Navigating through the choppy waters of the U.S. restaurant industry, companies have displayed remarkable endurance in the face of soaring prices. In 2023, sales at dining establishments surged steadily, a trend that has carried into this year. The recent rate cut by the Federal Reserve is poised to act as a catalyst for the industry, driving down costs of raw materials and encouraging consumer spending.

Amidst this backdrop, investors eyeing growth potential for 2024 would do well to consider restaurant stocks such as Yum China Holdings, Inc. YUMC, El Pollo Loco Holdings, Inc. LOCO, Texas Roadhouse, Inc. TXRH, and Potbelly Corporation PBPB, all of which have shown positive earnings estimates revisions in the last 60 days. Each of these stocks carries a Zacks Rank either #1 (Strong Buy) or 2 (Buy). Explore the full list of Zacks #1 Rank stocks here.

The August Surge: Industry’s Foundation Shines

August 2024 witnessed a revenue spike in the dining realm, as per the Commerce Department’s report. Sales at eating and drinking establishments climbed to $94.5 billion from $91.1 billion in July 2024, marking a 2.7% year-over-year increase. The appetite for dining out remains robust, with a significant proportion of millennials, Gen Xers, baby boomers, and Gen Z adults seeking more diverse dining options.

Despite the uphill battle against rising prices, restaurant businesses are holding strong. Increased personal income has empowered consumers to splurge, propelling sales. The gradual easing of inflation has alleviated price constraints over recent months.

The Rate Cut Ripple: Boosting Restaurant Sector

The much-anticipated Federal Reserve rate cuts were finally rolled out last week. The 50-basis point reduction brings the benchmark policy rate within the 4.75-5% range. This move marks the first rate cut by the Fed since March 2020 and the most substantial one since 2008.

Lower interest rates are a boon for both restaurateurs and consumers alike. Reduced borrowing costs typically fuel consumer expenditures. Moreover, the diminished interest rates present an opportunity for restaurant owners to pursue expansion initiatives.

With inflation projected to align with the Fed’s 2% target and speculations rife about an additional 50-basis point rate cut later this year, the future looks promising for the restaurant sector.

Unveiling Potential: 4 Dining Stocks on the Rise

Yum China Holdings: Seizing Global Palates

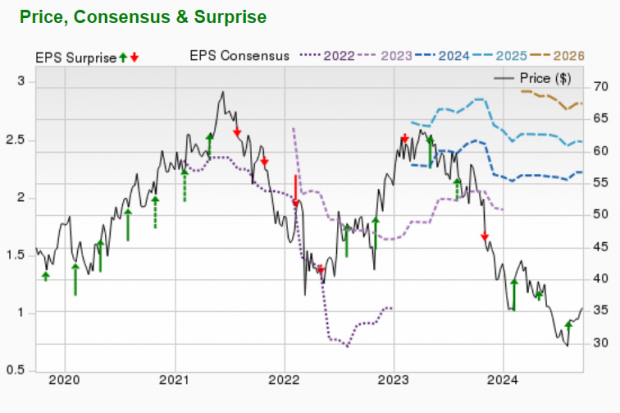

Yum China Holdings operates a diverse array of restaurants on both company-owned and franchised models, offering brands like KFC, Pizza Hut, and Taco Bell. Their expected earnings growth rate for the current fiscal year stands at 11%, with a 2.8% improvement in the Zacks Consensus Estimate over the past 90 days. YUMC currently carries a Zacks Rank #2.

Image Source: Zacks Investment Research

Growth Spurt at El Pollo Loco Holdings

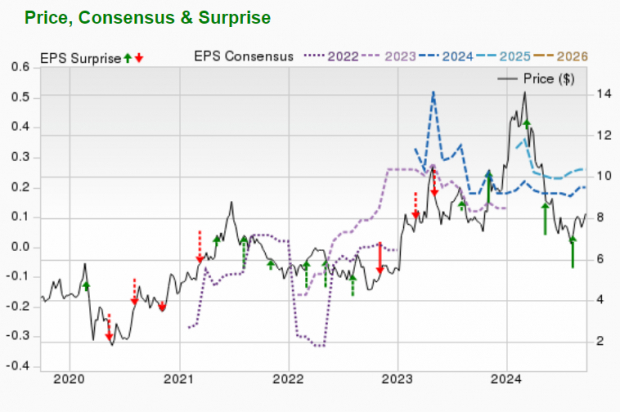

El Pollo Loco Holdings, known for its flame-grilled chicken offerings, is making a mark in the industry. With an expected earnings growth rate of 12.7% this year and a 12.7% upsurge in the Zacks Consensus Estimate over the past 60 days, LOCO holds a Zacks Rank #2.

Image Source: Zacks Investment Research

Texas Roadhouse: Sizzling Success Story

Texas Roadhouse is a prominent player in the full-service dining space, renowned for its hand-cut, open grill steaks offered under the Texas Roadhouse and Aspen Creek brands. With an impressive expected earnings growth rate of 39.2% for the year and a 4.3% uptick in the Zacks Consensus Estimate over the last 60 days, TXRH boasts a Zacks Rank #1.

Image Source: Zacks Investment Research

Feast at Potbelly: Riding the Growth Wave

Potbelly delivers a delightful neighborhood sandwich experience, alongside an array of delectable offerings from sandwiches to smoothies. With an anticipated earnings growth rate of 33.3% for the current year and a 17.6% surge in the Zacks Consensus Estimate over the past 60 days, PBPB holds a Zacks Rank #2.

Image Source: Zacks Investment Research

Rebuilding America: Infrastructure Stocks Poised for Growth

A transformative initiative to revamp the crumbling U.S. infrastructure is on the horizon, marking a bipartisan, imperative commitment. Trillions in investments are imminent, heralding a wealth of opportunities.

Now, the pivotal question looms – “Are you positioned to capitalize on the growth potential of these stocks at an opportune juncture?”

Zacks has curated a Special Report aimed at guiding investors to seize this opportunity while it’s ripe, and it’s complimentary today. Uncover 5 distinctive companies poised to benefit significantly from the extensive construction and renovation of roads, bridges, buildings, and the vast scale of energy transformation and cargo transportation.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Free Stock Analysis Report for Texas Roadhouse, Inc. (TXRH)

Free Stock Analysis Report for Potbelly Corporation (PBPB)

Free Stock Analysis Report for El Pollo Loco Holdings, Inc. (LOCO)

Free Stock Analysis Report for Yum China (YUMC)

Access the full article on Zacks.com here

Opinions shared are solely that of the author and may not align with those of Nasdaq, Inc.