Analysts See Growth Potential in iShares Core S&P U.S. Growth ETF

Current Outlook Suggests 10.60% Upside for Investors

At ETF Channel, we analyzed the ETFs within our coverage and examined how their underlying holdings are performing compared to analysts’ 12-month price targets. For the iShares Core S&P U.S. Growth ETF (Symbol: IUSG), our findings indicate an implied target price of $155.38 per unit.

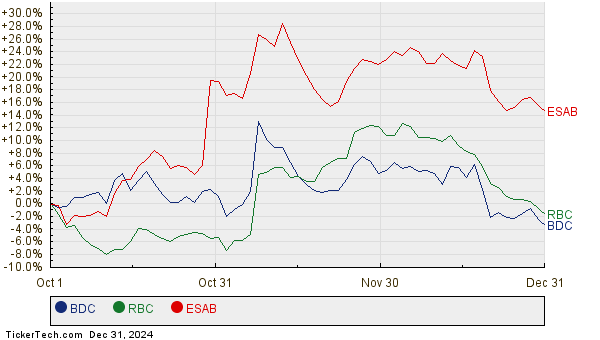

Currently, IUSG trades at approximately $140.49 per unit, suggesting that analysts anticipate a potential upside of 10.60% based on their forecasts. Noteworthy underlying holdings contributing to this positive outlook include Belden Inc (Symbol: BDC), RBC Bearings Inc (Symbol: RBC), and ESAB Corp (Symbol: ESAB). Belden Inc’s recent share price of $112.15 is well below the average target of $128.40, representing a 14.49% growth potential. Similarly, RBC Bearings Inc shows a strong upside possibility of 13.83%, with a recent share price of $297.09 against a target of $338.17. Lastly, analysts expect ESAB to reach $136.56, indicating a 13.62% increase from its current price of $120.19. Below is a 12-month price history chart illustrating the performance of BDC, RBC, and ESAB:

Here is a summary table of the analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core S&P U.S. Growth ETF | IUSG | $140.49 | $155.38 | 10.60% |

| Belden Inc | BDC | $112.15 | $128.40 | 14.49% |

| RBC Bearings Inc | RBC | $297.09 | $338.17 | 13.83% |

| ESAB Corp | ESAB | $120.19 | $136.56 | 13.62% |

Investors might wonder whether analysts are too optimistic in their projections. Questions arise about the validity of these targets and whether analysts are adequately responding to recent developments in these companies and their sectors. While a high target can signal optimism, it can also lead to price downgrades if expectations are deemed outdated. Investors will need to conduct thorough research to better understand these dynamics.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• HCI Average Annual Return

• TLPH shares outstanding history

• Top Ten Hedge Funds Holding DTSI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.