Paramount Global Faces Legal Challenges Over User Data Practices

Paramount Global (PARA) is currently navigating serious issues related to user viewing history, which have resulted in a new class-action lawsuit against the entertainment giant. This complaint raises questions about privacy and industry standards.

According to the lawsuit, filed by Victor Cho in a California federal court, Paramount allegedly shared its users’ viewing histories with social media companies like Meta Platforms (META) and TikTok. The companies then utilized this data to serve targeted advertisements based on individuals’ viewing habits. While such practices are common in the industry, the lawsuit argues that they violate the Video Privacy Protection Act. This law prohibits the disclosure of personal viewing history and allows for statutory damages of up to $2,500 for each affected user.

Investor Scrutiny Increases Amid Merger Concerns

Investor dissatisfaction is mounting over Paramount’s management of its recent Skydance merger. Some reports suggest that further legal action could arise from this merger process. Additionally, Gamco Investors has reduced its stake in Paramount and is urging the company to reassess the $13.5 billion cash offer it received from Project Rise Partners, which includes $5 billion for debt restructuring.

Wall Street’s Take on Paramount Stock

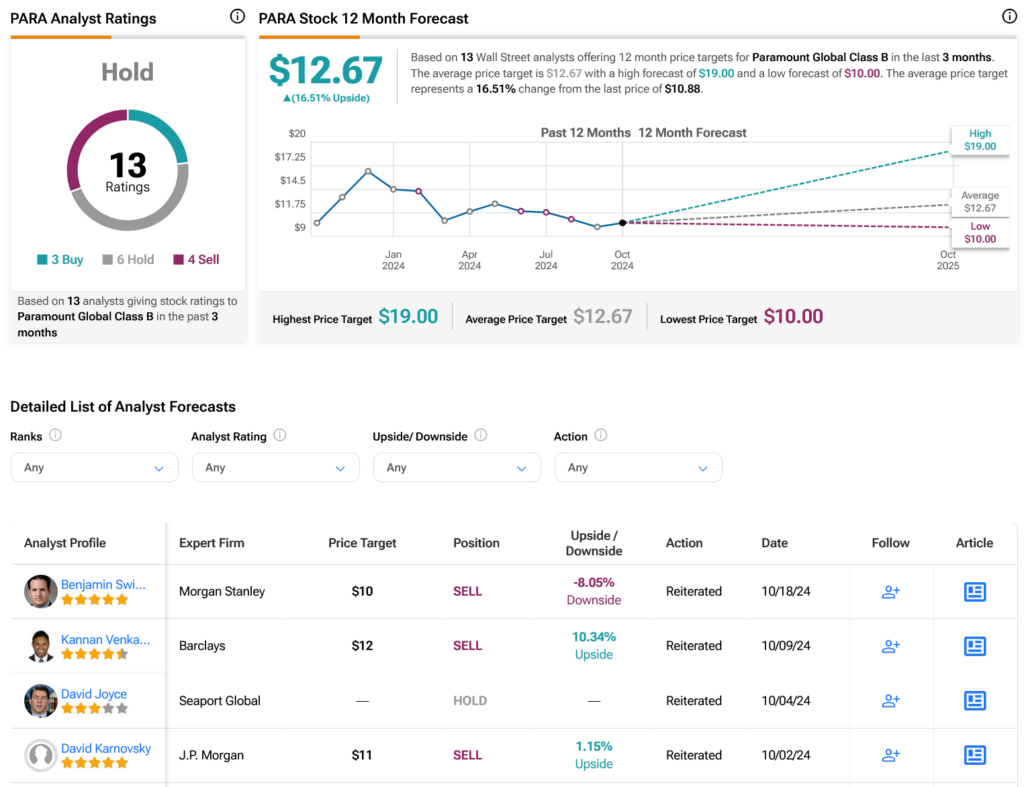

On Wall Street, analysts have assigned a Hold consensus rating to PARA stock, which is reflected through three Buys, six Holds, and four Sells over the last three months. After experiencing a 12.79% decline in share price over the past year, the average price target for PARA is now $12.67 per share, indicating a potential upside of 16.51%.

See more PARA analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.