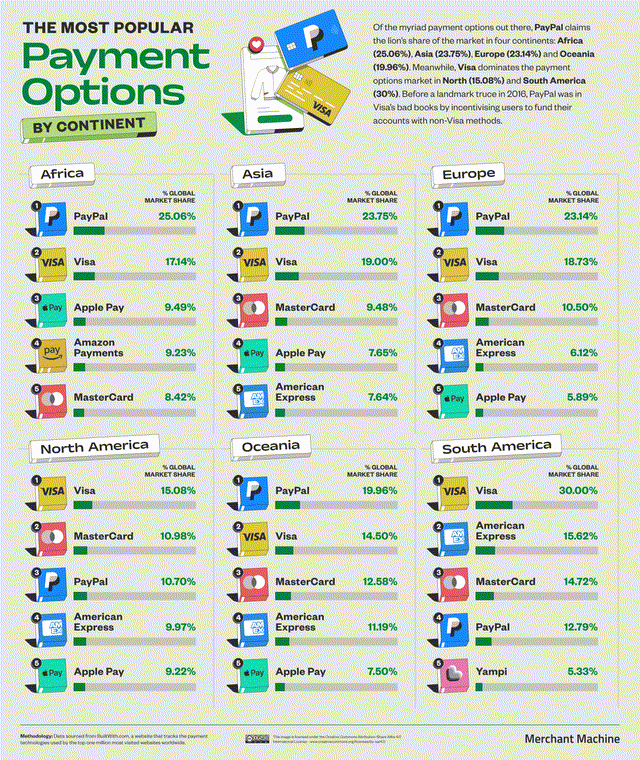

PayPal (NASDAQ:NASDAQ:PYPL) is a company that operates a payments ecosystem— everything from peer-to-peer transfers, digital wallets, checkout solutions as well as the processing infrastructure behind it. The product suite is a vast array of services that complement each other which is also needed in the ever-growing, ever-competitive market. In the payments space, outside of North- and South America, PayPal is the undisputed payments king, according to Merchant Machine.

I see a well-positioned business, set to benefit from further payment digitization trends globally as we become more of a cashless society. PayPal may not put up growth in parity with the digital payments market, but that is not necessary to justify a buy at current levels. Trading where it is now, if PayPal can post any sort of growth, then it is undervalued.

A Company in Distress or a Misunderstood Gem?

It has likely not escaped anyone’s attention that PayPal has been downtrending for quite some time; now trading at 2017 levels. However, it is important to try and understand why.

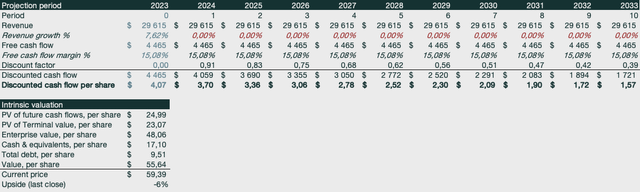

An easy exercise is to create a reverse discounted cash flow model (DCF). That way, we can get a better understanding of what the current stock price implies in terms of the present value of future cash flows.

The pictured DCF model uses a 10% weighted average cost of capital and 3% terminal growth assumptions.

Assuming current consensus estimates for fiscal year 2023 (Source: S&P Global Market Intelligence) for revenue and cash flow margins and then keeping it at 0% growth for 10 periods, we get some interesting results. The intrinsic value using these assumptions outputs a $55,64 value per share, which is roughly where PayPal has been trading recently.

- This implies that the market does not believe that PayPal will have any growth past 2023 and is pricing it as such.

The next question to ask is if that is a reasonable assumption or not.

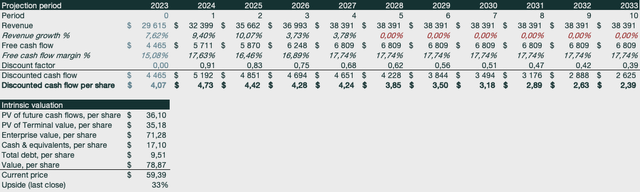

Looking at the analyst consensus estimates (Source: Canalyst, Bloomberg), PayPal is projected to grow net revenues to $38,391 billion by fiscal year 2027, which would mean a compounded annual growth rate (CAGR) of ~6,9%– an estimate that in itself seems a bit conservative.

The analyst consensus is also that PayPal will have free cash flow of $6,809 billion in 2027, which is roughly a 6% CAGR. Another seemingly conservative projection. If we give the analysts credibility in that there is likely to be some growth, at least until 2027, but then revert to 0% growth, what happens to the value per share in our intrinsic valuation?

