Piper Sandler Lowers SolarEdge Technologies to Underweight

On November 7, 2024, Piper Sandler downgraded SolarEdge Technologies (WBAG:SEDG) from Neutral to Underweight. This news comes as part of a broader trend in the investment community.

Investor Sentiment Shifts

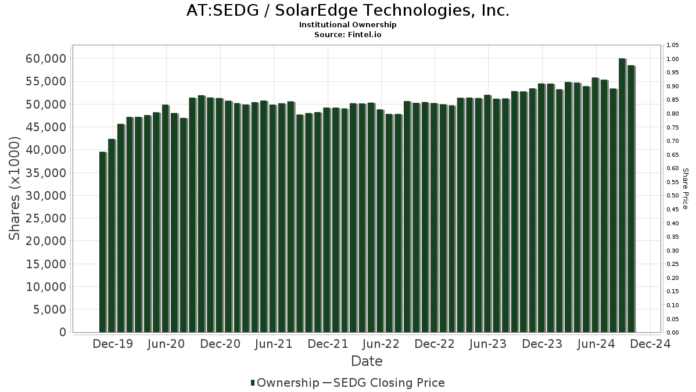

A total of 570 funds now report holdings in SolarEdge Technologies, reflecting a decrease of 54 investors or 8.65% compared to the previous quarter. Average portfolio weight for all funds invested in SEDG is currently 0.10%, a notable increase of 48.22%. Over the past three months, total shares owned by institutions have risen by 12.76%, amounting to 59,196,000 shares.

The iShares Core S&P Small-Cap ETF holds 3,706,000 shares, accounting for 6.51% ownership of SolarEdge. Its most recent filing indicated a decrease from 3,842,000 shares, marking a decline of 3.67%. Additionally, the ETF reduced its allocation in SEDG by 64.35% in the last quarter.

Grantham, Mayo, Van Otterloo & Co. has increased its stake, now holding 3,338,000 shares (5.86% ownership). This represents a 17.86% increase from its previous count of 2,742,000 shares, though the firm has still lowered its portfolio allocation in SEDG by 59.73% this past quarter.

Goldman Sachs Group’s holdings rose to 2,068,000 shares (3.63% ownership), up from 1,606,000 shares, which shows a significant increase of 22.35%. However, this firm also reduced its allocation in SEDG by 56.27% over the last three months.

Baillie Gifford decreased its shares to 1,719,000 (3.02% ownership), a slight drop of 0.23% from 1,723,000 shares. Similar to others, Baillie Gifford reduced its portfolio allocation in SEDG by 13.08% last quarter.

Invesco’s stake grew to 1,689,000 shares (2.96% ownership), an increase of 17.99% from 1,385,000 shares previously held, although it also cut its allocation in SEDG by 57.27% over the same period.

Fintel serves as a vital resource for individual investors, traders, and financial advisors, providing in-depth insights on investment opportunities.

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.