Exploring the depths of the ETF realm, we delve into the enthralling undercurrents of the iShares U.S. Energy ETF (IYE). Analysts have cast their gaze upon this financial vessel, projecting an average target price of $53.12 per unit, poised to chart a course for a profitable horizon. At its current trading value of $47.91 per unit, this suggests a buoyant 10.87% potential surge, as ascertained from the aggregate analyst forecasts for the underlying assets. Among these, Cheniere Energy Inc. (LNG), Chevron Corporation (CVX), and Antero Resources Corp (AR) stand out as beacons of hope, each hinting at significant upticks from their current standings.

Seeking the Silver Lining

Is this optimistic outlook a beacon of rationality or a mirage in the financial desert? Do these projections mirror the pulse of the present reality, or are they whispers of a bygone era? The confluence of a lofty target and a stock’s reality can signify a bright future or a harbinger of subsequent downgrades. These ambiguities beckon further exploration, urging investors to navigate these delicate waters with prudence.

Charting the Course

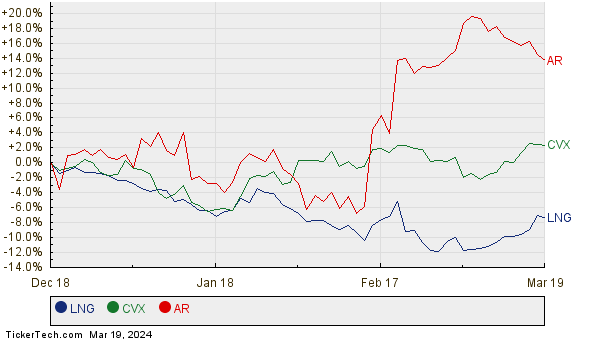

Chasing the shadow of performance, behold the twelve-month price saga of LNG, CVX, and AR, rendered graphically below. A vivid illustration of the financial odyssey these entities have embarked upon, a tale of ebbs, flows, and the tantalizing promise of potential.

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Energy ETF | IYE | $47.91 | $53.12 | 10.87% |

| Cheniere Energy Inc. | LNG | $160.67 | $201.24 | 25.25% |

| Chevron Corporation | CVX | $155.41 | $177.95 | 14.50% |

| Antero Resources Corp | AR | $25.60 | $28.94 | 13.04% |

![]() Explore the Top 10 ETFs With the Most Potential According to Analyst Projections

Explore the Top 10 ETFs With the Most Potential According to Analyst Projections

Also see:

LRMR Past Earnings

CSCD Videos

REED Videos

The thoughts and opinions expressed here reflect the views of the author and not necessarily those of Nasdaq, Inc.