December Blues: Retail Giants Struggle as Holiday Sales Peak

As Black Friday and Cyber Monday approach, investors eyeing major U.S. retailers like Amazon.com Inc. AMZN, Walmart Inc. WMT, and Best Buy could face unexpected outcomes when December rolls around.

Although the holiday shopping season appears promising, historical trends indicate that December isn’t the best month for investing in these retail giants.

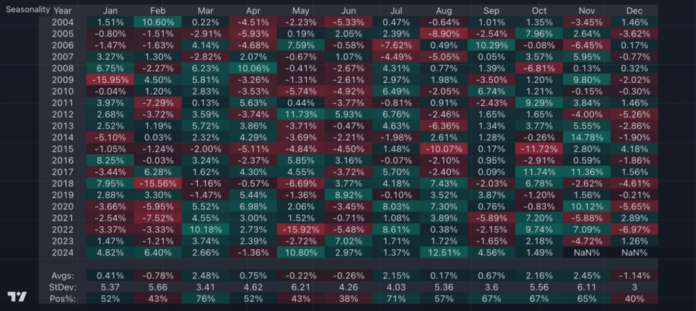

Walmart’s Historically Tough December

For the past 20 years, December has proven to be Walmart’s weakest month, with an average decline of 1.1% in its stock price.

The data reveals that Walmart’s shares have only ended December positively 40% of the time—achieving this in merely 8 out of the last 20 years. This marks December as the month with the lowest success rate for the company.

Walmart’s most significant drop occurred in December 2022, when its shares fell by 7% during that month.

Looking back 30 years, the pattern remains unchanged: Walmart experiences an average stock decline of 0.9% in December, maintaining a win rate of just 40% during the month.

Read also: November Small-Cap Surge Could Carry Into December’s Santa Rally, Historical Trends Suggest

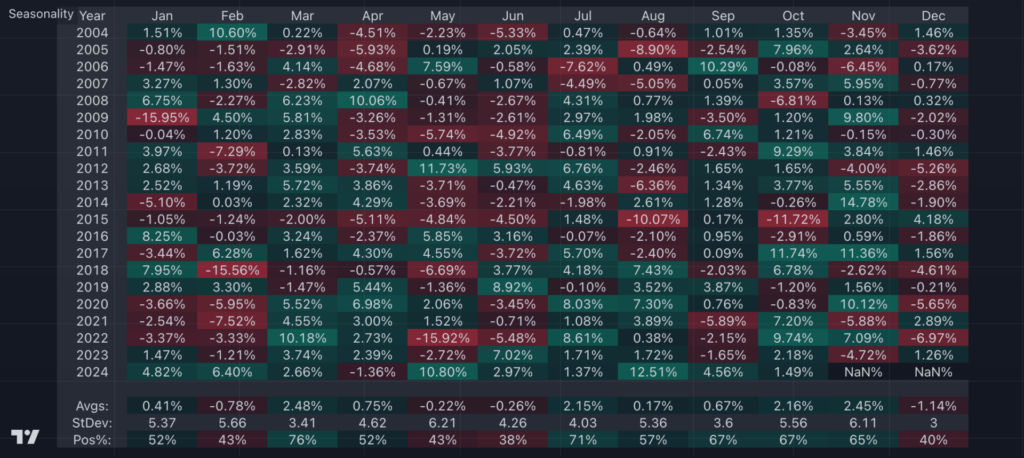

Amazon Faces December Downturn Too

Amazon.com Inc. has also encountered difficulties in December. While its stock doesn’t see declines as severe as Walmart’s, this month ranks as Amazon’s second-worst for stock performance, outperforming only February.

In the past 20 years, Amazon shares have dipped by an average of 0.27% in December, with a winning percentage of only 45%.

December 2022 marked Amazon’s worst performance, with the stock dropping a notable 13% during the month amid widespread market challenges.

Nonetheless, not all Decembers have been dismal. Past performance includes notable increases, such as a rise of 20.1% in 2008 and an 11.6% boost in 2004.

What Causes Amazon and Walmart’s December Struggles?

It seems counterintuitive, but the holiday season—a peak shopping time—can lead to poor stock performance for major retailers. Investors on Wall Street often hesitate to purchase shares in Amazon and Walmart during this period due to profit margin concerns.

Sales from Black Friday and Cyber Monday do generate revenue increases, yet the deep discounts required to draw in customers can shrink profit margins. This is a concern for investors focused on profitability.

Furthermore, high expectations for retail performance during the holidays mean that any disappointing results are likely to cause stock sell-offs.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs