Nuclear Energy Stocks Shine as AI Demand Surges

In today’s episode of Full Court Finance at Zacks, we discuss how Wall Street perceives nuclear energy stocks as a promising investment connected to the long-term growth of artificial intelligence (AI).

We also explore three rising nuclear energy companies—BWX Technologies, Vistra, and Oklo—that might be worth buying before December for long-term growth.

Check out the Zacks Earnings Calendar for the latest market updates.

The U.S. is striving to achieve energy independence while reducing fossil fuel reliance. Nuclear energy offers clean and reliable power, operating continuously around the clock.

Nuclear power plants function at peak efficiency over 92% of the time, making them nearly twice as reliable as natural gas and three times more reliable than wind and solar energy.

Today, large data centers consume nearly as much electricity as a midsize city, with generative AI technologies like ChatGPT requiring at least 10 times the energy of a simple Google search.

This demand has led tech giants such as Amazon, Alphabet, and Microsoft to forge multi-billion-dollar nuclear energy agreements in 2024.

The development of a nuclear-powered economy is anticipated to cost trillions and take decades to establish, despite nuclear energy generating about 20% of U.S. electricity for over 30 years.

The U.S. government has initiated several efforts to encourage a resurgence in nuclear energy, pledging to triple its nuclear capacity by 2050. Countries like China and India are also heavily investing in nuclear technology.

Interestingly, three of the top 10 stocks in the S&P 500 for 2024 are nuclear companies, with Vistra leading the pack.

The three companies mentioned below are included in the Alternative Energy Innovators service at Zacks.

Is BWXT a Smart Long-Term Nuclear Energy Investment?

BWX TechnologiesBWXT serves as a primary supplier of nuclear technologies and fuel to the U.S. government. With one of the largest commercial nuclear manufacturing facilities, it is set to expand in anticipation of the nuclear energy growth.

The company is enhancing its manufacturing capacity to accommodate investments in Small Modular Reactors, as well as traditional large-scale nuclear projects, not just in the U.S. but globally.

BWX Technologies has established partnerships with the U.S. Department of Defense to develop innovative micro-nuclear reactors. Collaborations with major nuclear companies like GE Vernova and TerraPower are also in progress.

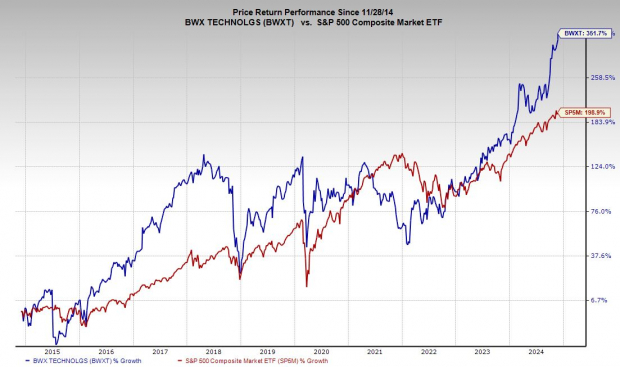

Image Source: Zacks Investment Research

In early November, BWXT announced a strong Q3 report, fueled by rising investments in nuclear solutions across defense, commercial, and medical sectors. The company expects to see revenue growth of 8% in 2024, followed by an additional 6% the next year, which should boost adjusted EPS by 7% and 6%, respectively.

With positive earnings revisions, BWXT holds a Zacks Rank #2 (Buy). Its stock has surged 350% over the past decade, outrunning the S&P 500, which has increased by 200%, and achieving a 75% rise year-to-date.

While BWXT shares are likely to attract profit-taking in the near term due to trading above its 21-week moving average, they still have a PEG ratio of 4.1, representing a 42% discount from their historical highs.

Oklo: A Potential Home Run in Nuclear Energy Investments?

OkloOKLO is revolutionizing the nuclear fission sector. Having gone public in May through a SPAC backed by OpenAI co-founder Sam Altman, Oklo aims to innovate with established nuclear energy technologies. The company focuses on fission technology and nuclear fuel recycling, targeting the construction of smaller nuclear power plants to meet the energy demands of the burgeoning AI data center market.

