Oracle’s Q2 Earnings Fall Short, Cloud Growth Still Strong

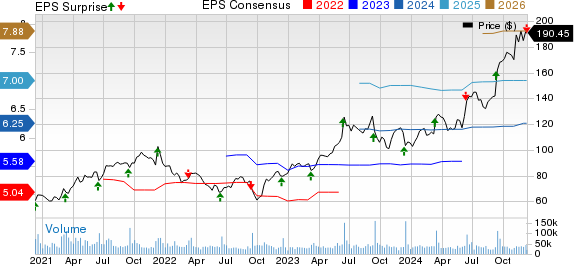

Oracle ORCL announced its second-quarter fiscal 2025 non-GAAP earnings of $1.47 per share. This figure was 0.68% below the Zacks Consensus Estimate but represented a year-over-year increase of 9.7%, consistent in both USD and constant currency (cc).

Revenue Growth Driven by Cloud Services

Revenues for the quarter climbed 9% year over year, reaching $14.1 billion. This growth was largely fueled by Oracle Cloud Infrastructure (“OCI”), especially as the company secured contracts with AI startups. However, this total fell short of the Zacks Consensus Estimate by 0.46%, leading to a 7% drop in shares during after-hours trading, closing at $190.45. For context, Oracle’s stock has surged 80.6% year to date, reflecting optimism about its cloud services in a sector largely dominated by giants like Amazon.com AMZN, which operates AWS, and Microsoft MSFT.

Noteworthy clients fueling Oracle’s cloud growth include Uber Technologies UBER and ByteDance Ltd. with TikTok. The Americas generated 63.5% of total revenues, amounting to $8.93 billion, increasing by 10.7% year over year. Meanwhile, revenues from the Europe/Middle East/Africa region rose by 6.7% to $3.38 billion and contributed 24% to total revenues, with the Asia Pacific segment rounding out with a slight increase of 0.2% to $1.7 billion.

Impressive Cloud Service Performance

Cloud services and license support revenues surged 12% year over year to $10.8 billion, driven by various strategic cloud applications and OCI enhancements. Though cloud license and on-premise license revenues experienced modest growth of 1% to $1.19 billion, total cloud revenues (SaaS and IaaS combined) rose 24% to $5.9 billion. Specifically, IaaS revenues soared by 52% year over year to $2.4 billion, while SaaS revenues climbed 10% to $3.5 billion.

Notable contributions within the SaaS category included Fusion Cloud ERP at $0.9 billion, rising 18%, and NetSuite Cloud ERP, which grew by 20% to also reach $0.9 billion. However, hardware revenues dipped 4% to $728 million, and services revenues decreased by 3% to $1.33 billion.

Currently, Oracle operates 17 cloud regions with plans for 35 more in collaboration with Azure, Google, and AWS. The company reported a 5% increase in database subscription services and a 7% rise in application subscription revenues, totaling $4.8 billion. Infrastructure subscription revenues, which include license support, totaled $6 billion, marking a 17% increase.

Operational and Financial Insights

The non-GAAP total operating expenses grew by 8% to $7.96 billion. Non-GAAP operating income improved by 10% year over year to $6.09 billion, with a margin of 43%, reflecting an expansion of 58 basis points year-over-year.

Balance Sheet and Future Expectations

As of November 30, 2024, Oracle’s cash and cash equivalents along with marketable securities increased to $11.3 billion from $10.9 billion on August 31, 2024. The operating cash flow was reported at $20.2 billion, with free cash flow reaching $9.54 billion.

Oracle’s remaining performance obligation (RPO) now exceeds $97.3 billion, reflecting a strong demand for longer contracts as clients increasingly recognize the value of Oracle Cloud Services. Remarkably, cloud RPO surged over 80%, constituting nearly three-fourths of total RPO. About 39% of the total RPO is expected to convert to revenue within the next year. Additionally, the company repurchased 1 million shares at a cost of $150 million and announced a quarterly cash dividend of 40 cents per share.

Future Guidance

For the second quarter of fiscal 2025, Oracle anticipates total revenues to grow between 9-11% in constant currency and between 7-9% in USD. Cloud revenues are expected to rise by 25-27% at constant currency and by 23-25% in USD. Non-GAAP EPS is forecasted to grow 7-9%, with estimates ranging from $1.50 to $1.54 in constant currency and from $1.47 to $1.41 in USD. Oracle aims to achieve cloud revenues of $25 billion in fiscal 2025.

Zacks Naming Top 10 Stocks for 2025

Interested in discovering 10 top stock picks for 2025? Historical performance indicates they could excel.

Since 2012, when the Director of Research Sheraz Mian took over, the Zacks Top 10 Stocks portfolio has gained +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz is now reviewing 4,400 companies to select the best 10 stocks to buy and hold in 2025. Don’t miss out; these selections will be revealed on January 2.

For the latest recommendations from Zacks Investment Research, you can download 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Uber Technologies, Inc. (UBER): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.