Onto Innovation Set to Reveal Q4 Results: What Investors Need to Know

Onto Innovation (ONTO) plans to announce its fourth-quarter 2024 earnings on February 6, after the market closes.

Keep track of all quarterly releases: Check out Zacks Earnings Calendar.

Q4 Earnings Expectations

The Zacks Consensus Estimate for fourth-quarter earnings per share (EPS) stands at $1.39. This figure reflects a promising growth of 31.1% compared to last year’s quarter. The company anticipates its non-GAAP EPS will fall within the range of $1.33 to $1.48.

Revenue expectations are pegged at $259.4 million, an increase of 18.5% from the previous year’s quarter. Management estimates revenue to be between $253 million and $267 million.

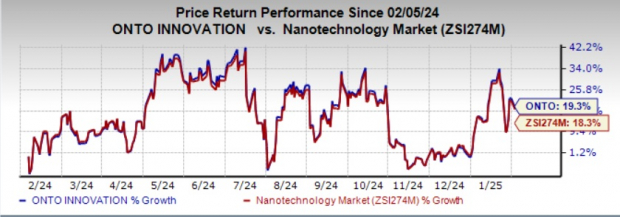

Over the past four quarters, ONTO has consistently surpassed the Zacks Consensus Estimate, with an average surprise of 6.9%. The company’s shares have appreciated by 19.3%, slightly outperforming the sub-industry’s 18.3% growth over the past year.

Image Source: Zacks Investment Research

Key Drivers of Performance

The ongoing adoption of the Dragonfly inspection system has likely been a significant factor in ONTO’s revenue performance. Inspection services have become central to the company, and projections indicate that inspection revenues could nearly double for 2024. A recent acquisition of Lumina Instruments in October 2024 aims to further boost this segment. Lumina’s cutting-edge technology is designed to enhance high-sensitivity scanning for various substrates, expanding ONTO’s serviceable available market (SAM) by $250 million annually over the next three years.

Additionally, Onto’s acquisition of the lithography business from Kulicke and Soffa Industries, Inc. has allowed it to gain essential intellectual property, including 24 patents. This move is expected to contribute an estimated $100 million in additional annual revenues within three years, with earnings benefits anticipated within a year.

Growth in revenue is further supported by momentum across advanced nodes, specialty devices, and software and services. Advanced packaging has become a significant sector within the metrology business.

To improve cash flow, the company is focusing on inventory optimization, reducing inventory from $320 million in the prior quarter to $308 million. ONTO anticipates a further reduction of $8-$10 million in the upcoming quarter, aiming to bring inventory levels below $300 million by the end of 2024, marking a substantial decrease from peak levels in 2023.

Reflections on Earnings and Risks

Despite these achievements, key risks remain, including customer concentration, supply chain issues, and general economic uncertainties. As a result, rising operational costs may impact margins. For the fourth quarter, ONTO expects operating expenses to be between $66 million and $68 million, while aiming to maintain stable costs and optimize R&D following its recent acquisitions. The projected gross margins are anticipated to be between 54% and 55%. Challenges with high inventory levels are also hindering supply chain cost efficiencies.

We estimate fourth-quarter operating expenses to reach $66 million and gross margins at 54.8%.

Recent Developments

In January 2025, Onto Innovation secured a $69 million volume purchase agreement with a leading DRAM manufacturer. This deal encompasses ONTO’s comprehensive portfolio of metrology solutions. On the same day, the company announced significant advancements in its product line for 3D interconnect process control, introducing 3Di technology on the Dragonfly G3 system and the new EchoScan system.

Future Earnings Predictions

Our analysis does not currently predict an earnings beat for Onto Innovation this quarter. Generally, a positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy) or #3 (Hold) enhances the likelihood of an earnings surprise. Unfortunately, this is not the situation for ONTO.

Earnings ESP: ONTO has an Earnings ESP of 0.00%. You can discover other stocks with promising conditions using our Earnings ESP Filter.

Zacks Rank: Currently, ONTO holds a Zacks Rank of #3. For a complete list of top-ranked stocks, please visit Zacks.

Potential Stocks for Earnings Beats

Here are a few stocks with favorable characteristics that may outperform this earnings season:

QUALCOMM Incorporated (QCOM) shows an Earnings ESP of +3.34% and holds a Zacks Rank of #2. Reports are slated for February 5, with an expected EPS of $2.93 and revenues of $10.92 billion. Shares have increased by 15.8% over the past year.

Amazon.com, Inc. (AMZN) boasts an Earnings ESP of +4.78% and Zacks Rank #2. Scheduled to report on February 6, the earnings estimate stands at $1.52 per share with $187.28 billion in revenue. AMZN shares have surged by 51.2% in the past year.

Airbnb (ABNB) presents an Earnings ESP of +38.46% and a Zacks Rank #3. They will announce Q4 2024 results on February 13, with an expected EPS of 63 cents and revenues of $2.42 billion. However, ABNB shares have dipped by 10.1% over the last twelve months.

Insider Stock Recommendations

From a pool of thousands, five Zacks experts have pinpointed their top stock selections predicted to double in value. Among these, Director of Research Sheraz Mian confidently selects one stock for potential explosive growth.

This company appeals to millennial and Gen Z markets, boasting nearly $1 billion in revenue last quarter alone. A recent pullback in its shares may offer an attractive entry point for investors. While past recommendations have not always guaranteed success, this pick shows significant promise compared to previous top-performing stocks.

To discover our top stock pick along with four alternatives, click to access our free report.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Onto Innovation Inc. (ONTO) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.