2023: A Year of Stock Splits and AI Potential

This year has seen several notable stock splits in the market, with Nvidia (NASDAQ: NVDA) leading the charge. Other well-known companies like Chipotle Mexican Grill, Broadcom, and Walmart have also made headlines with their splits.

Typically, companies split their stocks when they are already experiencing positive performance. While a stock split can indicate a strong future, it’s wise to monitor which companies might consider a split next.

Below are a couple of artificial intelligence (AI) firms that currently look promising for a stock split.

1. Meta

Meta (NASDAQ: META) has changed significantly from its early days as “The Facebook.” Although the company still runs Facebook, which holds the title of the most popular social media platform globally, it now oversees a suite of social networks reaching 3.3 billion users daily. This vast audience is key to its impressive financial performance.

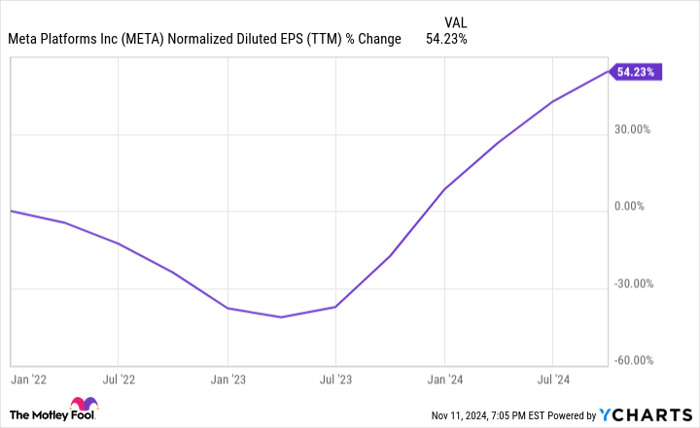

In third-quarter 2024, Meta reported revenues reaching $40.6 billion, up 19% from the previous year. This marks the fifth consecutive quarter of at least 19% year-over-year growth. Alongside revenue growth, Meta has been focused on cost management, leading to significant increases in its earnings per share (EPS). The following chart illustrates this accelerated growth since mid-2023.

META Normalized Diluted EPS (TTM) data by YCharts.

Meta’s significant investments in AI are expected to offer substantial returns in the near future. During the latest earnings call, CEO Mark Zuckerberg highlighted “new opportunities to use AI advances to accelerate our core business that should yield strong ROI over the next few years.”

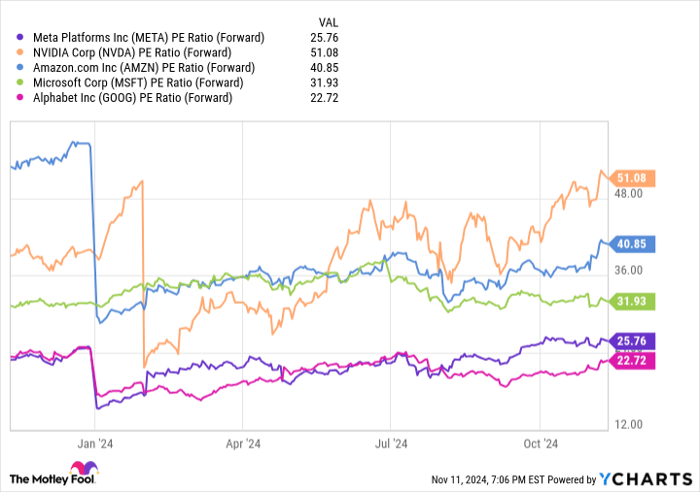

This is noteworthy as the recent earnings growth is occurring while Meta is actively investing in AI development. Despite its potential, the stock remains one of the more affordable options among its big-tech counterparts. The accompanying chart shows its current valuation.

META PE Ratio (Forward) data by YCharts.

Given its current valuation, Meta appears primed for investment consideration. It is the only stock among the so-called Magnificent Seven that has yet to undergo a split, making a potential split more likely with its shares nearing $600.

2. ServiceNow

ServiceNow (NYSE: NOW) is another key player utilizing AI for practical applications. Unlike the AI chip manufacturers that often dominate news coverage, ServiceNow focuses on helping companies enhance their IT and operations.

ServiceNow has consistently demonstrated growth, which has seen acceleration in the last couple of years as AI has gained traction. The company reported nearly 80% year-over-year EPS growth last quarter, showcasing strong performance.

As a leader in agentic AI—AI that can perform tasks autonomously—ServiceNow is seen as poised for significant advancements. The efficiency gains from AI handling basic tasks with minimal oversight could be transformative for businesses.

However, ServiceNow’s high valuation poses a challenge. The stock is trading at a forward price-to-earnings ratio (P/E) of 60, which necessitates continued exceptional growth to justify such a premium. Currently priced above $1,000 per share, ServiceNow is in a perfect position to consider a stock split soon.

Ready for a Unique Investment Opportunity?

Do you ever feel like you’ve missed opportunities to invest in top-performing stocks? Here’s a chance to catch up.

Our expert analysts occasionally release a “Double Down” stock recommendation for companies they believe are on the verge of significant success. Now could be the optimal moment to invest before prices rise. The numbers illustrate this point:

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $24,113!

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $42,634!

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $447,865!

Currently, we’re issuing “Double Down” alerts for three incredible companies, and opportunities like this don’t come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms, Nvidia, and ServiceNow. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.