Quantum Computing: The New Frontier in AI Investments

Artificial intelligence (AI) is the biggest opportunity in the tech sector today, and within this realm, semiconductor companies are reaping significant rewards. The reason is simple: chips are essential for creating numerous generative AI applications. Recently, quantum computing has emerged as a new focus within the AI space.

Looking to invest $1,000? Our analyst team has identified the 10 best stocks to buy now. Discover the 10 stocks »

Are Quantum Computing Stocks Set to Shine?

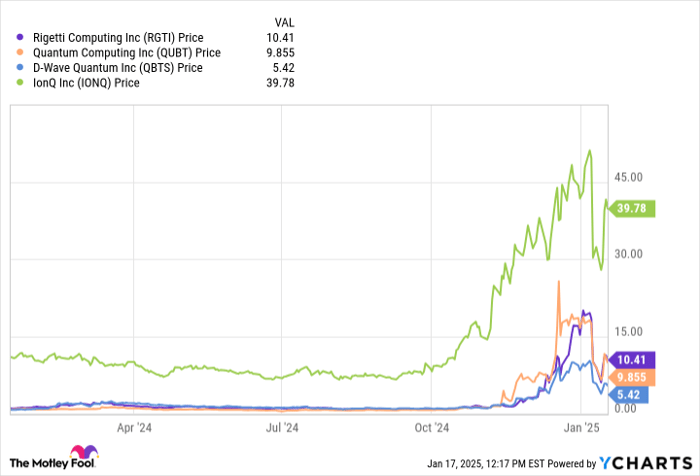

Quantum computing is paving an exciting path in the AI domain. Naturally, investors are eager to explore investment opportunities in this field. The recent trends are illustrated in the chart below:

RGTI data by YCharts

By late 2024, companies like IonQ, D-Wave Quantum, Quantum Computing, and Rigetti Computing saw significant stock price increases. Interestingly, these companies started as penny stocks before climbing to billion-dollar valuations in just a few months.

However, be cautious about these stocks. They remain in the development phase, meaning they aren’t generating sufficient revenue and are consistently losing money. Thus, the rapid price increases resemble those of meme stocks rather than sound investment options.

Although their prices may seem low, the valuation multiples suggest these stocks shouldn’t command their current prices. Thankfully, there are safer strategies for investing in quantum computing.

Image source: Getty Images.

My Top Recommendation for Quantum Computing Investments

A well-known principle in business suggests that those who profited most during the Gold Rush were the sellers of tools, not the miners. In investment, identifying companies that provide essential resources for emerging themes can be a wise strategy.

For those interested in quantum computing, I recommend Nvidia (NASDAQ: NVDA).

During a recent CES trade show in Las Vegas, Nvidia CEO Jensen Huang suggested that mainstream quantum computing may still be about 20 years away. This perspective carries both positive and negative implications.

For companies like IonQ, Rigetti Computing, D-Wave, and Quantum Computing, Huang’s comments indicate many hurdles remain before they can achieve notable growth. As a result, they will likely continue to spend heavily on research and development, running up losses in the meantime.

This scenario, while challenging for those firms, presents an opportunity for Nvidia. Developing quantum technologies requires substantial investment in AI infrastructure, which includes graphics processing units (GPU), data centers, and software. Nvidia delivers all these components, making it vital to the quantum computing movement.

I see Nvidia as the “pick and shovel” provider within quantum computing. The company can benefit regardless of which firms make breakthroughs in this field. Nvidia’s hardware and software will play essential roles as interest in quantum computing grows.

Given that quantum computing scaling is likely decades away, Nvidia stands to gain significantly as more organizations venture into this new area of AI. With plenty of opportunities on the horizon, Nvidia remains a strong buy-and-hold option, especially for those looking for growth or deep exposure to AI developments.

Seize This Opportunity for Potential Gains

Do you ever feel you missed out on investing in top-performing stocks? If so, listen closely.

On rare occasions, our expert team issues a “Double Down” stock recommendation for companies they believe are about to soar. If you’re concerned you’ve missed your chance, now is an ideal time to invest before potential gains shift further away. The numbers reveal compelling outcomes:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $357,084!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $43,554!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $462,766!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and opportunities like this may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 13, 2025

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.