Some investors and analysts were writing Netflix‘s (NASDAQ: NFLX) eulogy not too long ago. Though it delivered life-changing results from the early 2010s through the early pandemic years, the streaming specialist started encountering issues, including slow revenue and subscriber growth, and mounting competition.

However, Netflix has successfully dealt with these challenges and has delivered excellent financial results in the past few years. Could Netflix keep up this momentum? My view is that the streaming leader will do so, and could even join the exclusive group of trillion-dollar stocks by 2032.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

As of this writing, Netflix’s market capitalization is $413 billion, so it needs a compound annual growth rate of 13.5% in the next seven years to reach that goal. Read on to find out why Netflix can pull it off.

Financial results should remain strong

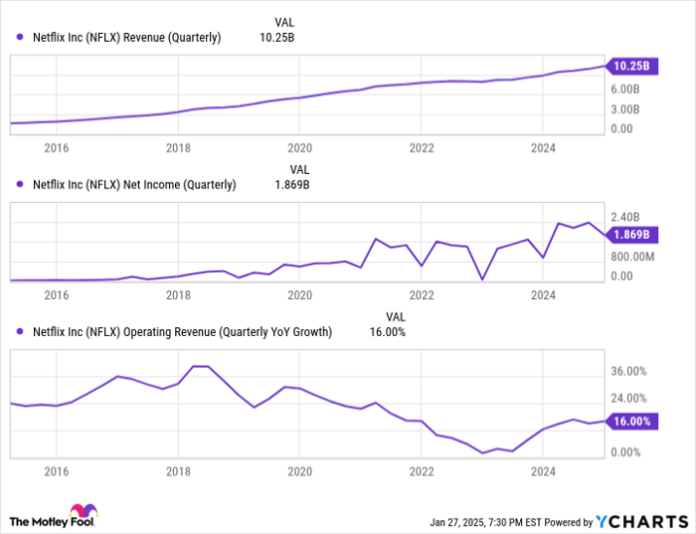

Netflix’s recent fourth-quarter results, once again, had the market buzzing. The company’s revenue jumped by 16% year over year to $10.2 billion. Netflix’s net income almost doubled to $1.9 billion, while it grew its paid memberships by 16% year over year to 301.63 million. One strong period may not mean much in the grand scheme of things, but Netflix has a habit of performing well.

NFLX Revenue (Quarterly) data by YCharts.

True, the company’s top-line growth has slowed over the years — that’s typically what happens as corporations become larger. It’s almost impossible for companies to maintain revenue growth in the same range as they mature. Even then, some might argue that the past is no guarantee of future success. While that’s also true, it at least tells us something about a business and, importantly, the leadership team leading it. That’s arguably the single most crucial factor in a company’s success.

Consider that Netflix’s management long scoffed at the idea of introducing an ad-supported subscription option. Eventually, as market conditions evolved, they changed their minds, and the results of that 180 degree turn were excellent. Some CEOs might have doubled down, prioritizing keeping their word over the company’s performance. That’s not what Netflix’s leadership team did.

Investors can be sure that the company will encounter other challenges through 2032 that will harm its financial results and sink its share price. The stock will not see an uninterrupted northbound path in the next seven years. However, as it has many times, Netflix should be more than capable of bouncing back after whatever headwind slows its march forward.

Netflix can thrive despite the competition

Netflix is one of the pioneers of the streaming industry. The company had little direct competition in the field for a while. That has changed as the company’s business model has proved incredibly successful. It’s hard to know precisely how many video streaming platforms there are now — but there are a lot.

Netflix, though, remains one of the top dogs. In fact, the company’s name is, in informal language, a verb synonymous with streaming. In other words, Netflix benefits from a strong brand name — a powerful competitive advantage.

That’s not the only source of Netflix’s moat. The company also benefits from the network effect. The more subscribers join its platform, the more data it can collect on viewer habits and preferences. It then uses this information to guide its content strategy. In addition to the many successful shows and movies it is already known for, Netflix is making a push in live programming. Last year, it held several live events, including sporting events, some of which became the most streamed ever in their respective categories.

That would be less likely to happen with a smaller, less prominent platform than Netflix. So, Netflix is more than capable of thriving in a highly competitive environment — it is doing so right now. That’s important, since new streaming platforms will likely continue to pop up. FuboTV, a leading sports-focused streaming specialist, is merging with Disney‘s Hulu+ Live TV. Whatever platform results from that merger may or may not be considered “new,” but it will have more market power than its original, individual components.

It’s nothing Netflix and its shareholders should be worried about, though. In addition to Netflix’s moat, streaming arguably remains underpenetrated worldwide. In December, it made up 43% of television viewing time in the U.S. — one of the most advanced streaming markets. That number is much lower in most other countries. In my view, it won’t have peaked by 2032.

Netflix has significant opportunity ahead. That’s one more reason why the stock could deliver market-beating returns in the next seven years and join the trillion-dollar club. Long-term investors who initiate a position today shouldn’t be disappointed.

Should you invest $1,000 in Netflix right now?

Before you buy stock in Netflix, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Netflix wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $763,921!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

Learn more »

*Stock Advisor returns as of January 27, 2025

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Netflix, Walt Disney, and fuboTV. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.