The model now outputs a ~35% upside from the ~$60 stock price range, even though there’s no growth after the fourth period in the DCF. This means that the analyst consensus disagrees with the way the market is currently pricing PayPal.

Unleashing Potential: Can PayPal Keep Growing?

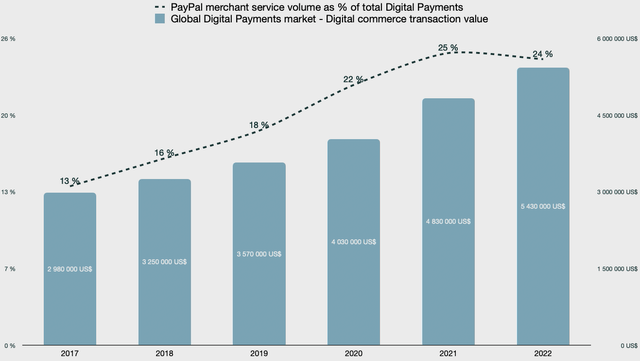

Looking at Total payment volume (TPV) as a percentage of the total global digital payments market (Source: statista.com), we can see that PayPal has increasingly been gaining market share over a 5 year period. We don’t have a 1:1 comparison here, as the reported data does not allow it. However, we can roughly gauge the metrics by doing the following as a proxy:

- The global digital payments volume only includes digital commerce

- PayPal stopped reporting merchant service volume as % of the TPV at the end of fiscal year 2021. I will use the quarterly averages per year and use the last reported figure (97%) for 2022.

Looking at the above chart, we know that PayPal has been steadily growing their market share before posting a flat year in 2022. According to the same source, digital payments are set to grow at a 12% CAGR between 2024 and 2027. This means that whilst PayPal may not show the same impressive market share growth, they will likely grow revenues as the industry as a whole grows, despite flatlining or declining their total share.

There are data points and management commentary that suggest that PayPal will actually accelerate their growth. To understand where the growth may come from, it’s vital to be aware of the business segments PayPal operates. It is likely that you have used a PayPal product recently; it’s way more than a simple checkout button that reads “PayPal”.

The Future of PayPal: an In-Depth Analysis

The Expanding BNPL Segment

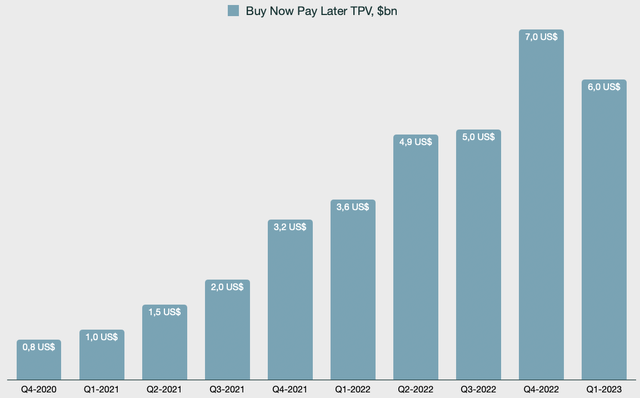

PayPal’s Buy Now Pay Later (BNPL) segment, while currently a smaller portion of its total payment volume, has exhibited remarkable growth, especially in the context of a global economic environment fraught with inflation concerns. The younger, digitally-savvy generation driving the digital payments space, marked by a proclivity for higher spending and lower savings, presents a favorable environment for BNPL’s continued ascent.

While recent quarters have witnessed a decline in growth rates, the BNPL product’s potential remains robust, with the surge in year-over-year growth being primarily in the triple digits. PayPal’s ability to capitalize on the momentum of this segment, particularly amidst prevailing macroeconomic challenges, signals an underlying strength that bodes well for its overall growth trajectory.

