Raymond James Upgrades Block: What Investors Need to Know

On January 3, 2025, Fintel reported that Raymond James has changed its outlook for Block (BRSE:SQ3) from Market Perform to Outperform.

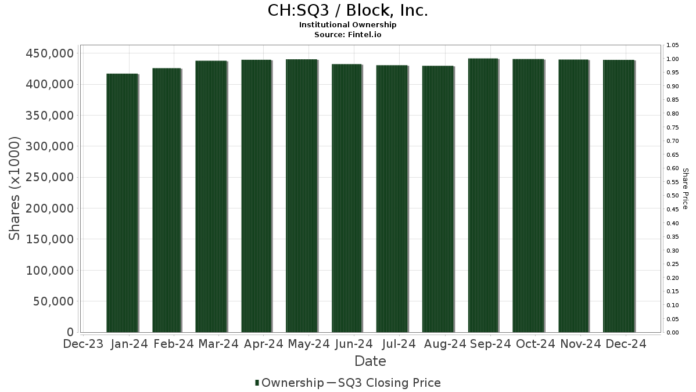

Current Fund Sentiment

There are currently 1,656 funds or institutions that hold positions in Block. This marks a decline of 14 owners, or 0.84%, since the last quarter. The average portfolio weight of all funds invested in SQ3 stands at -6.11%, a significant increase of 1,971.97%. Over the past three months, the total shares owned by institutions rose by 2.14% to 436,719,000 shares.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 17,637,000 shares, which is 3.15% of the company. Previously, it reported 17,608,000 shares, showing an increase of 0.17%. However, the firm decreased its portfolio allocation in SQ3 by 2.07% over the last quarter.

JPMorgan Chase owns 15,888,000 shares, or 2.84% of the company. Their last filing indicated 14,597,000 shares, representing an increase of 8.13%. They also marked a substantial increase of 1,080.87% in their portfolio allocation in SQ3 last quarter.

VIMSX – Vanguard Mid-Cap Index Fund Investor Shares currently holds 11,757,000 shares for 2.10% ownership. This reflects a notable rise from the previous 5,961,000 shares, showing an increase of 49.30%. Its portfolio allocation in SQ3 rose by 88.87% during the last quarter.

Sands Capital Management possesses 11,228,000 shares, accounting for 2.01% ownership. This is down from 11,510,000 shares previously, indicating a decrease of 2.52%. Nonetheless, there was a 4.88% increase in their portfolio allocation in SQ3 over the last three months.

Baillie Gifford controls 10,233,000 shares, or 1.83% ownership. Previously, it reported 10,085,000 shares, an increase of 1.45%. However, this firm decreased its portfolio allocation in SQ3 by 61.85% over the last quarter.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds. Our data provides insights into global fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Moreover, we offer exclusive stock picks backed by advanced, backtested quantitative models designed for better profitability.

Click to Learn More

This report was originally published by Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.