Setting the Stage: Implied Volatility and Strategy Selection

Lately, the markets have been flashing green lights, signaling a potential gold rush for investors. Given this backdrop, it’s prudent to turn our attention to the Naked Put Screener, but before diving in, let’s scout for stocks with enticing implied volatility levels.

Implied Volatility Rank, known as IV Rank, serves as a compass for evaluating a stock’s current implied volatility standing over the last twelve months. When the IV Rank soars, it beckons us to consider options trading strategies like naked puts, bull put spreads, bear call spreads, and iron condors.

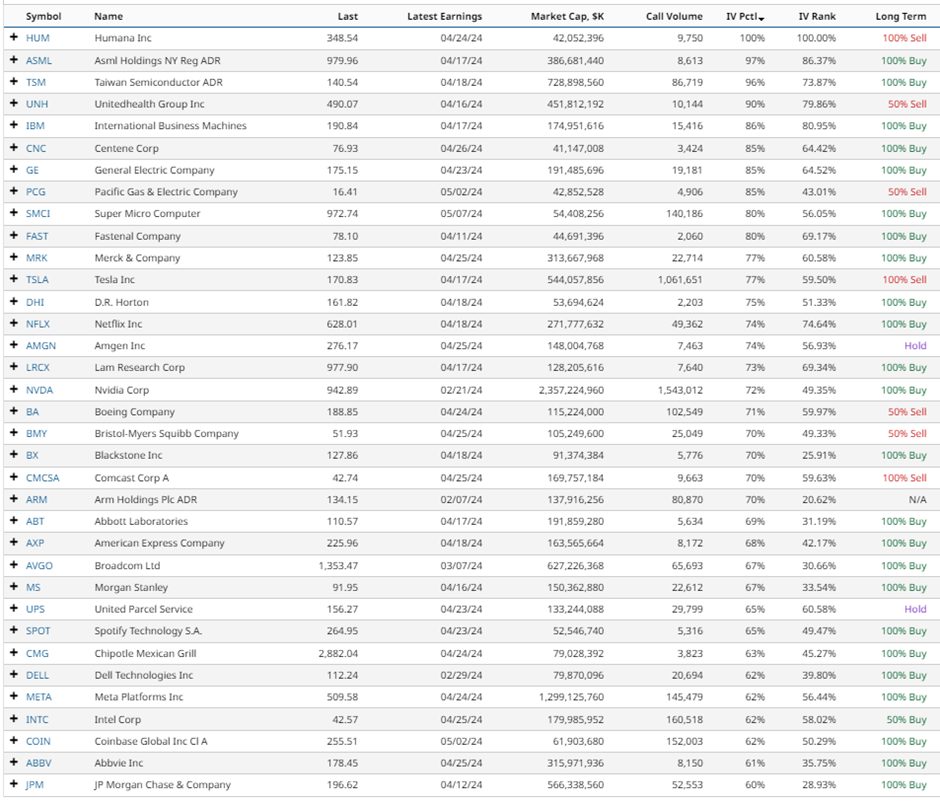

Now, let’s spotlight large-cap stocks boasting an IV Percentile exceeding 60% to lay the groundwork for potential option selling powerhouse.

Fine-Tuning the Field: Parameters and Initial Stock Selection

The Naked Put Screener’s criteria include IV Percentile above 60%, Market Cap surpassing 40 billion, and a Total Call Volume exceeding 2000, presenting us with a list of blue-chip candidates worth delving deeper into for option selling prospects.

Our journey continues with a peek into the Naked Puts Screener’s results, featuring notable stocks like Coinbase (COIN), Super Micro Computer (SMCI), Tesla (TSLA), Arm Holdings (ARM), and Nvidia (NVDA).

Navigating the Trade Landscape: Unveiling Strategy Insights

By customizing our filters to include Market Cap above 40 billion, Days to Expiration between 15-45, Option Volume greater than 50, Open Interest exceeding 100, and Moneyness from -15% to -5%, we refine our focus on options with an IV Percentile above 60% and a Buy rating, leading us to a promising roster of stocks.

One intriguing method to potentially snag a stock at a discount looms in the form of a cash-secured put, offering a neutral to slightly bullish strategy compared to outright stock purchasing.

Delving into a possible scenario with Taiwan Semiconductor (TSM), envision a trader selling a $133-strike put for a sweet $261 premium, with an effective net cost of $130.39 if assigned, representing a 5.37% buffer below the current stock price.

Should TSM hold above $133 at expiry, the trader garners a 2.0% return on the capital at risk, translating to a hefty 27.1% annualized return. Potential losses mirror stock ownership risks, yet the premium cushions the blow.

Cash-secured puts offer a compelling avenue to yield returns without immediate stock ownership. If assigned, investors can leverage a reduced cost base to explore selling covered calls for added income.

Remember, the key plank of investing is understanding the risks: options pose potential losses of 100%. Always conduct due diligence and consult a financial advisor before diving into the investment fray.

Parting Words: Caveats and Conclusory Remarks

As the curtain falls on this discourse, remember that education, prudence, and consultation are the name of the game in the investing arena. Let the Naked Put Screener illuminate your path to potential options success.

This article serves as a beacon of knowledge, not as a directive for trading. Always heed caution, fortify your knowledge base, and seek counsel before treading the investment waters.

On the date of publication, Gavin McMaster had no positions, directly or indirectly, in any of the securities mentioned in this article. The information provided is for informational purposes only.

The opinions expressed are solely those of the author and do not necessarily mirror the views of Nasdaq, Inc.