RBC Bearings Incorporated’s RBC fourth-quarter fiscal 2024 (ended March 2024) adjusted earnings of $2.47 per share beat the Zacks Consensus Estimate of $2.32. The figure increased 16% from the year-ago adjusted earnings of $2.13, supported by higher revenues.

Revenue Details

In the quarter under review, RBC Bearings’ revenues were $413.7 million, which increased 4.9% year over year. However, the figure missed the Zacks Consensus Estimate of $416 million.

While exiting the reported quarter, RBC had a backlog of $726.1 million, up 9.4% year over year.

For fiscal 2024, the company’s revenues came in at $1.56 billion, up 6.2% year over year. It reported adjusted earnings of $8.62, reflecting an increase of 15.2% on a year-over-year basis.

Segmental Details

The company currently has two reportable segments, namely Aerospace/Defense and Industrial. Its segmental performance for the fiscal fourth quarter is briefly discussed below:

Industrial revenues of $271.4 million (representing 65.6% of the quarter’s revenues) were down 0.4% year over year.

Aerospace/Defense revenues totaled $142.3 million (34.4%), up 16.8% year over year.

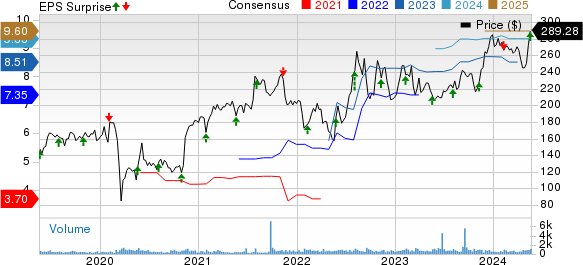

RBC Bearings Incorporated Price, Consensus and EPS Surprise

RBC Bearings Incorporated price-consensus-eps-surprise-chart | RBC Bearings Incorporated Quote

Margin Profile

In the reported quarter, the company’s cost of sales rose 3.2% year over year to $235.4 million. Gross profit grew 7.2% to $178.3 million. The margin expanded 90 basis points (bps) to 43.1%.

Selling, general and administrative expenses were $64.4 million, up 8.1% year over year. Adjusted EBITDA jumped 7.4% to $130.1 million. The adjusted EBITDA margin was 31.4%, up 70 bps year over year.

Adjusted operating income increased 8.6% year over year to $96.3 million. The adjusted margin increased 80 bps to 23.3%. Net interest expenses were $18.8 million compared with $21.7 million in the year-ago quarter.

Balance Sheet and Cash Flow

At the time of exiting the fiscal fourth quarter, RBC had cash and cash equivalents of $63.5 million compared with $65.4 million at the end of the year-ago fiscal quarter. Total debt was $1.19 billion, down from $1.40 billion at the end of the year-earlier fiscal quarter.

In fiscal 2024, the company generated net cash of $274.7 million from operating activities, which increased 24.5% on a year-over-year basis. Capital expenditure of $33.2 million decreased 21% year over year.

In fiscal 2024, RBC Bearings repurchased shares worth $11 million, up 41.4% year over year.

Outlook

For the first quarter of fiscal 2025, management anticipates net sales in the range of $415-$420 million, suggesting a climb of 7.2-8.5% from the prior-year figure of $387.1 million.

Zacks Rank & Other Stocks to Consider

RBC currently carries a Zacks Rank #2 (Buy).

Some other top-ranked companies from the same space are discussed below:

Luxfer Holdings LXFR presently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter average earnings surprise of 122.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LXFR’s 2024 earnings has increased 13.5% in the past 60 days.

Crane Company CR presently carries a Zacks Rank of 2. It delivered a trailing four-quarter average earnings surprise of 15.2%.

In the past 60 days, the Zacks Consensus Estimate for CR’s 2024 earnings has risen 3.3%.

Tennant Company TNC currently carries a Zacks Rank of 2. TNC delivered a trailing four-quarter average earnings surprise of 38%.

In the past 60 days, the Zacks Consensus Estimate for its 2024 earnings has inched up 1.9%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

RBC Bearings Incorporated (RBC) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report

Luxfer Holdings PLC (LXFR) : Free Stock Analysis Report

Tennant Company (TNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.