The key question investors are asking in the stock market today is: what’s next for Palantir Technologies Inc. PLTR? After a strong earnings report that sent PLTR’s stock soaring, many speculate that it could fall sharply. However, the numbers tell a different story.

Looking at the recent performance, skepticism seems justified. Palantir’s fourth-quarter results were impressive, with adjusted earnings per share reaching 14 cents and revenue totaling $827.52 million, both surpassing the analysts’ predictions of 11 cents and $775.91 million. Revenue grew 36% compared to the previous year, with sales from government contracts alone soaring 45% year-over-year to $343 million.

The challenge now is whether this growth can continue. Notably, Cathie Wood‘s Ark Invest recently made headlines by reducing its stake in Palantir. The ARK Innovation ETF ARKK sold 5,495 shares of PLTR, which could suggest that the stock may be overvalued.

Yet, some analysts maintain an optimistic outlook. BofA Securities analyst Mariana Perez Mora upgraded her rating on the stock to Buy and raised the price target from $90 to $125, stating that “2024 was only a dress rehearsal” for what Palantir sees as a forthcoming AI and technology revolution.

Also Read: Block In The S&P500? BofA Analyst Says Company Meets All Criteria

How ‘FOMO’ Drives PLTR Stock’s Exciting Rise

Stock prices often rise and fall, and Palantir’s recent increase highlights this trend. Certain stocks, however, are influenced more by investors’ emotions, particularly the fear of missing out, or FOMO. This dynamic may well define PLTR’s recent behavior.

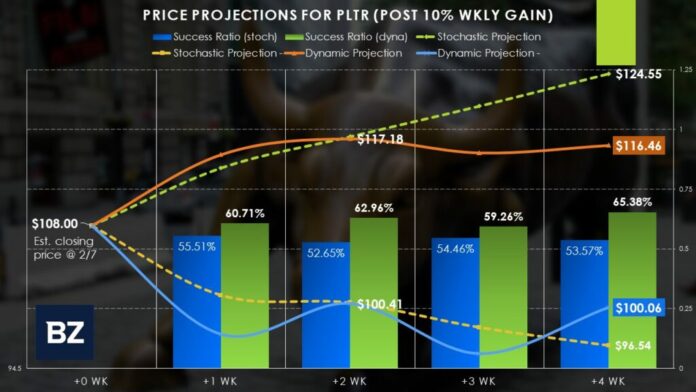

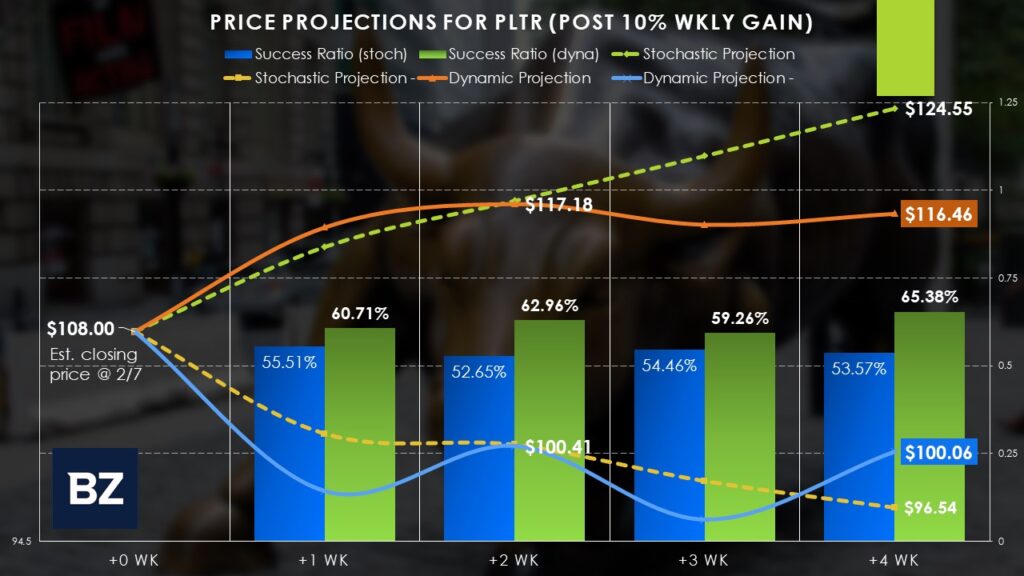

Since its initial market entry, PLTR’s stock price shows a consistent upward trend. Statistics indicate that there is a 55.51% chance a position taken at the start of the week will rise by the week’s end. Over the next four weeks, that probability only slightly decreases to 53.57%.

Investors tend to react strongly to significant changes in the market. If PLTR continues this pattern, it is on track for a weekly return exceeding 30% by Friday’s close. Historical data shows that when PLTR experiences double-digit gains in a week, the likelihood of continued growth the following week jumps to 60.71%.

Looking at it over a longer time frame, the chances for continued gains after a significant one-week rise increase to 65.38%. Remarkably, for a jump of 20% or more, success rates reach 80%, reflecting PLTR’s unique market behavior.

Yet, the dataset narrows as conditions tighten, causing potential distortions. History shows that while FOMO drives short-term success, the returns tend to lessen over time. For those bullish on the stock, the average return after a significant rise stands around 15.33% in a month, with a lower 7.83% since the last extreme surge.

Crafting a Practical Trading Strategy

With the insights gathered, a more cautious price target for investors could be wise. While many expect the stock to reach $120, a target of about $116 may be more realistic. It’s plausible that PLTR might land around $114 in four weeks, a modest gain if it starts at $108 this Friday. Traders might consider using options to potentially amplify rewards.

For example, an investor could utilize a bull call spread by buying a $107 call and selling a $114 call within the options chain expiring March 7. This method balances costs, as selling the short call offsets some expense of the long call, creating a net long position at a discount.

While bull spreads define clear limits on both potential profits and losses, it’s critical to select a strike price that the stock can realistically achieve. In summary, targeting a $114 short strike offers a reasonable approach in light of PLTR’s distinctive market characteristics.

Read Next:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.