Analysts Predict Gains for Key Stocks in SPDR Portfolio S&P 500 ETF

ETF Channel analysis shows potential for significant upside in SPLG, benefiting from top-performing underlying stocks.

After reviewing the holdings of the SPDR Portfolio S&P 500 ETF (Symbol: SPLG), we’ve calculated the implied target price based on the average analyst 12-month forecasts. The result suggests an implied target price of $74.66 per unit for SPLG.

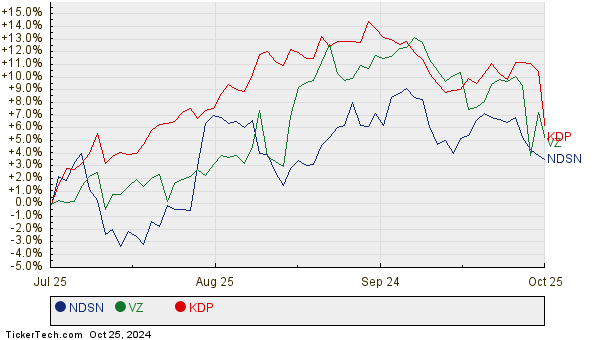

Currently trading at approximately $68.13 per unit, SPLG presents a promising 9.58% upside based on these projections. The ETF has several underlying stocks with strong potential increases. Notably, three of these stocks are Nordson Corp. (Symbol: NDSN), Verizon Communications Inc. (Symbol: VZ), and Keurig Dr Pepper Inc. (Symbol: KDP). Despite recent trading at $248.89/share, NDSN is anticipated to reach an average analyst target of $277.20/share, providing an 11.37% upside. Similarly, VZ, priced at $41.86, has an average target of $46.55/share, reflecting an 11.20% potential increase. Lastly, KDP, trading at $34.94, has a target price of $38.82/share, equating to an 11.11% upside.

Displayed below is a twelve-month price history chart comparing the performance of NDSN, VZ, and KDP:

Consult the table below for a summary of analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Portfolio S&P 500 ETF | SPLG | $68.13 | $74.66 | 9.58% |

| Nordson Corp. | NDSN | $248.89 | $277.20 | 11.37% |

| Verizon Communications Inc | VZ | $41.86 | $46.55 | 11.20% |

| Keurig Dr Pepper Inc | KDP | $34.94 | $38.82 | 11.11% |

As we consider these projections, essential questions arise. Are these analyst targets achievable, or are they overly optimistic? Analysts’ targets may reflect an optimistic outlook but could also risk becoming outdated in light of recent events in the companies and industries involved. These questions warrant careful exploration by investors.

![]()

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Cheap Services Stocks

• FSS Price Target

• ASTC shares outstanding history

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.