Nvidia’s GPU Demand Surges

Nvidia reported a remarkable $57 billion in revenue for Q3 of fiscal 2026, concluding on October 26. CEO Jensen Huang announced that the company is “sold out” of cloud GPUs, indicating an inability to meet the high demand for its data center GPUs. Despite concerns regarding competition and a potential AI bubble, analysts project a 48% revenue growth for Nvidia in the upcoming year.

Amazon’s Growth in Cloud Computing

Amazon Web Services (AWS) achieved a 20% revenue growth rate in Q3, the highest in years, as Amazon prepares for a rebound in 2026. The growth in AWS, alongside its advertising services, positions Amazon strategically for future growth despite a flat stock performance for 2025.

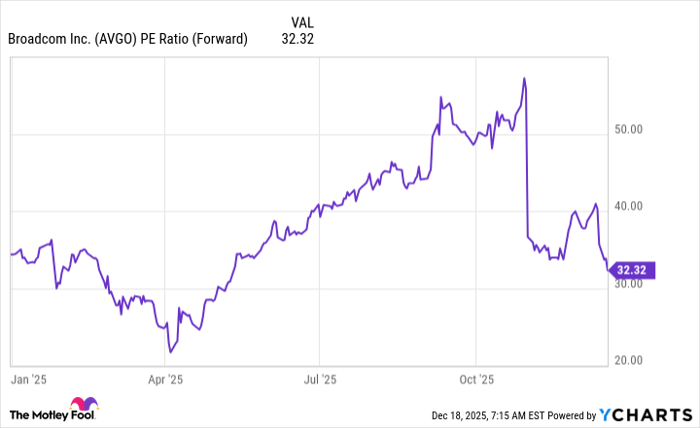

Broadcom’s AI Semiconductor Revenue Expectations

Broadcom’s fiscal Q4 revenues grew by 28%, with its AI semiconductor revenue increasing by 74% year-over-year. While the company faced a stock decline due to postponed purchases for custom AI chips until 2027, predictions suggest that its AI semiconductor revenue will double in Q1 of 2026, making it an attractive investment option moving forward.