Roku’s Streaming Dominance Faces Profitability Challenges

Roku (NASDAQ: ROKU) has established itself as a leader in the U.S. streaming TV market, even amidst fierce competition from well-funded technology giants. Despite its growth—85.5 million households streaming over 32 billion hours quarterly—its stock has fallen significantly, down 57% over the past five years. This decline may stem from doubts about its profitability. Yet, Roku’s ongoing growth places its stock at historically low levels, presenting potential opportunities for investors.

Capitalizing on the Streaming Boom

The shift to streaming is still in its early stages, with Nielsen reporting that streaming video comprises just 41% of total TV viewing in the U.S. Over the next 10 to 20 years, this number could approach 100%.

Roku captures a notable share of this viewership. Once dominated by third-party services like Netflix, today its own app, the Roku Channel, has grown to hold a 1.6% market share in TV viewing. This popularity is underscored by the fact that the app is exclusive to Roku devices. In the last quarter alone, streaming hours on the Roku Channel surged by 80% year-over-year.

The increase in viewing hours is a positive sign, as it correlates with revenue growth. Last quarter, revenues from Roku’s platform increased by 15% year-over-year, reaching $908.2 million, with a robust gross margin of 54.2% primarily driven by advertising spending.

Improving Profit Margins Show Potential

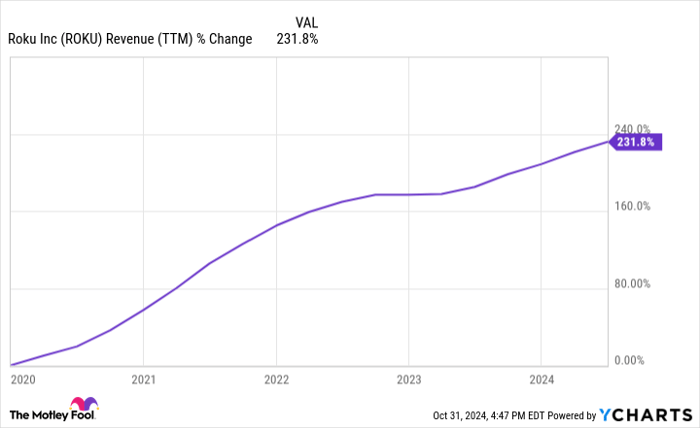

While Roku’s stock has seen a decline of nearly 60% over the past five years, its revenue has soared by 232% cumulatively. The challenge lies in improving profitability.

Over the last 12 months, Roku posted an operating income of -$600 million, continuing a trend of negative figures over several years. However, the company is making progress. In Q3, for instance, its operating margin decreased to -3%, a near break-even point.

Future performance will depend on how well Roku can expand its margins while sustaining revenue growth. If successful, this could lead to significant bottom-line earnings.

ROKU Revenue (TTM) data by YCharts

Looking Ahead: Stock Projections for the Next Five Years

Roku’s profit margins will play a crucial role in determining its stock performance in the next five years. Given the ongoing trend in global streaming growth, maintaining a 10% annual revenue growth seems achievable, potentially elevating annual revenue to $6 billion within five years.

With a consolidated gross margin of 45%, Roku could see profit margins rise to around 10% at that revenue scale, translating to $600 million in annual earnings.

Currently, Roku’s market cap is $9 billion, reflecting a five-year forward price-to-earnings (P/E) ratio of 15. This valuation, while considered inexpensive, is fairly close to historical market averages. For investors, unless Roku can demonstrate faster revenue growth or improved profit margins, significant stock appreciation may be unlikely.

A Potential Second Chance for Investors

If you’ve ever thought about missing a big investment opportunity, here’s a moment to reconsider.

Our analysts occasionally recommend “Double Down” stocks—companies poised for significant growth. If you’re concerned about previously missed opportunities, you might want to act swiftly as the current numbers indicate strong potential benefits:

- Amazon: $1,000 investment in 2010 would be worth $22,292 now!*

- Apple: $1,000 investment in 2008 would have grown to $42,169!

- Netflix: $1,000 from 2004 would have skyrocketed to $407,758!

Right now, we are identifying three “Double Down” stocks that could offer remarkable returns.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Netflix and Roku. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.