American Express: A Potentially Strong Investment for Next Five Years

In a market dominated by tech giants, American Express (NYSE: AXP) has stood out, achieving a remarkable total return of 160% over the past five years—surpassing the S&P 500’s return of 106% during the same period, much of which occurred in the last 12 months.

Looking to invest $1,000? Discover the market’s top 10 stocks right now. See the 10 stocks »

American Express has revitalized its growth strategy by concentrating on travel and entertainment. This focus has enhanced its earnings as the company expands its market share both in the U.S. and internationally.

Turning Challenges into Opportunities

In 2015, American Express faced a significant challenge when Costco Wholesale ended their credit card partnership. This arrangement had accounted for 10% of American Express cards, and its termination resulted in a drop in stock value. Investors were anxious, fearing stagnant growth in the aftermath.

However, this setback proved beneficial in the long run. With Costco’s considerable bargaining power in the deal, American Express had not gained favorable returns. The end of this partnership allowed the company to focus on enhancing its renowned travel perks that appeal to its premium clientele.

When CEO Stephen Squeri took over in 2018, he made the decision to reinvest in valuable travel and entertainment benefits for members. This included new partnerships for co-branded cards and enhanced travel-related perks. Additionally, the expansion of airport lounges offered cardholders unique advantages that elevated the brand’s status in the travel sector.

As a result of these strategic choices, American Express has seen earnings per share (EPS) increase nearly 150% over the past decade. The company is acquiring more than 3 million new card accounts each quarter, marking a turning point after years of stagnation just above 100 million cards in circulation.

Capitalizing on International Growth

American Express has established itself as a leader in its home market and is likely to continue gaining market share, especially among younger customers. Nonetheless, explosive revenue growth from card spending may not be on the horizon in the U.S. just yet.

The real potential lies in international markets. With solid positions in countries like Mexico, Japan, and Australia, the company is eager to tap into more global opportunities. Many countries have customers who are drawn to a premium travel credit card, making it a ripe area for expansion. Management has reported a 50% increase in international locations accepting American Express from 2021 to 2023.

This international growth complements the company’s value proposition to U.S. customers. For instance, if American Express enhances its acceptance and perks in Mexico, American travelers could benefit significantly when visiting.

This synergy is crucial for the future growth of American Express. Management has set a goal for revenue to expand at a 10% annual rate, and continued international development will play a necessary role in achieving this target.

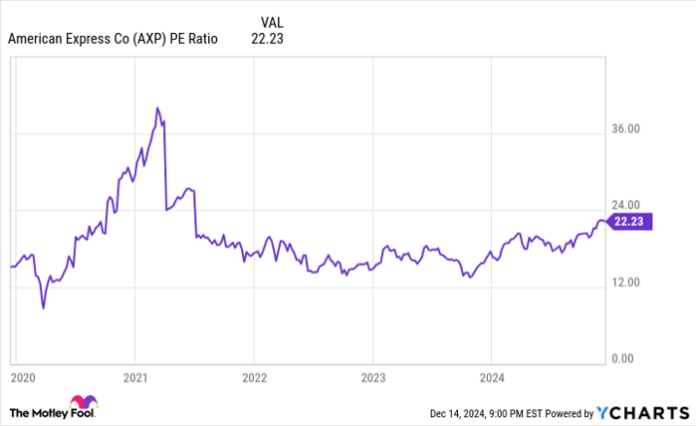

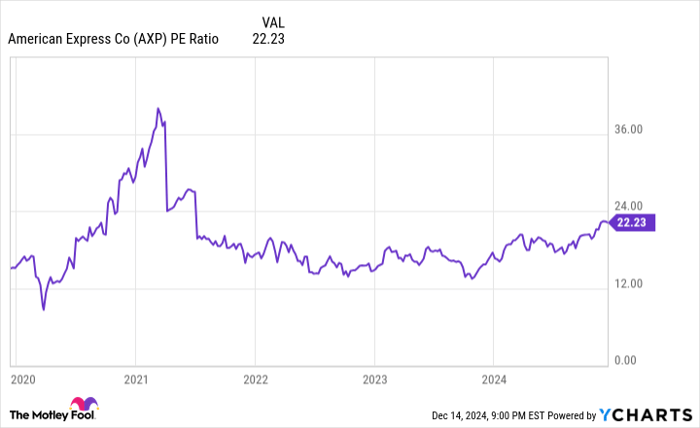

AXP PE Ratio data by YCharts

Future Projections for American Express Stock

American Express has ample opportunities to expand in the next five years. Continued growth in market share, international expansion, and strong pricing strategies could help maintain a 10% revenue growth rate. With consistent operating leverage and share buybacks, management predicts EPS growth at 15% annually. Additionally, the company provides a 1% dividend yield.

Currently, American Express holds a price-to-earnings (P/E) ratio of 22. While this number has risen recently, it remains favorable compared to the S&P 500’s P/E of over 30. A strong brand like American Express can justify a P/E of 22 or even higher.

Given these factors, it is reasonable to expect American Express stock to appreciate alongside its earnings growth. If EPS increases by 15% annually, investments made today could potentially double for long-term shareholders.

Is Investing $1,000 in American Express a Smart Move?

Before investing in American Express, consider this:

The Motley Fool Stock Advisor team has identified the 10 best stocks to buy now, and American Express is not on that list. The stocks recommended have the potential for substantial returns in the upcoming years.

For example, when Nvidia was featured on April 15, 2005, investing $1,000 then would be worth $808,966 today!*

Stock Advisor offers a simple guide to investing success, including portfolio building tips, frequent analyst updates, and two new stock picks monthly. The Stock Advisor service has more than quadrupled the return of the S&P 500 since its inception in 2002.*

See the 10 stocks »

*Stock Advisor returns as of December 16, 2024

American Express is an advertising partner of Motley Fool Money. Brett Schafer has no positions in any mentioned stocks. The Motley Fool holds positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.