“`html

S&P 500’s Post-Election Moves: Trading Volatility Amid Market Uncertainty

Please note, our offices will be closed on Monday, January 20th in observance of Martin Luther King Jr. Day.

Our Customer Service Department will be available to assist you when we reopen on Tuesday.

Donald Trump’s Victory and Immediate Market Reactions

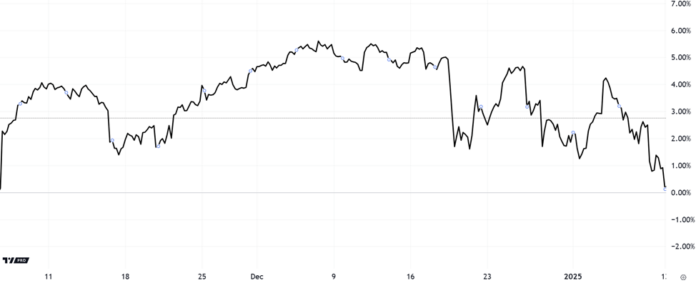

On November 5, Donald Trump secured his second term in office, sparking an immediate rise in stock prices.

By early December, the S&P 500 index climbed over 5%, with many individual stocks seeing bigger gains.

For instance, EPAM Systems (EPAM) surged over 30%, Axon Enterprise (AXON) jumped more than 50%, and Tesla (TSLA) skyrocketed by roughly 90%.

Despite this strong momentum, what was the total return for the S&P 500 from November 5th to just a week ago?

The answer is 0%.

Source: TradingView

While many previously high-performing stocks are still up overall, they have significantly retreated since December.

What Caused the Market Retreat?

According to Jeff Clark, an expert analyst, the reason for this downturn relates back to a well-known investor saying: “The market hates uncertainty.”

As we enter “Trump 2.0,” several crucial questions loom:

- Will tariffs spark inflation once more?

- How will the Federal Reserve react?

- Is there potential for additional tax cuts?

- Can Trump lead advancements in AI, electric vehicles, and crypto?

- How will international responses shape the political landscape following such major U.S. policy changes?

- Could Elon Musk and the Department of Government Efficiency (DOGE) truly manage a $2 trillion reduction in federal spending? What could that mean?

- What legislative battles await in Congress? Trump’s first term saw him impeached twice.

Given the many uncertainties, market fluctuations can lead to a rollercoaster experience for investors.

As Trump plans significant overhauls in his first 100 days, investors should prepare for potential extreme market volatility.

Current Market Activity and Upcoming Trading Opportunities

The market hasn’t quieted; as of lunchtime today, the S&P has risen over 3% this week.

This type of “volatility whiplash” can be unsettling to many investors. However, for seasoned traders like Jeff, it presents a chance for profit.

Looking forward, Jeff expects an increase in volatility and numerous trading opportunities under Trump 2.0.

Webinar on Trading Volatility with Jeff

Jeff will be discussing how to seize trading opportunities amid this volatility in a webinar scheduled for Wednesday at 1 PM ET.

According to Jeff:

For well-prepared traders, Trump’s first 100 days could offer remarkable profit potential.

The Power of Trading in Volatile Markets

For illustration, consider Tilray Brands (TLRY), a leader in medical cannabis. Between mid-June 2023 and October 2023, investors who employed a buy-and-hold strategy saw their returns stagnant at 0%.

Source: TradingView

For adept traders, volatile markets create substantial advantages. While buy-and-hold investors might feel discouraged by unstable prices, skilled traders can capitalize on market swings, whether they move upwards or downwards.

While long-term investing is a prudent approach for many, a deep understanding of volatility can open new opportunities.

“`

Traders vs. Buy-and-Hold: Why Short-Term Strategies Can Lead to Big Gains

The Pitfalls of Buy-and-Hold: Lessons from Jeff’s Experience During Trump’s Presidency

Relying solely on a buy-and-hold strategy might mean missing out on significant returns—real, transformative financial gains.

