Energy Fuels Poised for Revenue Growth and Break-Even Earnings in Q4 2024

Energy Fuels Inc. UUUU is set to announce improved revenue figures and potentially break-even earnings in its upcoming fourth-quarter report for 2024, scheduled for later this month.

Check for the latest earnings forecasts and surprises on Zacks Earnings Calendar.

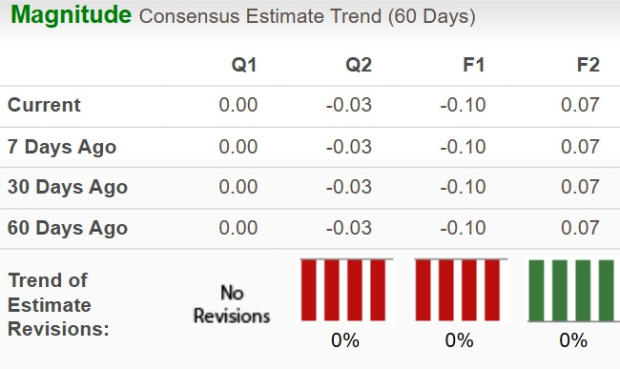

The Zacks Consensus Estimate forecasts break-even earnings for Energy Fuels this quarter, a notable turnaround from the 13 cents per share loss in the same period last year. Interestingly, this estimate has remained stable for the past two months.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The revenue consensus for UUUU stands at $45.25 million, which reflects a substantial increase from last year’s revenue of $0.47 million.

Examining Energy Fuels’ Earnings History

In the last four quarters, UUUU managed to surpass Zacks Consensus Estimates twice while falling short in the other two. On average, the company has recorded a negative earnings surprise of 85%, illustrating the inconsistencies in its earnings performance.

Image Source: Zacks Investment Research

Insights from the Zacks Model for UUUU

Currently, the Zacks model does not indicate a guarantee of an earnings beat for Energy Fuels this quarter. A combination of a positive Earnings ESP and a favorable Zacks Rank of 1 (Strong Buy), 2 (Buy), or 3 (Hold) typically raises the likelihood of surpassing estimates, but this situation does not qualify.

Earnings ESP: Energy Fuels reports an Earnings ESP of 0.00%. Use our Earnings ESP Filter to uncover potential winners before they are announced.

Zacks Rank: The company currently holds a Zacks Rank of 3. For further insights, you can view today’s top Zacks #1 Rank stocks here.

Factors Influencing Energy Fuels’ Q4 Performance

Due to concerns from the Navajo Nation regarding the transport of radioactive materials, UUUU paused ore shipments from its Pinyon mine in Arizona. However, mining operations continued, allowing the company to stockpile mined ore on-site. As a result, Energy Fuels projects production of 150,000-200,000 pounds of finished uranium in 2024, a reduction from previous estimates of 150,000-500,000 pounds.

Recently, UUUU, along with the Navajo Nation Department of Justice and Environmental Protection Agency, established a significant agreement to resume ore transport, expected to commence in February.

At the start of the fourth quarter, the company reported an inventory of 235,000 pounds of finished uranium, alongside 805,000 pounds of uranium in ore and various stages of processing. Additionally, Energy Fuels possessed 905,000 pounds of finished vanadium and significant amounts of other rare earth elements.

In the first quarter of 2024, Energy Fuels sold 200,000 pounds of uranium under long-term contracts at $75.13 per pound. Without new contract sales planned for the fourth quarter of 2024, the company likely relied on selling off inventory in the spot market. In the initial three quarters of 2024, 250,000 pounds of uranium were sold at an average price of $91.51 per pound, primarily during the first quarter to take advantage of rising prices.

Sales figures for 2024 are expected to fall short of last year’s total of 560,000 pounds, indicating maximum sales of 110,000 pounds for Q4 2024. Notably, with uranium spot prices averaging $76.75 per pound in Q4 2024, a decline of 7% from the previous year, this drop could impact UUUU’s revenue for the quarter.

Lastly, increased salaries and benefits due to expanding staff for business improvements are likely to elevate selling, general, and administrative expenses.

Stock Performance and Valuation for UUUU

Over the past year, Energy Fuels shares have declined by 23.2%, contrasting the 10.6% growth seen in the broader industry. The Zacks Basic Materials sector and the S&P 500 saw gains of 0.7% and 23.2%, respectively, in the same timeframe.

Comparing Energy Fuels’ Price Performance to Industry and Market

Image Source: Zacks Investment Research

Energy Fuels currently trades at a forward sales multiple of 5.98, significantly higher than the industry average of 2.80.

Image Source: Zacks Investment Research

However, it remains more affordable than competitors Cameco CCJ and Uranium Energy UEC, which have price-to-sales ratios of 8.37 and 21.34, respectively.

Investment Considerations for UUUU

With a debt-free balance sheet, Energy Fuels is increasing uranium production and enhancing its rare earth element capabilities to meet the rising demand driven by clean energy initiatives. Its recent acquisition of Base Resources Limited exemplifies its ambition to emerge as a prominent global REE producer. The company’s abundance of quality mineral resources and robust development projects bolster its competitive stance.

Moreover, by acquiring RadTran LLC, UUUU has tapped into the medical isotope market, which is vital for cancer treatment and currently faces a global shortage. Utilizing RadTran’s expertise, Energy Fuels aims to recover valuable isotopes from production waste, significantly benefiting the industry.

Is Now the Right Time to Invest in Energy Fuels?

Projected uranium sales will likely influence the company’s revenue figures in the upcoming quarter. Although uranium prices have dipped this year, this trend appears temporary; supply constraints and robust demand may contribute to rising uranium prices going forward. Energy Fuels is actively investing to enhance production capacity to satisfy the growing demand for uranium and rare earth elements linked to clean energy developments.

Despite a relatively high valuation, UUUU is positioned as a valuable addition to any portfolio, allowing investors to take advantage of the long-term stability within the uranium market.

Discover a New Top 10 Stocks List for 2025

Don’t miss your chance to get ahead with our Top 10 stocks for 2025. Curated by Zacks Director of Research, Sheraz Mian, this selection has seen remarkable success. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks have achieved an impressive +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz meticulously analyzed 4,400 companies to select the top 10 for purchase in 2025. Be among the first to see these promising stocks.

Explore New Top 10 Stocks >>

Want the latest investment recommendations from Zacks Investment Research? Download our report on the 7 Best Stocks for the Next 30 Days for free.

Cameco Corporation (CCJ) : Free Stock Analysis Report

Energy Fuels Inc (UUUU) : Free Stock Analysis Report

Uranium Energy Corp. (UEC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.