Currently, only Meta Platforms has meaningfully outperformed the S&P 500 (SNPINDEX: ^GSPC), which has seen a modest year-to-date gain of 2.4% as of this report. Meanwhile, other members of the group have faced difficulties.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

AAPL data by YCharts

This year, Amazon (NASDAQ: AMZN) has emerged as a key performer. Not only has its stock outgained the S&P 500 by just over 2%, but it also continues to strengthen its presence in AI.

Image source: Getty Images.

Now, let’s delve into why Amazon is considered a strong buy at present.

Understanding Amazon’s AI Framework

During its earnings call on February 6, CEO Andrew Jassy shared details about Amazon’s expansive AI strategy. The company boasts approximately 1,000 generative AI applications in development or already functional, highlighting their multi-layered technological approach.

On the foundational level, Amazon produces its own AI chips. The newly launched Trainium2 offers a 30% to 40% improvement in price performance over traditional graphics processing units (GPUs). Following this success, Amazon plans to introduce Trainium3 in late 2025 and is developing Trainium4. A partnership with chatbot pioneer Anthropic also aims to enhance model development.

In the middle layer, Amazon Bedrock supplies foundational models for AI application development. The Nova models, introduced in Q4 2024, provide capabilities on par with leading competitors at an impressive 75% lower cost. This innovation has attracted major clients such as Palantir Technologies, SAP, and Robinhood.

At the application level, Amazon’s AI assistant, Q, has already demonstrated its worth. Early implementations of Q led to significant savings, including $260 million and a time savings equivalent to 4,500 developer years on Java migrations. The company intends to expand Q’s functionalities to simplify the migration of Windows servers, VMware systems, and mainframe computers to Amazon Web Services (AWS).

Prioritizing Investment in AI

Amazon’s Q4 2024 earnings report showcased its robust investment capacity, with capital expenditures reaching $26.3 billion. While these funds support various business needs, the emphasis on AI development is evident. The robust investment strategy is yielding results, as AWS saw AI-related revenue surge, contributing to an impressive $115 billion annual revenue run rate.

Although current growth is hindered by hardware supply and power infrastructure challenges, Amazon predicts a resolution of these limitations in the latter half of 2025. As Jassy highlighted, “AI represents, for sure, the biggest opportunity since cloud and probably the biggest technology shift and opportunity in business since the internet.”

Why Invest in Amazon Stock?

Currently, Amazon shares trade at 35.4 times forward earnings, compared to 24.2 times for the S&P 500. This premium signals investor confidence in the company’s AI strategy and its effectiveness throughout various tech fields. As a technology leader, Amazon encompasses all vital layers of the AI spectrum, from custom chip development to business applications.

Amazingly, Amazon’s AI division is already seeing triple-digit annual revenue growth. When supply-related limitations ease later in 2025, Amazon is poised for significant growth in the AI sector.

Is Now the Time to Invest $1,000 in Amazon?

Before making an investment in Amazon, it’s important to consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to buy at this time, and notably, Amazon is not one of them. The selected stocks are expected to yield substantial returns in future years.

Reflecting on when Nvidia was recommended on April 15, 2005… if you invested $1,000 at that time, you’d now have $813,868!*

Stock Advisor offers a straightforward approach for investors, including guidance for portfolio building, frequent analyst updates, and two new stock picks each month. Since its inception in 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.*

Learn more »

*Stock Advisor returns as of February 7, 2025

Randi Zuckerberg, former director of market development at Facebook and sister to Meta Platforms CEO, is an advisory board member of The Motley Fool. John Mackey, ex-CEO of Whole Foods Market (an Amazon subsidiary), is also on the board. The Motley Fool has investments in and recommends multiple companies including Alphabet, Amazon, and Nvidia as well as options recommendations concerning Microsoft. Please review The Motley Fool’s disclosure policy for more details.

The views and opinions expressed herein belong to the author and do not necessarily represent the views of Nasdaq, Inc.