PTC Inc. Reports Strong Fourth Quarter Earnings and Boosts Share Buyback Program

PTC Inc. announced impressive results for its fourth quarter of fiscal 2024, with non-GAAP earnings per share (EPS) of $1.54, reflecting a 28% increase compared to the same period last year. This figure surpassed the Zacks Consensus Estimate by 7.7%.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Quarterly revenues reached $627 million, marking a 15% rise year over year, and just above the Zacks Consensus Estimate of $620.5 million. The strong performance was fueled by ongoing demand for PTC’s product lifecycle management (PLM) and computer-aided design (CAD) solutions.

In a move to enhance shareholder value, PTC announced a new $2 billion share repurchase program effective until September 30, 2027. The company plans to buy back approximately $300 million of its stock in fiscal 2025, starting in the fiscal first quarter. Additionally, PTC will retire $500 million in senior notes due in fiscal second quarter 2025.

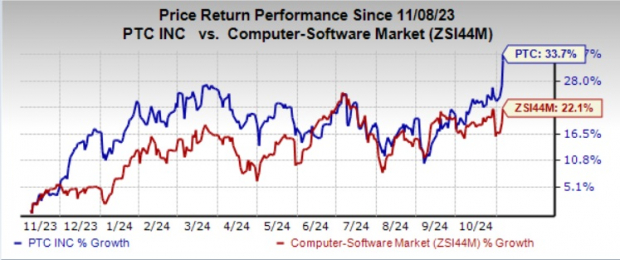

Following the earnings announcement, PTC shares climbed 4.2% on November 6, closing at $198.04. Over the past year, the stock has increased by 33.7%, outperforming the sub-industry’s 22.1% growth rate.

Image Source: Zacks Investment Research

Revenue Insights

Recurring revenues amounted to $582.4 million, showing a 16.4% increase year over year. Meanwhile, perpetual licenses saw a substantial rise of 21%, reaching $9.9 million.

PTC Inc. Price, Consensus, and EPS Surprise

PTC Inc. price-consensus-eps-surprise-chart | PTC Inc. Quote

Revenue Breakdown by License, Support, and Services

License revenues, representing 38.2% of total revenues, increased to $239.5 million, a rise of 29.9% from the previous year.

Support and cloud services revenues, which accounted for 56.3%, rose by 8.9% to $352.9 million.

Professional services revenues, making up 5.5%, decreased by 10.4%, totaling $34.2 million.

Performance by Product Group

Both PLM and CAD businesses demonstrated solid growth. In the fourth quarter, PLM revenues hit $408 million, up 14% year over year, while CAD revenues reached $219 million, marking a 16% increase.

Annualized Recurring Revenue (ARR)

Annualized recurring revenues reached $2.255 billion, a 14% rise year over year. When adjusted for constant currency, ARR was $2.207 billion, reflecting a 12% increase. Strong growth was noted across all divisions and geographical regions.

For the fourth quarter, PLM and CAD ARR amounted to $1,387 million and $868 million, respectively, showing year-over-year increases of 15% and 13%.

Operating Metrics

Non-GAAP gross margin improved to 84.4%, up from 81.6% in the same quarter last year. Total operating expenses rose 3.3% year over year to $319.8 million. Non-GAAP operating income experienced a significant increase of 37.8%, reaching $276.6 million, while operating margin rose by 740 basis points to 44.1%.

Financial Health Overview

As of September 30, 2024, cash and cash equivalents stood at $266 million, which is a decrease from $288 million a year earlier. Total debt was $1.748 billion, up from $1.695 billion as of September 30, 2023. Cash from operating activities improved to $98 million, compared to $50 million in the prior year, while free cash flow rose to $94 million from $44 million.

Future Outlook

For the first quarter of fiscal 2025, PTC expects revenues to be between $540 million and $570 million. Non-GAAP EPS is projected between 75 cents and 95 cents, while cash from operations is anticipated to be $234 million, and free cash flow is forecasted to reach $230 million.

For the entirety of fiscal 2025, revenues are expected in the range of $2.505 billion to $2.605 billion, reflecting a 9% to 13% increase year over year. Non-GAAP EPS is anticipated between $5.60 and $6.30, representing a potential rise of 10% to 24%. Cash from operations is projected to be between $850 million and $865 million, with free cash flow expected in the range of $835 million to $850 million, indicating a 14% to 16% increase. PTC also forecasts a growth in ARR between 9% and 10% on a constant currency basis for fiscal 2025.

PTC’s Investment Position

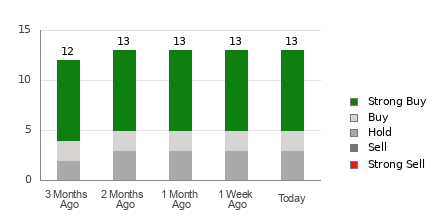

Currently, PTC holds a Zacks Rank of #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Comparative Performance of Other Companies

Itron Inc. (ITRI) reported non-GAAP EPS of $1.84 for the third quarter of 2024, exceeding the Zacks Consensus Estimate by 62.8%. This marks an increase from earnings of 98 cents in the same quarter last year. ITRI shares have appreciated by 77% over the past year.

