Analysts Adjust Outlook for RingCentral Amid Positive Revenue Projections

On January 3, 2025, Raymond James revised its rating for RingCentral (LSE:0V50) from Strong Buy to Outperform.

Price Target Forecast Indicates Potential Growth

As of December 23, 2024, analysts estimate a one-year price target for RingCentral at 43.72 GBX per share. This forecast ranges from a low of 37.49 GBX to a high of 57.94 GBX. If achieved, this represents a potential increase of 24.71% from the latest closing price of 35.06 GBX per share.

Revenue Outlook Shows Promising Trends

Projected annual revenue for RingCentral is expected to reach 2,777MM, marking a 17.81% growth. Additionally, the non-GAAP EPS is forecasted at 4.21.

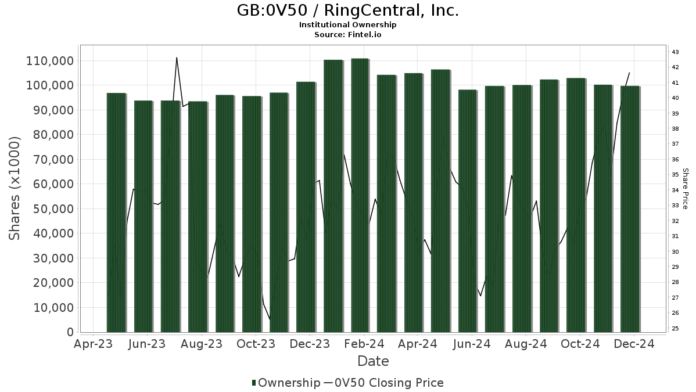

Investor Sentiment and Institutional Holdings

A total of 572 institutional funds hold positions in RingCentral, reflecting an increase of 11 funds, or 1.96%, over the last quarter. On average, these funds assigned a portfolio weight of 0.13% to 0V50, which is an 8.58% increase. However, total shares held by institutions decreased by 4.36% to 100,221K shares over the past three months.

Capital World Investors now holds 10,072K shares, accounting for 12.51% of the company. This marks an increase from their previous ownership of 9,863K shares, reflecting a growth of 2.08%. Their portfolio allocation in 0V50 rose by 8.90% in the last quarter.

Sylebra Capital retained 7,536K shares, representing 9.36% ownership, with no changes reported over the last quarter.

Ameriprise Financial’s holdings dropped slightly, now at 6,371K shares, or 7.91% ownership. This reflects a minor decrease of 0.07% from their earlier 6,376K shares. Their allocation in 0V50 sharply declined by 80.58% recently.

Columbia Seligman Communications and Information Fund (SLMCX) holds 4,318K shares, representing 5.36% ownership, which is an increase from 3,903K shares—a rise of 9.62%. They boosted their portfolio allocation by 5.11% in 0V50 in the last quarter.

SMALLCAP WORLD FUND INC (SMCWX) remains steady with 3,347K shares, representing 4.16% ownership, showing no change since the last report.

Fintel is a prominent investment research platform catering to individual investors, traders, financial advisors, and smaller hedge funds. Our extensive data includes fundamentals, analyst opinions, ownership statistics, fund sentiment, insider trading insight, and more. Additionally, we provide exclusive stock picks derived from advanced quantitative models to enhance investment returns.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.