Raymond James Upgrades United States Cellular: What Investors Need to Know

Analyst Forecast Indicates Potential Decline

On November 7, 2024, Raymond James changed its outlook for United States Cellular (NYSE: USM) from Market Perform to Outperform.

As of October 22, 2024, analysts project a one-year price target for United States Cellular at $60.18 per share. This target varies, with estimates ranging from a low of $43.43 to a high of $78.75. Notably, this average price target signifies a 6.73% decrease from its most recent closing price of $64.52 per share.

Strong Revenue Growth Expected

United States Cellular anticipates an annual revenue of $4,314 million, reflecting a healthy increase of 13.56%. Additionally, the projected annual non-GAAP EPS stands at 1.44.

Institutional Investment Trends

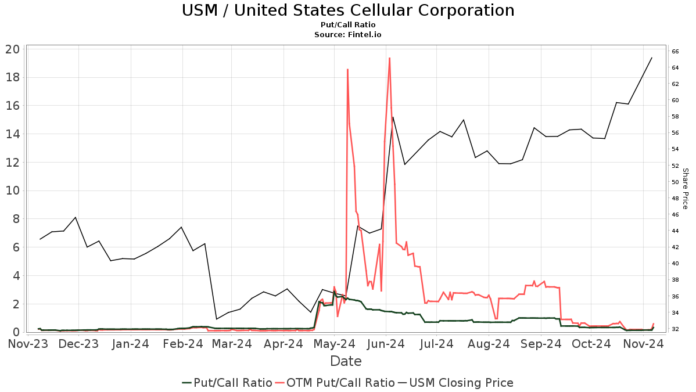

Currently, 273 funds or institutions have positions in United States Cellular, marking an increase of 13 owners (5.00%) from the previous quarter. The average portfolio weight for all funds invested in USM is 0.20%, which is an increase of 38.15%. In total, institutional ownership rose by 1.50% over the past three months, reaching 17,813,000 shares.  Notably, the put/call ratio for USM is 0.33, suggesting a bullish outlook among investors.

Notably, the put/call ratio for USM is 0.33, suggesting a bullish outlook among investors.

Several major shareholders have adjusted their positions recently: Jericho Capital Asset Management now holds 1,781,000 shares, a 10.56% increase from 1,593,000 shares previously reported. This firm significantly boosted its USM allocation by 92.80% last quarter.

Gamco Investors, Inc. Et Al currently has 1,414,000 shares, a decrease of 4.66% from 1,480,000 shares reported before. However, this firm still increased its USM portfolio by 57.11% over the last quarter.

Millennium Management has also seen notable growth, raising its ownership from 394,000 to 893,000 shares, marking a massive increase of 55.85% and a 275.49% uptick in its portfolio allocation for USM.

Loomis Sayles & Co L P has maintained its stake at 695,000 shares, though this reflects a minor reduction of 0.06%. Nonetheless, the firm increased its portfolio allocation by 48.12% in the past quarter.

Lastly, Gabelli Funds now holds 680,000 shares, slightly up from 660,000 shares, representing a 3.06% increase, alongside a 62.65% increase in its portfolio allocation.

Understanding United States Cellular

Background Information:

(This description is provided by the company.)

United States Cellular is the fourth-largest full-service wireless carrier in the nation. Based in Chicago, the company aims to improve customer experience through cutting-edge innovations and robust national network coverage. Its commitment to strengthening its infrastructure includes the latest 5G technology, enhancing not just consumer lives but also supporting local businesses and government operations.

Fintel provides a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds, offering a wealth of data from fundamentals to exclusive stock picks.

This article originally appeared on Fintel.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.