Palantir (NYSE: PLTR) has emerged as one of the most talked-about artificial intelligence (AI) stocks this year, boasting an impressive increase of approximately 280%. This performance has clearly surpassed many investors’ expectations.

Nevertheless, the stock’s sharp rise isn’t solely due to its growing business. The price investors are willing to pay for Palantir’s performance has skyrocketed along with its stock price. This development has prompted a rare scenario for investors to consider.

Demand for Palantir’s Products is Skyrocketing

Palantir’s AI software has gained immense popularity due to its years of expertise in the field, which its competitors lack. The company initially focused on serving government clients, creating software capable of processing large amounts of data quickly and providing actionable insights.

This foundational concept proved beneficial for commercial businesses, leading Palantir to expand its offerings. By the third quarter, government revenue accounted for 56% of Palantir’s total revenue, indicating a nearly even split with the commercial sector.

The recent surge in AI interest has significantly impacted Palantir’s business, attracting more clients seeking to incorporate AI into their operations. For customers, this translates to automating tedious tasks and receiving real-time insights to improve decision-making.

As a result, Palantir’s product revenue jumped by 30% year over year, reaching $726 million. Notably, demand in the U.S. outpaced international sales, with U.S. commercial revenue increasing by 54% to $179 million and U.S. government revenue rising by 40% to $320 million.

International revenue, which constitutes about one-third of Palantir’s sales, is promising yet slower to evolve compared to the U.S. Once international clients begin to embrace AI at the same pace as those in the U.S., Palantir’s growth could accelerate further.

While this positive data might encourage significant investments in Palantir’s stock, investors should note that the company’s stock recently reached levels it hasn’t seen since 2021, which raises flags.

The Stock is Becoming Excessively Priced

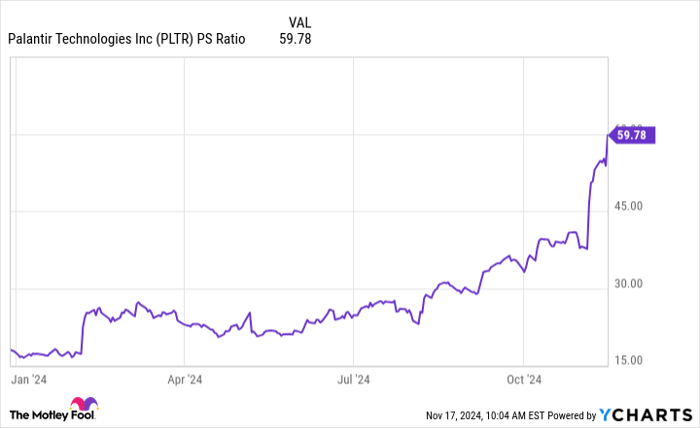

Despite a 280% rise in stock price this year, Palantir’s revenue increase of about 30% indicates a disconnect between business growth and stock valuation. Investors are paying increasingly higher prices for Palantir’s services, resulting in a noticeably high valuation.

Currently, Palantir trades at nearly 60 times its sales, a level reminiscent of early 2021, when its stock suffered a dramatic decline in the years that followed. In February 2021, after reaching its highest valuation, the stock plummeted approximately 80% from those all-time highs, despite the company’s revenue continuing to grow.

PLTR Operating Revenue (Quarterly YoY Growth) data by YCharts

This situation highlights a critical reality for investors: although Palantir’s business shows growth, its stock price can still drop significantly. Historically, few companies manage to deliver strong returns while trading at such high multiples. Achieving a price-to-sales ratio above 50 typically demands rapid revenue growth rates of 100% or more, something Palantir is not currently achieving.

Comparatively, Nvidia has reported revenue growth rates that tripled year over year, yet has never exceeded a price-to-sales multiple of 45.

PLTR PS Ratio data by YCharts

Such disparities in growth versus valuation raise concerns. Investors should heed historical trends, recognizing that while Palantir’s business progress is commendable, the stock’s lofty valuation may not be sustainable. If revenue growth doesn’t significantly improve, the stock could face a troubling correction.

Investors may find themselves in a similar position as those who held Palantir stocks in 2021 and 2022, potentially facing losses. A cautious approach is advised; consider taking partial profits if you believe in the company’s future upside.

Is Now the Time to Invest $1,000 in Palantir Technologies?

Before deciding to buy shares in Palantir Technologies, contemplate this:

The Motley Fool Stock Advisor analyst team has highlighted what they consider the 10 best stocks to invest in currently, and Palantir Technologies did not make the cut. These recommended stocks may present substantial growth opportunities in the years ahead.

For instance, when Nvidia was suggested on April 15, 2005, investing $1,000 at that time would have grown to an astounding $900,893!

Stock Advisor offers guidance to investors, sharing strategies for portfolio construction, market analysis, and selecting two new stocks each month. Since its inception, the Stock Advisor service has outperformed the S&P 500 by more than four times.

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Nvidia and Palantir Technologies. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.