Watts Water Technologies, Inc. (WTS) delivered a third-quarter 2024 adjusted EPS of $2.03, slightly lower than the $2.04 reported in the prior-year quarter, but exceeded Zacks Consensus by 2%. WTS shares have risen by 5.2% in the past year.

Western Digital Corporation (WDC) recorded first-quarter fiscal 2025 non-GAAP earnings of $1.78 per share, surpassing the Zacks Consensus Estimate by 2.3%, following a loss of $1.76 per share in the prior-year quarter. WDC has seen a remarkable 51.1% increase in its shares over the last year.

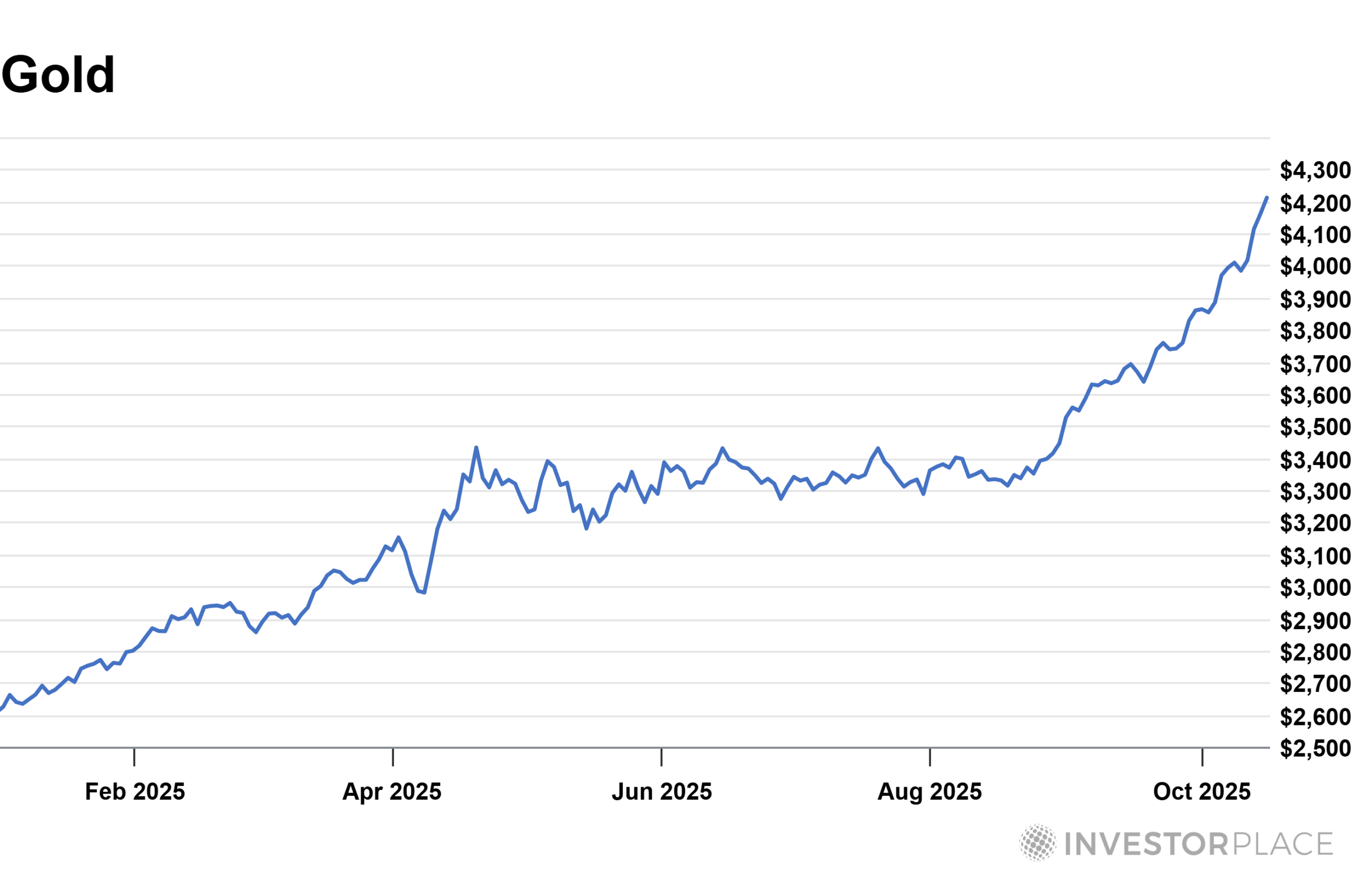

New Opportunities in Nuclear Energy

The demand for electricity is on the rise, while the need to reduce reliance on fossil fuels has become urgent. Nuclear power presents a viable alternative. Recently, leaders from the U.S. and 21 other nations agreed to TRIPLE the world’s nuclear energy capacities, a bold transition that could yield significant profits for nuclear-related stocks and early investors.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, examines the key players and technologies shaping this trend, highlighting three standout stocks likely to benefit most.

Download the report, Atomic Opportunity: Nuclear Energy’s Comeback, for free today.

Want more recommendations from Zacks Investment Research? Download our report, 5 Stocks Set to Double, for free now!

Itron, Inc. (ITRI) : Free Stock Analysis Report

Western Digital Corporation (WDC) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

PTC Inc. (PTC) : Free Stock Analysis Report

To read more on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.