Analysts Forecast 22.99% Upside for iShares North American Natural Resources ETF

Recent analysis from ETF Channel reveals promising targets for the iShares North American Natural Resources ETF (Symbol: IGE). Based on the ETF’s underlying holdings, the average analyst target price stands at $52.55 per unit.

Current Trading Status and Analyst Insights

Presently, IGE is trading at approximately $42.73 per unit, suggesting that analysts predict a 22.99% potential increase. Notably, three underlying companies exhibit significant upside potential relative to their target prices: B2Gold Corp (Symbol: BTG), NexGen Energy Ltd (Symbol: NXE), and Equinox Gold Corp (Symbol: EQX).

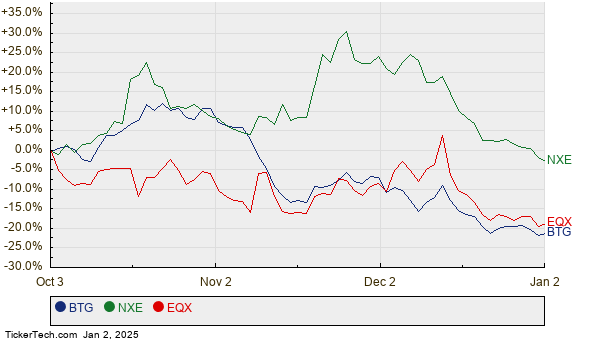

B2Gold Corp, currently trading at $2.45 per share, has an average target of $4.42, indicating a potential upside of 80.29%. Meanwhile, NexGen Energy’s recent price of $6.60 shows a 51.36% upside to the target of $9.99. Equinox Gold is trading at $5.02, with analysts expecting it to reach $7.44, which represents an upside of 48.29%. Below is a twelve-month price history chart that compares the performance of BTG, NXE, and EQX:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares North American Natural Resources ETF | IGE | $42.73 | $52.55 | 22.99% |

| B2Gold Corp | BTG | $2.45 | $4.42 | 80.29% |

| NexGen Energy Ltd | NXE | $6.60 | $9.99 | 51.36% |

| Equinox Gold Corp | EQX | $5.02 | $7.44 | 48.29% |

Evaluating Analyst Targets

Are these analysts’ expectations grounded in reality, or do they reflect unwarranted optimism? The disparity between a stock’s current price and its target can signal an optimistic outlook, but it may also lead to downward adjustments if the predictions no longer align with recent market trends. Investors are encouraged to conduct thorough research to assess the validity of these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding VV

• TNTR market cap history

• LGVN Stock Predictions

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.