Oklo plans to provide energy directly to customers, as companies like Amazon AMZN seek direct connections to nuclear plants to satisfy their growing energy needs. The company received a site use permit from the U.S. Department of Energy in 2019 and is actively expanding its customer network, planning to deploy its first nuclear reactor by 2027.

Oklo’s Strong Cash Position and Vistra’s Stellar Performance in Energy Sector

Oklo’s Financial Update: Short Seller Frenzy Fuels Stock Surge

Oklo, a speculative company still in its early stages, reported an adjusted loss of -$0.08 per share for Q3, which aligns with our estimate at Zacks. The company’s financial health remains robust, with $231 million in cash and equivalents and total assets of $294 million against liabilities of only $31 million. Notably, Chris Wright, the CEO of Liberty Energy and a board member of Oklo, was recently nominated by President-elect Donald Trump as Energy Secretary.

The stock of Oklo has seen significant short selling, contributing to a dramatic rise of 330% since early September, as investors have expressed increasing interest in nuclear energy stocks.

On Thursday, Oklo’s stock rebounded to exceed its 21-day moving average, effectively stabilizing after its early May highs. With upward earnings revisions, Oklo earns a Zacks Rank #2 (Buy) and currently trades at around $25 per share, making it an appealing prospect for certain investors.

Vistra: Powering Ahead as a Top Energy Stock

Vistra VST operates the second-largest competitive nuclear fleet in the nation and ranks second in energy storage capacity. This Texas-based company serves approximately 5 million residential, commercial, and industrial customers across 20 states, playing a key role in several major competitive wholesale markets.

As the largest competitive power generator in the U.S., Vistra has a diverse portfolio that includes nuclear, solar, battery storage, and natural gas assets.

Thanks to the energy initiatives supported by the U.S. Inflation Reduction Act, Vistra is projected to see a 33% increase in revenue in FY24, along with a 13% growth projected for the following year, raising total revenue to an impressive $22.2 billion. Additionally, adjusted earnings are anticipated to rise by 38% this year and 24% next year, reflecting an upward trend in earnings estimates.

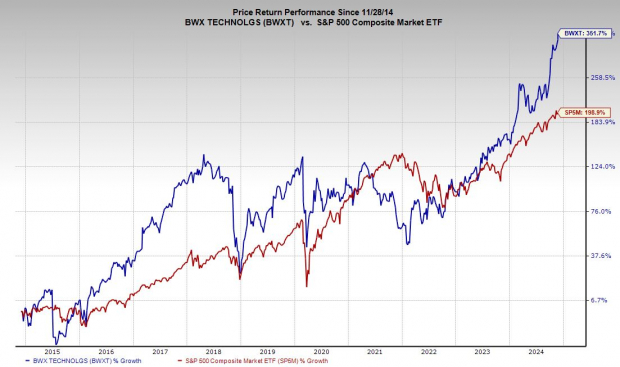

Image Source: Zacks Investment Research

In 2024, Vistra’s stock surged roughly 330%, outperforming notable companies like Nvidia NVDA and other S&P 500 contenders. This stock has seen a remarkable 720% increase over the last three years.

Vistra also pays a dividend and is currently trading at a 23% discount based on its Price/Earnings-to-Growth (PEG) Ratio in the Utilities sector. A dip towards its 21-day or 50-day moving average could present an attractive buying opportunity.

Five Stocks Poised for Remarkable Growth

Five stocks have been selected by Zacks experts as their top picks, each expected to double in value in 2024. Although not every selection will succeed, previous recommendations have seen gains of +143.0%, +175.9%, +498.3%, and even +673.0%.

Many of these promising stocks remain under the radar of Wall Street, offering a unique chance to invest early. Today, explore these 5 potential home runs >>

Want the latest recommendations from Zacks Investment Research? You can now download the report on the 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

BWX Technologies, Inc. (BWXT) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

Oklo Inc. (OKLO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.