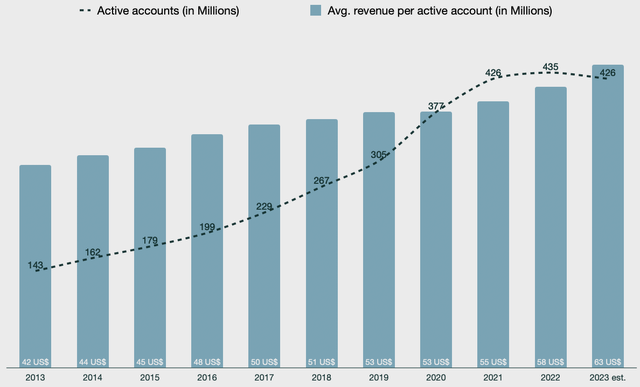

The Quality Drive in Active Accounts and Account Activity

Despite the reduction in active accounts, a deliberate strategic move aimed at culling low-quality accounts, PayPal’s average transaction revenue per active account has continued to rise. The pandemic-induced influx of accounts and revenue notwithstanding, the sustained upward trajectory in transaction revenues underscores the resilience and quality of PayPal’s active user base. Notably, the increased transaction volume per average active account signifies an acceleration of this positive trend, revealing a proactive response to post-pandemic shifts in consumer behavior.

While the deliberate reduction in active accounts may raise concerns, PayPal’s focus on enhancing the quality of its user base is translating into increased spending and transactional activity per user. This discerning approach not only augurs well for the long-term health of its user ecosystem but also reflects a proactive stance in aligning its user base with its strategic objectives.

Advancements in Payment Processing and Checkout Solutions

PayPal’s robust growth outlook in the processing segment, predicated on solutions independent of users’ choice of checkout options, signals a diversification of revenue streams and resilience against market fluctuations. With sustained year-over-year growth rates and an uptick in acceleration in recent quarters, PayPal’s unbranded processing segment is poised for further expansion, underpinned by its adaptability to various payment methods and providers.

Amidst intensifying competition from players like Stripe and Adyen, PayPal’s ability to navigate this landscape and sustain its growth momentum underscores its agility and competitive positioning within the payment processing domain.

Each segment underscores PayPal’s acumen and shrewdness, reassuring investors of the company’s adaptive capacity within a dynamically evolving market landscape. While macroeconomic headwinds and competitive pressures pose challenges, PayPal’s strategic maneuvers and astute adjustments cement its standing as a stalwart in the digital payments arena.

The New Path to Growth: How PayPal Plans to Expand its Market Share

There is no denying that in the financial arena, a relentless scramble to capture market share often triggers a disconcerting “race to the bottom.” Companies, in a frenzied pursuit of market domination, embark on a perilous journey of undercutting one another, leading to declining margins. However, amid the frenetic race, a new protagonist emerges in the form of PayPal’s CEO, Alex Chriss. During the Q3 earnings call, Chriss boldly defied the status quo, unequivocally declaring that PayPal is not interested in partaking in the impetuous race to the bottom in this space.

Plotting a Strategic Course

Chriss fortified his stance by showcasing PayPal’s remarkable prowess in capturing market share with Braintree, catering to colossal enterprises such as Adobe, Booking.com, DoorDash, Ticketmaster, and Uber. Notably, in the past 12 months alone, PayPal processed over $450 billion in volume from an estimated $4 trillion to $5 trillion of global large enterprise e-commerce, constituting a significant 10% market share. Building upon this formidable foundation, Chriss unveiled the company’s strategic beachhead for further advancements, emphasizing the intent to address additional customer needs, encompassing payouts, fraud management, chargeback automation, and FX. These value-added services not only assuage specific customer pain points but also augur well for PayPal’s quest to expand its margin. In Chriss’s own resolute words, it was crystal clear that the company’s unwavering focus is on relentless performance improvement, provision of supplementary services, and the expansion of margins.

Mapping Marginal Expansion

Delving deeper into Chriss’s articulated vision, it is palpable that the CEO has meticulously laid out a comprehensive plan to render PayPal a more alluring partner. Fundamental to this strategy is the integration of additional services beyond mere processing, notably payouts, fraud management, chargeback automation, and FX. Furthermore, the elucidated expansion beyond the U.S. market bears historical testament to higher margins in these regions as compared to the domestic market.

The Product Landscape: Braintree and PPCP

Further delineating the narrative, Chriss shed light on the two pivotal products within this segment—Braintree and PayPal Complete Payments (PPCP). While Braintree is tailored for large enterprises, offering highly customizable solutions, PPCP, directed towards small and medium-sized enterprises, exhibits swift scalability owing to its plug-and-play nature. Chriss astutely underscored the critical role of leveraging channel partners, such as Shopify, to facilitate the rapid deployment of PPCP across all their merchants, epitomizing an unequivocal commitment to expedited scaling.

