Analysis of Invesco International Dividend Achievers ETF: Potential for Growth

In a recent evaluation by ETF Channel, we analyzed the ETFs within our coverage universe, comparing the trading prices of their holdings against the average analyst 12-month target prices. For the Invesco International Dividend Achievers ETF (Symbol: PID), the computed implied analyst target price stands at $21.89 per unit, based on its underlying assets.

Current Trading Price and Analyst Outlook

Currently, PID is trading at approximately $19.14 per unit, revealing a potential upside of 14.36% according to analysts. Specifically, three notable holdings in PID show significant potential: National Grid plc (Symbol: NGG), Restaurant Brands International Inc (Symbol: QSR), and Novartis AG Basel (Symbol: NVS). Recently, NGG has traded around $62.83/share, but analysts have set an average target at $81.00/share, suggesting a 28.92% upside. QSR’s recent price of $69.21 offers a potential 20.28% increase, with a target of $83.24/share. Meanwhile, NVS, priced at $103.81, has a projected target of $124.00/share, indicating a 19.45% rise.

Performance Overview of Key Holdings

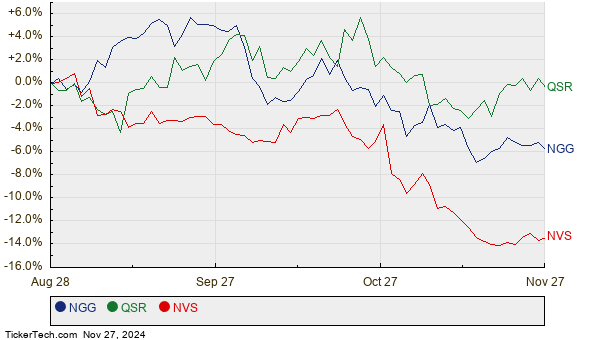

Below is a chart illustrating the 12-month price history for NGG, QSR, and NVS:

Together, NGG, QSR, and NVS make up 8.49% of the Invesco International Dividend Achievers ETF. Here’s a summary of current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco International Dividend Achievers ETF | PID | $19.14 | $21.89 | 14.36% |

| National Grid plc | NGG | $62.83 | $81.00 | 28.92% |

| Restaurant Brands International Inc | QSR | $69.21 | $83.24 | 20.28% |

| Novartis AG Basel | NVS | $103.81 | $124.00 | 19.45% |

Evaluating Analyst Predictions

This raises an important question: Are analysts being realistic with these targets, or are they overly optimistic about future stock prices? Determining whether analysts are keeping up with recent company changes or industry trends is crucial. While a high target price can suggest confidence in a stock’s future potential, it might also reflect outdated expectations. Investors should delve into these considerations thoroughly.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• STAB YTD Return

• Top Ten Hedge Funds Holding ONEM

• SPHQ Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.