Gold Shines Amid Rising Inflation Concerns

As inflation looms, gold emerges as a safe investment

Throughout history, some have dismissed gold as a “barbarous relic.” However, when economic conditions become unstable, many investors seek the safety of this precious metal. Although it may not seem as exciting as other investments, gold frequently stands out when inflation worries increase.

Consumer Confidence Takes a Hit

The latest consumer confidence report has raised concerns regarding rising prices. In February, this crucial economic indicator dropped more than expected, with the one-year inflation forecast soaring to 4.3%, a full point higher than the previous month.

Long-Term Inflation Expectations Rise

Another troubling sign is the increase in long-term inflation expectations, which moved up to 3.3%. This figure now sits significantly above pre-pandemic levels, raising worries that the challenges posed by rising consumer prices could linger more than previously thought.

Geopolitical Tensions Spark Investor Interest in Gold

Global trade tensions are adding to gold’s allure. Recently, the U.S. placed tariffs on major trade partners, including Mexico, Canada, and China. Such actions early in President Trump’s administration have created economic uncertainty, prompting investors to consider gold-focused funds as a protective measure.

Rethinking Government Policy Impacts Gold

However, not everything favors gold. Investors are reassessing their expectations for the Federal Reserve’s rate policy, especially following the rise in inflation outlooks. Additionally, the resurgence of global trade protectionism could lead to higher everyday expenses. This uncertainty might push the Federal Reserve to adopt a more aggressive stance that could jeopardize gold’s ongoing boom.

Gold Miners Struggle for Profitability

While gold prices have been rising, gold mining companies are facing challenges. Issues like increasing labor costs, foreign government regulations, and inflation have hurt their profitability, leading to skepticism about their potential recovery.

Exploring Direxion ETFs

With differing scenarios for gold’s future, Direxion offers both bullish and bearish funds in the junior mining sector. For optimists, the Direxion Daily Junior Gold Miners Index Bull 2X Shares JNUG aims for daily investment results that are 200% of the MVIS Global Junior Gold Miners Index performance.

On the flip side, pessimists can look to the Direxion Daily Junior Gold Miners Index Bear 2X Shares JDST, which tracks 200% of the index’s inverse performance, catering to bearish trades.

Convenient Trading with Direxion ETFs

Both JNUG and JDST provide a straightforward way for traders to speculate without delving into complex options trading. Investors can simply buy units of these funds like any publicly traded stock.

However, it is essential to note that these specialized financial products are designed for short-term exposure, typically not exceeding one trading session. Holding positions longer than recommended may lead to value decline due to the daily compounding effect of leverage.

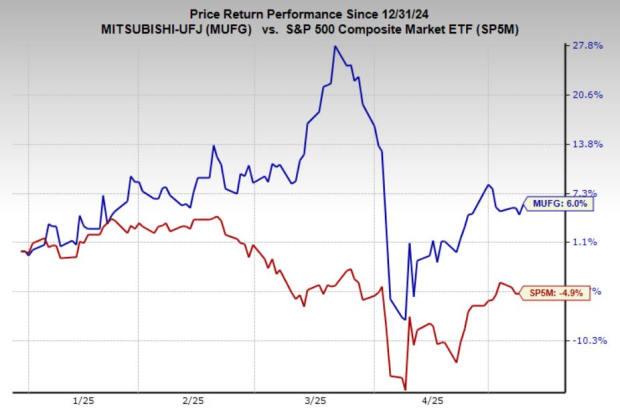

JNUG ETF’s Performance

The JNUG ETF has responded positively to excitement in the gold market, boasting a 101% gain over the past year.

- Currently, JNUG is performing well, with its price above both the 50 and 200-day moving averages.

- Looking ahead, it is crucial for the bull fund to maintain momentum as it approaches the $50 psychological support level.

JDST ETF’s Struggles

In contrast, the JDST fund has underperformed significantly, losing more than 70% of its market value in the past year.

- Unlike its bullish counterpart, JDST faces resistance from the 50 and 200-day averages, creating doubts about its recovery.

- Nonetheless, JDST showed some promise, gaining 2.5% on Tuesday, with $22 as its next target, followed by the important $25 barrier.

To learn more about Direxion’s Daily Junior Gold Miners Index Bull and Bear 2X Shares, click here.

Featured photo by Soofia Tailor on Pixabay.

Market News and Data brought to you by Benzinga APIs