Unveiling the Vault: PayPal’s Unparalleled Data Advantage

On peering into PayPal’s enviable arsenal, it becomes evident that the company harbors the most extensive data store among all processors, conferring upon it an unparalleled advantage in offering unparalleled business solutions. Notably, the most significant conundrum plaguing businesses pertains to conversions, with less than 5% of merchant visits culminating in a successful checkout. In direct response to this vexing industry challenge, PayPal’s proverbial trump card, known as the Vault, emerges. This formidable repository, ensconcing approximately 25% of all extant cards, furnishes PayPal with an unassailable competitive moat, enabling it to:

- Pre-fill customer information, curtailing friction

- Utilize AI to discern the context of purchases and seamlessly manage payment instruments and shipping addresses based on historical vault data

- Mitigate the risk of information obsolescence

- Provide merchants with granular data to tailor bespoke customer experiences

Drilling down into the sum of these parts, PayPal’s vault emerges as not just a potent asset but also a linchpin for the company’s sustained growth trajectory.

Foreseeing the Future: Venmo, Peer-to-Peer, and Beyond

Shifting the focus towards Venmo, it is discernible that this vertical has encountered sluggish growth, floundering amidst inclement competition from Cash App. Despite this seemingly daunting backdrop, hints of a potential resurgence surface with the erstwhile Amazon partnership, underpinning the premise that kindred payment revenue streams could indeed hold promise for Venmo’s future. Nevertheless, until poignant evidence or a lucid roadmap for Venmo’s resurgence materializes, a circumspect outlook would be prudent, signifying the potential for muted single-digit growth in the near term.

Forging a Pragmatic Valuation

Despite the prevalent hue and cry seemingly portending null growth for PayPal, a discerning evaluation unveils a contrasting narrative steeped in sustainable growth trends. The landscape is astir with a more resolute management, a clearly articulated roadmap for fortifying and scaling the product portfolio, and discernible data trends prognosticating an impending expansion. Projecting forward, the convergence of processing scale and margin augmentation emerges as the harbinger of a propitious fiscal period, culminating in a subsequent phase of stabilized growth and an intensified focus on margin augmentation.

Steering clear of conjectures, projections depict PayPal’s growth marginally lagging behind the digital payments market, signifying a modest erosion of market share. Nevertheless, amidst this apparent conundrum, the intrinsic value unveils an opportunity fraught with a potential ~100% surge, undergirded by a substantial margin of safety.

Couched within the confines of an 11% weighted average cost of capital (WACC) and 2% terminal growth rate assumptions, the valuation model, albeit tinged with a hint of pessimism, seeks to encapsulate the uncertainty inherent in execution, refraining from double counting the impact of the management’s shares repurchases on the free cash flow.

Charting the Course Forward

Veiled within the caverns of implied expectations for PayPal lies a business seemingly bereft of hope. Contrariwise, a contrarian perspective unveils a chink in the market’s armor, encapsulating a latent reservoir of growth that, when unearthed, unfurls a rare opportunity underscored by a significant margin of safety. It is against this backdrop that PayPal merits a resolute “strong buy” moniker, buoyed by unequivocal evidence of ongoing growth trajectories, currently ensnared in the maelstrom of market skepticism.

Zooming out for a panoramic perspective, what emerges is not just the anticipation of sustained growth but also the potential for an upswing, as PayPal, poised to streamline its portfolio, execute its roadmap, and leverage its expansive data reservoir, beckons as an enticing value proposition for merchants. Projecting ahead, the inevitability of continued ascension in the digital payments sphere becomes unmistakably clear, underpinned by an inexorable societal shift towards a cashless milieu, thereby conferring a tailwind upon PayPal’s future trajectory.

Within the vast expanse of PayPal’s product suite, palpable indications of growth echo resoundingly:

- Scaling processing solutions, endowing value-added services, and augmenting margins via the leverage of their moat-like data vault

- An anticipated uptick in transaction amounts from remaining active accounts, offsetting potential attrition from lower-quality accounts

- Sustained robust growth prospects of the Buy Now Pay Later solution, unfazed by a global economic milieu clouded in uncertainty

- An impending 12% compound annual growth rate (CAGR) in the global payments market from 2024 through 2027, reaffirming PayPal’s ascendant trajectory

Yet, amidst this palpable exhilaration, it behooves us to ward off complacency and remain vigilant to the specter of execution risk. This cognizance underpins a discerning charge of a higher equity risk premium in the discount rate, accentuating the prudence imbued within the realm of financial prognostication, even distilled within the vicissitudes of a seemingly stable business such as PayPal.