Palantir Technologies: Insider Sales Amid Record Stock Performance

Palantir Technologies (NYSE: PLTR) has been one of the standout stocks in 2023, climbing over 246% year to date as of now.

CEO Alex Karp celebrated his company’s impressive earnings, humorously noting, “I almost feel like we should just go home.” He also responded to critics questioning his comments.

While Karp enjoys the rewards of rising stock prices, he has been actively selling Palantir shares. This raises an important question for investors: should they follow Karp’s example and sell their Palantir stock?

Insider Selling on the Rise

Karp has sold Palantir stock consistently since late 2020, utilizing what is known as a Rule 10b5-1 plan. This allows company insiders to set up predetermined selling plans for shares based on specific criteria, either using fixed amounts on specific dates or more complex triggers.

In recent months, Karp’s selling activity has surged. His selling began in mid-September when he exercised options and sold 9 million shares at an average price of $36.18, totaling $325.6 million. Just before earnings, he sold an additional 5.66 million shares at an average price of $45.01 for $254.6 million. Following the earnings report, he exercised options again, selling over 12.3 million shares at an average price of $52.71, resulting in proceeds of $650.6 million.

In the past, Karp’s sales remained in the range of $15 million to $22 million.

Other insiders also sold shares after the earnings report. Chief Accounting Officer Heather Planishek and Director Lauren Friedman Stat used similar 10b5-1 plans. In a notable past instance, Chairman Peter Thiel quickly sold more than 28.5 million shares under a similar plan in September and October.

Image source: Getty Images.

What Should Investors Do?

Palantir has earned its reputation by assisting the U.S. government with critical tasks like counter-terrorism and pandemic response through its data analytics services. Recently, the company has made significant strides in the artificial intelligence (AI) sector, gaining traction in the U.S. commercial market.

Palantir’s focus on AI has contributed to accelerating revenue growth, with a 30% year-over-year increase last quarter. This marked the fifth consecutive quarter of accelerating revenue growth, mostly driven by a 54% uptick in the U.S. commercial sector and a 40% surge in U.S. government revenue.

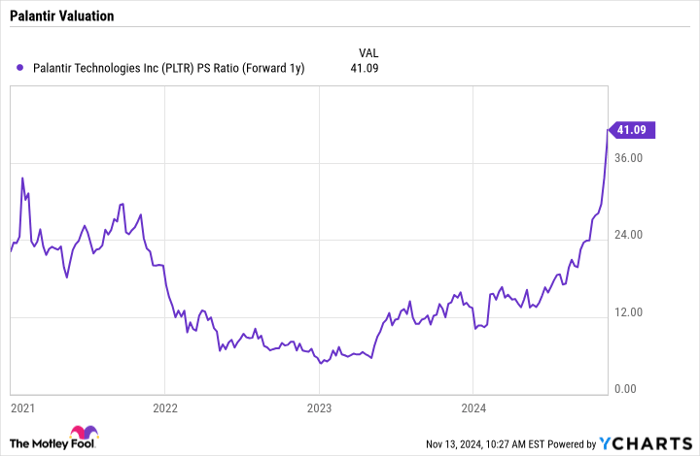

While Palantir excels in attracting new customers and expanding existing relationships, its stock valuation remains a concern. The stock currently carries a forward price-to-sales (P/S) ratio of 41 based on analyst estimates for 2025, which some may consider excessive given its revenue growth rate.

PLTR PS Ratio (Forward 1y) data by YCharts

For a company growing revenue at around 30%, such a valuation raises questions. Recognizing this, Karp has ramped up his selling pace in recent months.

Previously, I suggested it wasn’t too late to invest in Palantir. Given the latest surge in price, my opinion has shifted. Currently, it seems prudent to consider taking profits, similar to Karp and other insiders, after an impressive performance.

A Unique Investment Opportunity?

Have you ever felt you missed out on amazing investment opportunities? The chance might not be gone.

Occasionally, our analyst team identifies a “Double Down” recommendation for stocks poised for significant growth. If you’re worried that you’ve missed your chance to get in, it could be an ideal time to act before the opportunity slips away. Just look at these remarkable past examples:

- Amazon: A $1,000 investment in 2010 would now be worth $22,819!

- Apple: A $1,000 investment in 2008 would now be valued at $42,611!

- Netflix: A $1,000 investment in 2004 would have grown to $444,355!

Currently, we’re issuing “Double Down” alerts for three extraordinary companies, and this opportunity might not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024.

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.