JPMorgan Chase Faces Downgrade Amid Shifting Institutional Sentiment

On November 20, 2024, Oppenheimer downgraded JPMorgan Chase (WSE:JPM) from Outperform to Perform, marking a significant shift in outlook for the financial giant.

Institutional Investor Landscape

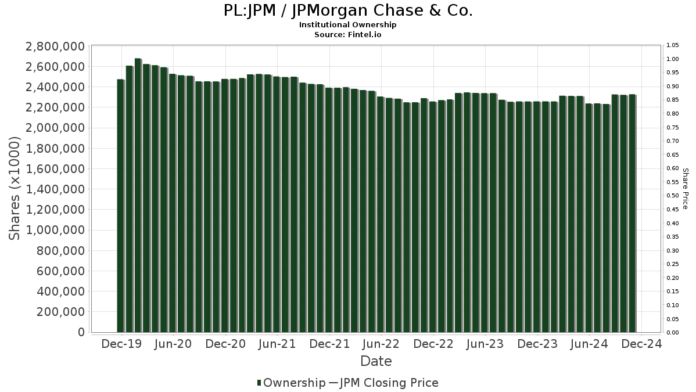

Currently, there are 5,749 funds or institutions with stakes in JPMorgan Chase, showing a modest increase of 64 investors or 1.13% from the last quarter. Notably, the average portfolio weight dedicated to JPM has risen to 1.15%, up by 4.14%. Interestingly, total shares held by these institutions decreased by 1.17% in the past three months, now sitting at 2,324,904K shares.

Among the major stakeholders, BlackRock stands out with 202,424K shares, accounting for 7.19% ownership of JPMorgan Chase. Meanwhile, the Vanguard Total Stock Market Index Fund (VTSMX) owns 90,705K shares, equating to 3.22% ownership. This represents a slight increase of 0.22% from their previous holding of 90,505K shares. However, VTSMX has decreased its allocations in JPM by 1.59% over the last quarter.

Another significant player, Vanguard 500 Index Fund (VFINX), currently holds 73,703K shares, reflecting 2.62% ownership, an increase from 72,855K shares previously, marking a rise of 1.15%. Despite this uptick, VFINX has notably reduced its portfolio exposure to JPM by 3.30% in recent months.

Geode Capital Management has 58,344K shares, representing 2.07% ownership, which is an increase of 0.87% from their earlier reporting of 57,838K shares. However, this firm drastically cut its portfolio allocation in JPM by 49.22% over the last quarter. Lastly, Bank Of America reported holdings of 50,050K shares, signifying a 1.78% stake, down from 51,423K shares, which is a noted decrease of 2.74% and a staggering 76.05% reduction in allocations toward JPM during the last quarter.

Fintel provides critical investment research to individual investors, traders, financial advisors, and small hedge funds.

Our extensive data covers global markets and includes fundamental data, analyst reports, ownership statistics, fund sentiments, insider trading information, and more. Furthermore, our stock selection models are based on comprehensive backtesting designed to enhance profitability.

This article first appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.