Jeff recalls an important moment:

In January 2017, President Trump signed an executive order requiring the use of American-made steel for U.S. pipeline projects.

Traders reacted quickly, causing United States Steel (X) stock to soar nearly 30% within a month. However, the company faced underlying issues, and the order’s implementation was slower than anticipated.

Just three months later, U.S. Steel’s share price plummeted.

Source: TradingView

While many investors chased headlines, I stuck to my tried-and-true strategies. We focused on consistent patterns rather than fleeting trends.

With my system, astute traders could have executed a profitable trade on January 25—just after the executive order—and tripled their initial investment.

By identifying bearish patterns later, they could have tripled their investment yet again during the downturn.

Achieving a two-fold tripling of investments in just four months exemplifies the trader’s domain, contrasting sharply with the buy-and-hold approach.

Exploring the Crypto Market: A Volatile Opportunity for Traders

Shifting our attention to the current market, Jeff sees significant potential in cryptocurrencies, which are making headlines today.

As I write on Friday, Bitcoin surged over 4% following suggestions that President-elect Donald Trump plans to prioritize crypto early in his administration.

According to CNBC:

This news follows a Bloomberg report indicating the potential establishment of a crypto advisory council within his administration.

Discussions are reportedly underway regarding a Bitcoin reserve, as noted in a New York Times article.

Whether positively or negatively received, the crypto market is always on the move, which can create opportunities for savvy traders.

Jeff emphasizes:

Imagine the financial gains that might result from easing regulations on emerging technologies like cryptocurrencies.

Trump’s advocacy for a strategic Bitcoin reserve has already propelled Bitcoin prices to new heights, resulting in a 42% gain for my subscribers within just two trading days.

One of Jeff’s strategies involves trading Bitcoin mining stocks. Analyzing the performance of TeraWulf (WULF) over the past months illustrates the volatility—and thus the profit opportunity—available in this sector.

Here’s how WULF fared since early November:

- Achieved gains exceeding 40%, then dropped

- Achieved gains around 30%, then dropped

- Gained over 40% again, then dropped

- Gained 35%, then dropped

- Fell to a 15% loss, then rallied

- Fell to another 15% loss, then rallied

Source: TradingView

This shows remarkable trading potential.

In contrast, what did those who adopted a buy-and-hold strategy receive during the same period?

A loss.

While buy-and-hold is essential for a long-term investment strategy, trading can significantly boost wealth during volatile market conditions.

For those interested in crypto, Jeff offers this insight:

Keep an eye on Bitcoin miners; their movements often signal trends in Bitcoin itself. Jeff has observed that the market tends to react to miner prices in advance of anticipated Bitcoin fluctuations.

Market Predictions: S&P Stagnation Amid Opportunity for Traders

Looking at the overall market, Jeff anticipates the S&P may end 2025 with little change.

Despite this expectation for stagnation, he foresees potential for significant price swings that could catch buy-and-hold investors off guard.

This scenario suggests that while traditional investors may face a flat year, traders could find numerous opportunities to profit.

If you’re eager to incorporate opportunistic trading techniques into your strategy, consider joining Jeff this coming Wednesday at 1 PM ET. With over 40 years of experience, he has become an excellent teacher, and his insights promise to enhance your investment acumen.

To conclude, Jeff states:

The first 100 days of Trump’s presidency will likely be characterized by market fluctuations.

However, I urge you to think of volatility as an opportunity for profit.

This perspective helped me achieve over 25 triple-digit gains for my subscribers during the 2007-2009 downturn, while others faced losses.

With Trump’s focus on deregulation, tax cuts, billionaire backing, and a dynamic approach, we are set for an exceptionally volatile market period.

To me, volatility indicates profit potential.

That is, as long as you adopt the right strategies and mindset.

I’m looking forward to sharing insights on strategies I’ve developed over my 42-year trading career during my webinar on Wednesday, January 22, at 1 PM ET. Reserve your spot for The Most Profitable 100 Days of Your Life right here.

Wishing you a pleasant evening,

Jeff Remsburg