Tesla’s Future Growth Faces Challenges Amid Stagnating EV Deliveries

Autonomous vehicles and artificial intelligence (AI). Robots. Energy storage. These are among the innovative products that Tesla (NASDAQ: TSLA) hopes will fuel its growth moving forward. However, a closer look at the company’s financials reveals that the bulk of its revenue still comes from electric vehicles (EVs), a trend expected to continue for several more years.

Investors in a Dilemma: Growth vs. Reality

This situation leaves Tesla investors in a tight spot. CEO Elon Musk has promised explosive growth from new ventures like the Optimus Robot, but the EV sector is showing signs of stagnation. Notably, deliveries dropped from 1.8 million in 2023 to 1.79 million in 2024, a worrying trend considering the significant price reductions made to boost demand. The slowdown in EV sales across the United States has also led to a decline in Tesla’s market share not just in America, but in Europe and China as well.

In contrast, competitors like BYD are thriving, hitting a record 4.27 million deliveries in 2024—over double Tesla’s numbers. While BYD doesn’t sell in the U.S., it’s gaining traction internationally, capitalizing on the demand in the Chinese market. To compete, Tesla is introducing an updated Model Y and the much-anticipated Cybertruck, although initial customer interest in the Cybertruck has been lukewarm.

Looking ahead, Tesla expects delivery growth to resume in 2025, but the company hasn’t provided specifics, and this growth is anticipated to fall short of the previously promised 50% annually. Monitoring delivery figures will be critical to assessing Tesla’s core business performance in the near future.

Innovative Ventures: AI, Cybercab, and Robots

Despite the challenges, Tesla’s ambitious product pipeline plays a significant role in its recent stock performance, which is up 75% over the last year. Among its most exciting projects is the Cybercab, a self-driving taxi expected to enter production in 2026. Success here could position Tesla strongly against its rival Waymo, which is expanding its robotaxi network throughout the U.S.

AI and self-driving technology represent another major investment for Tesla. The company plans to pour billions into these areas to enhance vehicle offerings and support the forthcoming Cybercab network. Additionally, the Optimus Robot, while still under development, could open new revenue streams for Tesla, with Musk speculating it could elevate the company’s valuation to $25 trillion in the future.

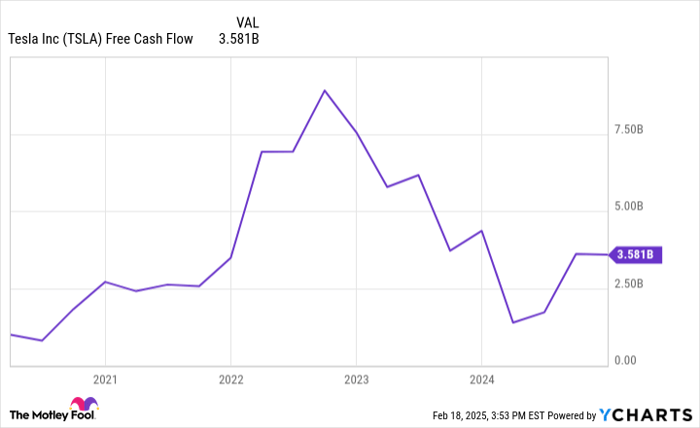

TSLA Free Cash Flow data by YCharts

Market Skepticism: Caution Advised

While the promise of new products paints an optimistic picture, investors should be wary. Musk has a history of generating excitement with bold claims that don’t always materialize. For instance, in 2016, he announced that all Tesla cars would be self-driving within a few years—a goal yet to be achieved nearly a decade later.

Currently, Tesla shares are valued as if these ambitious projects will come to fruition. With a market cap of $1.1 trillion and only $3.6 billion in free cash flow over the last year, Tesla’s price reflects expectations of significant profit increases in the coming decades. As things stand, it seems unlikely that the stock will see much appreciation over the next five years, suggesting investors might want to exercise caution at this time.

A Potential Opportunity Awaits

Do you ever feel like you’ve missed the opportunity to invest in top-performing stocks? If so, now may be the time to pay attention.

Occasionally, our team of experts recommends “Double Down” stocks—companies they believe are on the verge of notable gains. If you’re worried that you missed your chance to invest, this could be your opportunity to get in before it’s too late. Here are some impressive historical returns:

- Nvidia: An investment of $1,000 when we doubled down in 2009 would be worth $348,579 today!*

- Apple: If you had invested $1,000 when we doubled down in 2008, you’d have $46,554 now!

- Netflix: A $1,000 investment when we doubled down in 2004 would have grown to $540,990!

Our team is currently issuing “Double Down” alerts for three exceptional companies, and you may not want to miss this chance.

Learn more »

*Stock Advisor returns as of February 21, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends BYD Company. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.