Bank of America Preferred Stock Gets Upgraded; Fund Holdings Shift

Phillip Securities Boosts Rating Amid Changes in Institutional Ownership

Fintel reports that on October 18, 2024, Phillip Securities upgraded their outlook for Bank of America Corporation – Preferred Stock (NYSE:BAC.PRE) from Neutral to Accumulate.

Institutional Investor Sentiment on the Rise

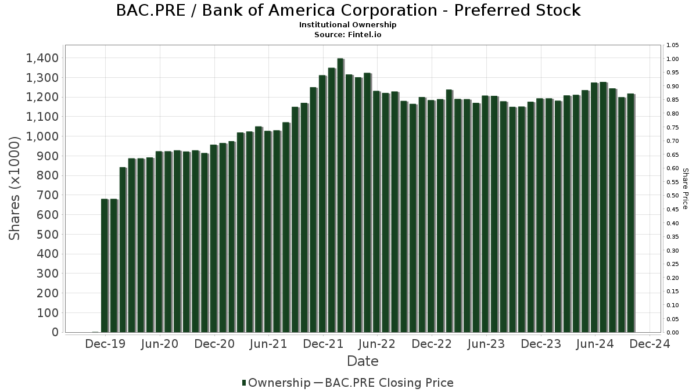

Currently, 12 funds or institutions hold positions in Bank of America Corporation – Preferred Stock, which marks an increase of one owner, or 9.09%, compared to the previous quarter. The average portfolio weight of all funds dedicated to BAC.PRE has risen to 0.41%, a growth of 9.41%. Despite this uptick in interest, the total number of shares owned by institutions has decreased by 4.62% in the last three months, totaling 1,218K shares.

Movements Among Key Funds

PFF – iShares Preferred and Income Securities ETF holds 584K shares, down from 628K shares, reflecting a decrease of 7.47%. The firm also reduced its portfolio allocation in BAC.PRE by 2.99% over the last quarter.

PFFD – Global X U.S. Preferred ETF now holds 221K shares, down from 227K shares, which indicates a decline of 2.80%. However, the firm increased its portfolio allocation in BAC.PRE by 5.67% during the same period.

PFFV – Global X Variable Rate Preferred ETF retains 126K shares, the same as their previous report, resulting in a minor decrease of 0.24%. Yet, they boosted their allocation in BAC.PRE by 4.15% last quarter.

VRP – Invesco Variable Rate Preferred ETF increased their holdings to 94K shares, up from 88K shares, marking an increase of 6.48%. They also upped their portfolio allocation in BAC.PRE by 1.90%.

PSK – SPDR(R) Wells Fargo Preferred Stock ETF has 50K shares, a decrease from 52K shares, indicating a drop of 3.76%. This firm reduced its allocation in BAC.PRE by 2.24% in the last quarter.

Fintel is known for being one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

The data provided covers a global perspective and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, unusual options trades, and much more. Furthermore, exclusive stock picks are powered by advanced, backtested quantitative models designed to enhance profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.